In the ever-evolving world of financial markets, binary options have emerged as a captivating and potentially lucrative trading instrument. These options allow traders to speculate on the future direction of an underlying asset, such as stocks, currencies, commodities, and even indices, within a predetermined time frame. Among the diverse asset classes, silver has gained considerable traction due to its intrinsic value, historical significance, and price volatility. In this comprehensive guide, we will delve into the intricacies of trading silver binary options, arming you with an in-depth understanding of this exciting financial instrument.

Image: www.youtube.com

Understanding Silver Binary Options

Binary options are financial contracts that derive their name from the binary nature of their outcomes. Upon expiration, they either result in a predefined payout or nothing at all. In the case of silver binary options, the underlying asset is the price of silver, and traders speculate on whether it will rise or fall within a specified time frame. The payoff is typically fixed and determined at the time of the trade, providing traders with a clear understanding of their potential gains or losses.

How Binary Options Work

When trading silver binary options, traders have the option to choose between two primary types of contracts: call options and put options. Call options are employed when traders anticipate a rise in silver prices, while put options are utilized when they foresee a decline. The strike price, representing the predicted price of silver at the expiration of the contract, is another crucial factor. Traders can also select the expiration time, which can range from minutes to days, depending on their trading strategies.

Factors Influencing Silver Price Movements

To make informed trading decisions, it is essential for traders to have a grasp of the factors that influence silver price movements. These include:

- Industrial Demand: Silver finds extensive use in various industries, including jewelry, electronics, and photography. Fluctuations in industrial demand can have a significant impact on its price.

- Investment Demand: Silver, being a precious metal, is considered a safe haven asset during periods of economic uncertainty. Increased investment demand typically leads to higher prices.

- Supply and Demand Dynamics: The balance between silver production and consumption plays a vital role in determining its price. Supply chain disruptions or unexpected changes in production levels can influence market dynamics.

- Currency Fluctuations: Silver is primarily traded in US dollars. A weakening US dollar tends to make silver more affordable for international buyers, leading to increased demand and potentially higher prices.

Image: www.educba.com

Tips for Successful Trading

While there is no foolproof formula for success in trading, adopting certain strategies and following expert advice can enhance your chances of maximizing profits:

Trading Tips

- Understand Market Sentiment: Before entering a trade, it is crucial to gauge the overall market sentiment. News, economic data, and technical analysis can provide valuable insights into the prevailing market conditions.

- Money Management: Risk management is paramount in binary options trading. Allocate only a portion of your trading capital to each trade and avoid overleveraging.

- Technical Analysis: Technical analysis involves studying historical price data to identify patterns and trends. This can help traders make informed trading decisions.

- Choose Credible Brokers: Partner with reputable binary options brokers who offer transparent trading conditions and provide reliable customer support.

Expert Advice

Seasoned binary options traders often emphasize the importance of the following practices:

- Set Trading Limits: Establish clear trading limits to prevent emotional decision-making and minimize potential losses.

- Seek Knowledge: Continuously educate yourself about binary options trading strategies, market analysis techniques, and risk management practices.

- Practice Discipline: Discipline is key in adhering to your trading plan and avoiding impulsive decisions.

Frequently Asked Questions

To provide further clarity, we address some frequently asked questions about silver binary options:

- Are binary options a form of gambling? While there is an element of risk involved, binary options trading is not considered gambling in most jurisdictions. It is a legitimate financial instrument that requires skill and market knowledge.

- What is the minimum investment required to trade binary options? The minimum investment can vary depending on the broker, but it is typically a small amount, making it accessible to even novice traders.

- Is it possible to make a consistent profit from binary options trading? While it is certainly possible to profit from binary options trading, it requires discipline, risk management, and a sound trading strategy.

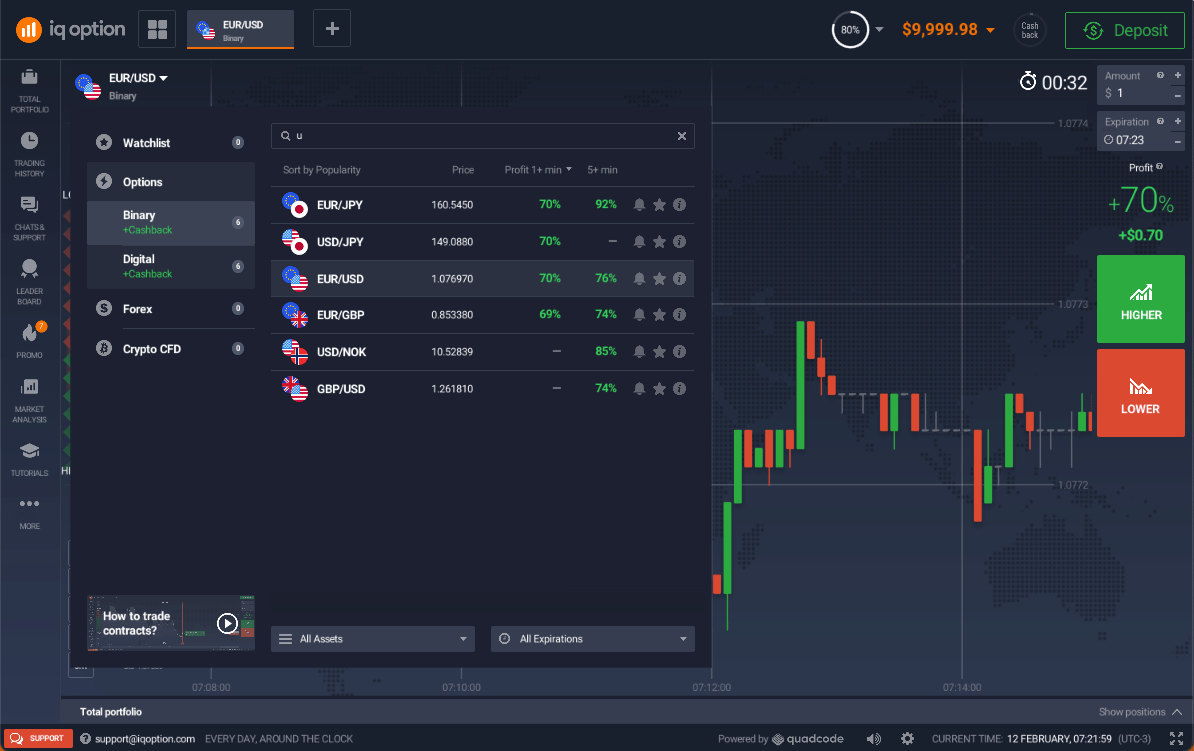

Trading Silver Binary Options

Image: iqbroker.com

Conclusion

Trading silver binary options presents an exciting opportunity to speculate on the price movements of this valuable precious metal. By understanding the mechanics of binary options, factors influencing silver prices, and implementing sound trading strategies, you can enhance your chances of success. Remember to always trade cautiously, manage your risk, and seek professional advice when necessary. Are you ready to embark on the thrilling world of silver binary options trading?