Igniting Your Options Trading Adventure

Stepping into the world of options trading can be akin to embarking on an exciting and lucrative adventure. As a trader, I vividly recall my initial ventures into this domain, where the intricate dance of put and call options captivated me. This article will serve as your comprehensive guide to traversing this financial landscape, equipping you with the knowledge and strategies to initiate your own options trading journey.

Image: www.onlinefinancialmarkets.com

Navigating Options Contracts: The Basics

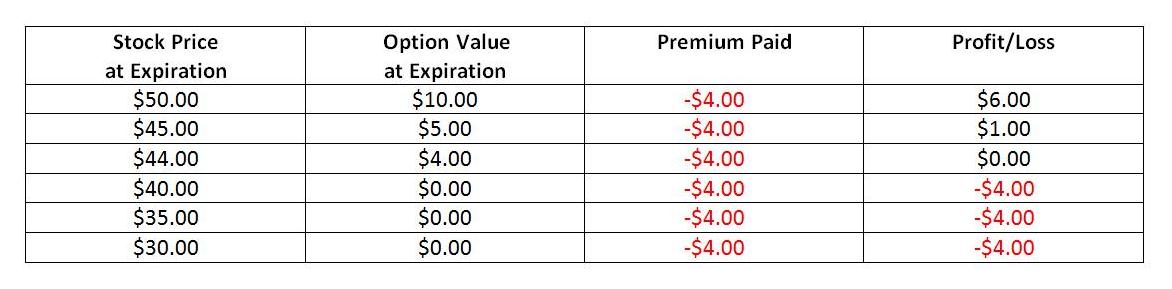

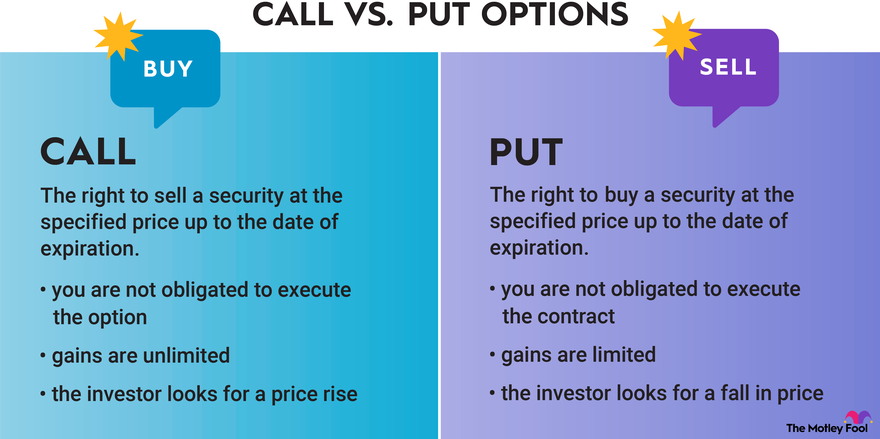

Options contracts are financial instruments that bestow upon the holder the right, but not the obligation, to either buy (call option) or sell (put option) an underlying asset at a predetermined price on a specific expiration date. The buyer of an option pays a premium to the seller of the option in exchange for this right. Understanding these fundamental concepts is essential for successful options trading.

Comprehending Call Options

A call option grants the holder the right to purchase an underlying asset at the strike price stipulated in the contract, regardless of its market value. This option proves lucrative when the underlying asset’s price ascends above the strike price. Call options are ideal for investors who anticipate an upswing in the asset’s value.

Delving into Put Options

A put option confers the right to sell an underlying asset at the strike price, even if the market price nosedives. Profitability ensues when the asset’s value diminishes below the strike price. Put options are favored by investors who expect the asset’s price to decline.

Image: www.fool.com

The Allure of Options Trading: Potential Benefits and Risks

Options trading holds the allure of leveraging relatively small sums of money to control significant underlying assets. This leverage can amplify gains when predictions align with market movements. However, it’s crucial to recognize the inherent risks associated with options trading. The value of options can fluctuate dramatically, potentially leading to substantial losses.

Essential Tips and Expert Advice for Options Beginners

As you embark on your options trading journey, heed these valuable tips from seasoned traders:

- Start Small: Begin with small trades to grasp the mechanics and risks of options trading.

- Choose Liquid Options: Opt for options with high trading volume to ensure swift execution and minimize slippage.

Frequently Asked Questions (FAQs): Unraveling Common Options Trading Queries

- Q: What is the difference between an option and a stock?

A: Options are contracts that grant the right to buy or sell an underlying asset, while stocks represent ownership in a company.

- Q: How do I determine an option’s premium?

A: Option premiums are influenced by factors such as the underlying asset’s price, volatility, time to expiration, and interest rates.

How Do I Start Put Call Option Trading

:max_bytes(150000):strip_icc()/CoveredCall-943af7ec4a354a05aaeaac1d494e160a.png)

Image: www.investopedia.com

Conclusion

Embarking on a put-call options trading journey requires a comprehensive understanding of the concepts, risks, and strategies involved. By embracing the advice and insights presented in this article, you can navigate the complexities of this market with confidence. Are you ready to explore the captivating world of options trading and potentially unlock lucrative opportunities?