Silver, a precious metal renowned for its versatility, has emerged as a captivating asset class for investors seeking both diversification and potential profits. The advent of silver option trading has further amplified these opportunities, offering a dynamic avenue for investors to navigate the ever-evolving silver market.

Image: www.litefinance.org

This comprehensive blog post will delving into the intricacies of silver option trading, empowering you with a profound understanding of this multifaceted trading strategy. Silver options present a unique blend of risk and reward, enabling investors to leverage their market insights and capitalize on price fluctuations of the underlying silver asset.

Empowering Investors: Unveiling the Nuances of Silver Option Trading

Silver option trading revolves around the concept of options contracts. Options grant investors the right, but not the obligation, to buy or sell a specific quantity of silver at a predetermined price (known as the strike price) on or before a specified date (known as the expiration date).

These contracts afford investors with a degree of flexibility, allowing them to speculate on the future direction of silver prices without committing to an outright purchase or sale. Furthermore, options provide investors with customizable risk and reward profiles, allowing them to tailor their strategies based on their tolerance for risk and market outlook.

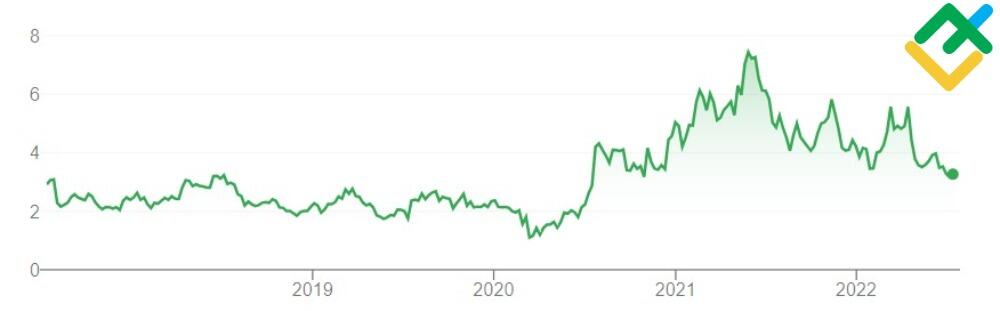

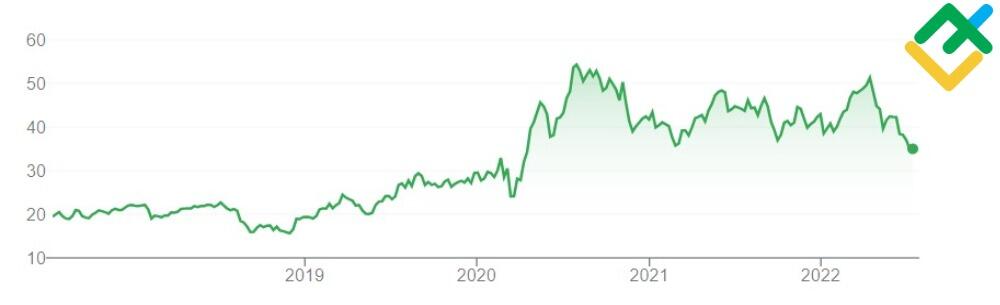

Silver Option Trading: A Historical Perspective

Silver’s allure as a precious metal dates back centuries, and the trading of silver options has evolved concurrently with the development of financial markets. The Chicago Mercantile Exchange (CME) introduced silverオプション in 1983, marking a watershed moment in the evolution of silver option trading.

Over the years, silver options have gained widespread acceptance as a sophisticated financial instrument for hedging against price fluctuations, speculating on market movements, and generating income through premium collection.

Decoding Silver Option Trading: Call and Put Options

Within the realm of silver option trading, two primary types of options exist: call options and put options.理解 these distinct options is essential for navigating the silver option market effectively.

Call Options: Call options confer upon the holder the right to buy a specified quantity of silver at the strike price on or before the expiration date. Investors typically purchase call options when they anticipate an increase in silver prices, as it allows them to lock in the purchase price at a predetermined level.

Put Options: Put options grant the holder the right to sell a specified quantity of silver at the strike price on or before the expiration date. These options are typically bought when investors anticipate a decline in silver prices, as they allow investors to lock in a selling price at a predetermined level.

Image: www.litefinance.org

Navigating the Nuances: Key Characteristics of Silver Options

When venturing into silver option trading, a thorough understanding of various key characteristics is crucial for informed decision-making.

- **Strike Price:** The predetermined price at which the holder can buy or sell the underlying silver.

- **Expiration Date:** The specified date on which the option contract expires.

- **Premium:** The price paid to acquire an option contract.

- **Option Type:** Call options confer the right to buy, while put options grant the right to sell.

- **Underlying Asset:** In this case, the underlying asset is silver, the value of which determines the value of the option contract.

Unveiling the Strategic Leverage of Silver Options

The strategic advantages of silver option trading are multifaceted, providing investors with a versatile toolkit for navigating the silver market.

- **Hedging Against Price Volatility:** Options allow investors to offset potential losses by hedging against adverse price movements.

- **Leveraging Market Movements:** Options provide investors with the ability to magnify their returns by capitalizing on market fluctuations.

- **Generating Income:** Options provide investors with opportunities to generate income through premium collection.

- **Tailoring Risk Profiles:** Options allow investors to customize their risk exposure based on their individual risk tolerance.

Expert Insights: Tips for Silver Option Trading Success

To enhance your silver option trading prowess, consider the following expert tips:

- **Thorough Market Analysis:** A profound understanding of the silver market, its drivers, and historical trends is imperative for making informed trading decisions.

- **Understanding Option Pricing:** Diligently study the factors that influence option pricing, including time to expiration, volatility, strike price, and supply and demand dynamics.

- **Risk Management Strategies:** Implement stringent risk management strategies to limit potential losses and preserve capital.

- **Seeking Professional Advice:** Consult with a qualified financial advisor to tailor an option trading strategy aligned with your specific financial goals and risk tolerance.

Frequently Asked Questions (FAQs) on Silver Option Trading

To clarify any lingering doubts, let’s delve into a series of frequently asked questions.

- **What is the minimum investment required for silver option trading?**

The minimum investment depends on the premium of the option contract, which varies based on market conditions and the specific option’s characteristics.

- **How do I determine the profitability of an option strategy?**

Profitability is calculated by considering the difference between the premium paid and the profit (or loss) made from exercising the option or selling it before expiration.

- **What factors influence silver option prices?**

Option prices are influenced by the underlying silver price, time to expiration, volatility, supply and demand dynamics, and interest rates.

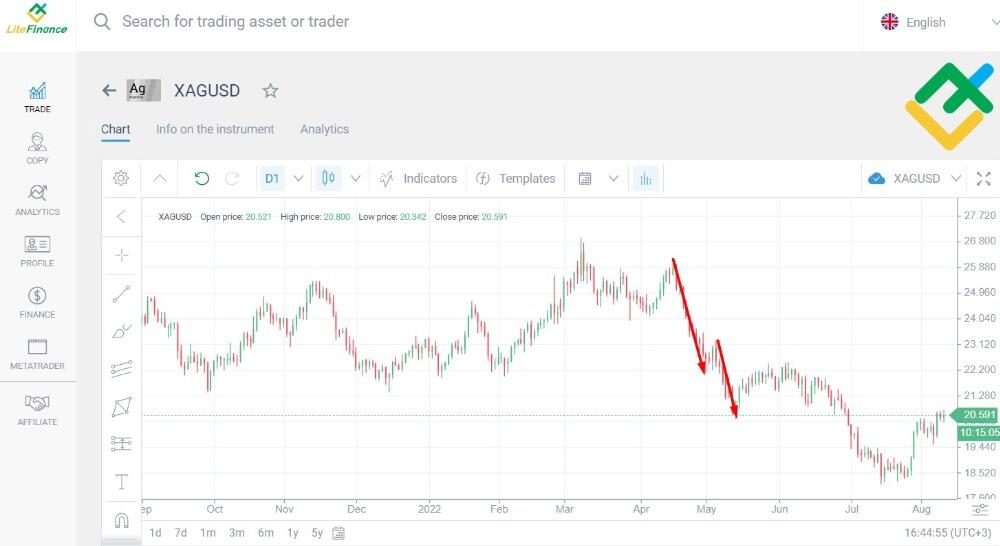

Silver Option Trading

Image: www.litefinance.org

Conclusion: A Gateway to Market Opportunities

Silver option trading presents a captivating avenue for investors seeking diversification and the potential for substantial returns. By harnessing the insights outlined in this article, investors can navigate the complexities of silver option trading and leverage this dynamic financial instrument to achieve their investment objectives.

Are you eager to delve further into the world of silver option trading? If so, embark on a journey of discovery, exploring the vast resources available. Immerse yourself in articles, webinars, and discussions with experienced traders to refine your understanding and enhance your trading acumen.