SEO Title:

Image: www.youtube.com

Unveiling the Secrets of Straddle Options Trading: A Comprehensive Guide for Success

Headline:

Unlock the Lucrative Potential of Straddle Options: A Journey into Returns

Introduction:

Many investors seek strategies to navigate market volatility and potentially enhance their returns. Enter straddle options, an alluring trading technique that offers both opportunities and complexities. This comprehensive guide will delve into the world of straddle options, empowering you with the knowledge to harness their potential effectively.

Understanding Straddle Options:

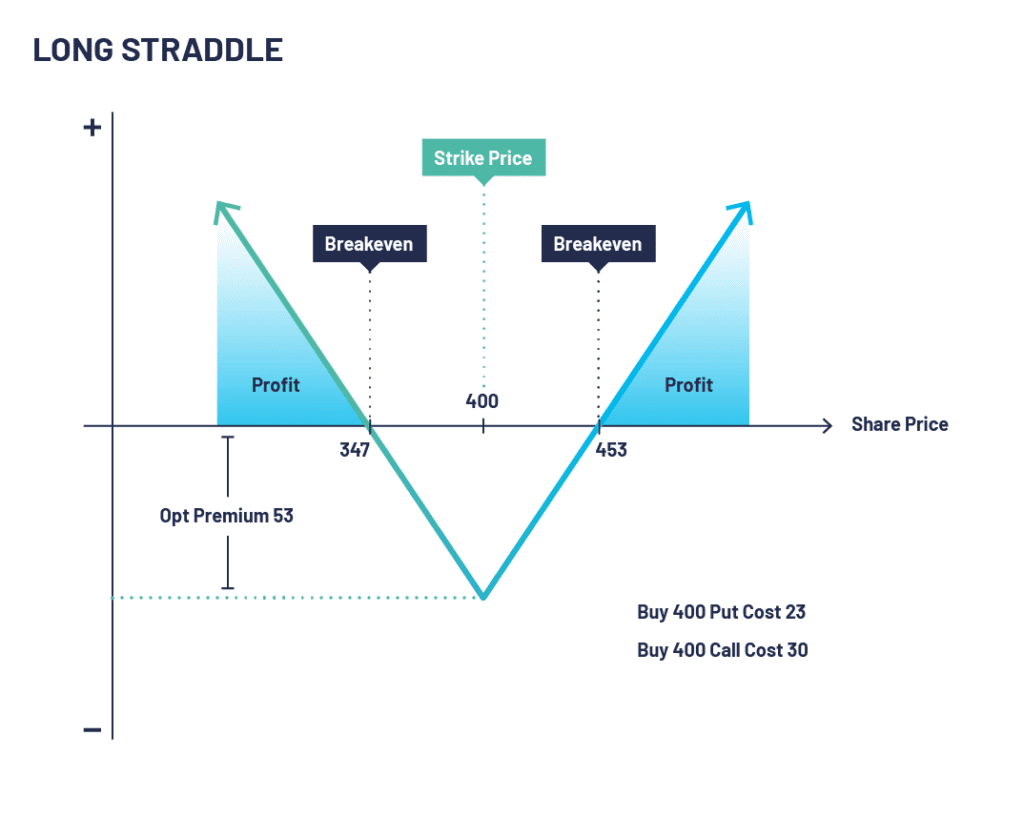

Straddle options are a neutral strategy involving the simultaneous purchase of both a call option and a put option on the same underlying asset, with the same strike price and expiration date. Essentially, the trader aims to profit from significant price fluctuations in either direction, regardless of whether the market rises or falls.

How Straddle Options Work:

Let’s simplify the concept: suppose the stock XYZ is trading at $50. A trader purchases a call option with a strike price of $55 (giving the right to buy at $55) and a put option with a strike price of $45 (granting the right to sell at $45). If the stock price closes above $55 on the expiration date, the call option will have intrinsic value, allowing the trader to sell it for a profit. Conversely, if the stock price falls below $45, the put option will gain intrinsic value, enabling a profitable sale.

Risk and Reward in Straddle Trading:

Straddle options offer the potential for substantial returns if the underlying asset exhibits significant price volatility within the option’s lifespan. However, this strategy also entails higher risk as the trader simultaneously buys both call and put options, effectively doubling the premium cost. Traders must carefully consider their risk tolerance and market conditions before engaging in straddle options trading.

Optimal Conditions for Straddle Options:

Straddle options perform best when the market exhibits high volatility, with a clear trend or significant news events expected. Conversely, periods of low volatility or sideways market movement can result in losses or diminished returns.

Implementing a Straddle Strategy:

- Determine Asset and Time Frame: Choose an underlying asset you anticipate experiencing significant price fluctuations and define the duration of the trade.

- Calculate Strike Prices: Select strike prices for both call and put options based on your analysis of the underlying asset’s price range.

- Purchase Options: Execute the purchase of both call and put options at the determined strike price and expiration date.

- Monitor and Adjust: Regularly monitor market conditions and adjust your strategy as needed, considering hedging or exiting positions if necessary.

Conclusion:

Straddle options provide traders with an intriguing strategy to capitalize on market volatility while also carrying potential risks. By thoroughly understanding the concept, weighing risk and reward dynamics, and considering market conditions, investors can harness the power of straddle options to potentially enhance their portfolio’s performance. Remember, always consult with a financial advisor to determine if this trading strategy aligns with your individual investment goals and risk tolerance.

Image: phemex.com

Straddle Options Trading System

Image: optionsdesk.com