SEO Title: Master the Art of NSE Option Trading: A Comprehensive Guide to Straddle and Strangle Strategies

Headline: Demystifying NSE Option Trading: Unlock the Secrets of Straddle and Strangle Strategies

Introduction:

The world of financial markets offers a plethora of opportunities for investors seeking to navigate the turbulent waters of volatile markets. Among these, options trading has emerged as a lucrative domain where savvy traders can harness the power of derivatives to enhance their returns. Two prominent strategies in this realm are straddles and strangles, both of which are widely employed in the vibrant National Stock Exchange (NSE) of India. This article aims to provide a comprehensive overview of these strategies, empowering traders with the knowledge to make informed decisions and potentially reap substantial rewards.

Image: stocktradersvideos.com

Understanding Straddle and Strangle Strategies:

Straddle and strangle strategies are commonly used in option trading to capitalize on market volatility. A straddle involves simultaneously buying both a call and a put option with the same strike price and expiration date. The call option grants the buyer the right to buy the underlying asset at a specified price, while the put option offers the right to sell. By employing this strategy, traders position themselves to profit from significant price movements in either direction, regardless of whether the market goes up or down.

In contrast, a strangle strategy is similar to a straddle but involves buying a call option and a put option with different strike prices. The strike price of the call option is set higher than the current market price, while that of the put option is set below the current price. This strategy allows traders to profit from larger price fluctuations while limiting their potential losses compared to a straddle.

Mechanics of Implementation:

Executing a straddle or strangle strategy in NSE option trading requires a thorough understanding of the underlying mechanics. Traders must first identify the underlying asset they wish to trade, such as a stock, index, or commodity. Next, they need to determine the strike prices of the call and put options, as well as the expiration date. The choice of strike prices and expiration date will depend on the trader’s market outlook and risk tolerance.

Once the parameters have been established, traders can place their orders on the NSE trading platform. It is crucial to remember that both straddles and strangles involve buying options, which entails paying a premium. The premium represents the cost of acquiring the options, and it is a significant factor in determining the overall profitability of the strategy.

Risk Management and Mitigation:

As with any trading strategy, risk management is paramount in straddle and strangle strategies. These positions involve simultaneous long positions in both call and put options, which can expose traders to significant losses if the market moves against their anticipated direction. Therefore, it is essential to carefully consider the potential risks and implement appropriate measures to mitigate them.

One effective risk management technique is to set clear profit targets and stop-loss levels. Profit targets define the desired profit level at which the trader will close the position, while stop-loss levels specify the maximum tolerable loss and trigger an automatic exit from the trade. Adhering to these predetermined parameters helps discipline trading decisions and prevents severe losses.

Image: vickikaycee.blogspot.com

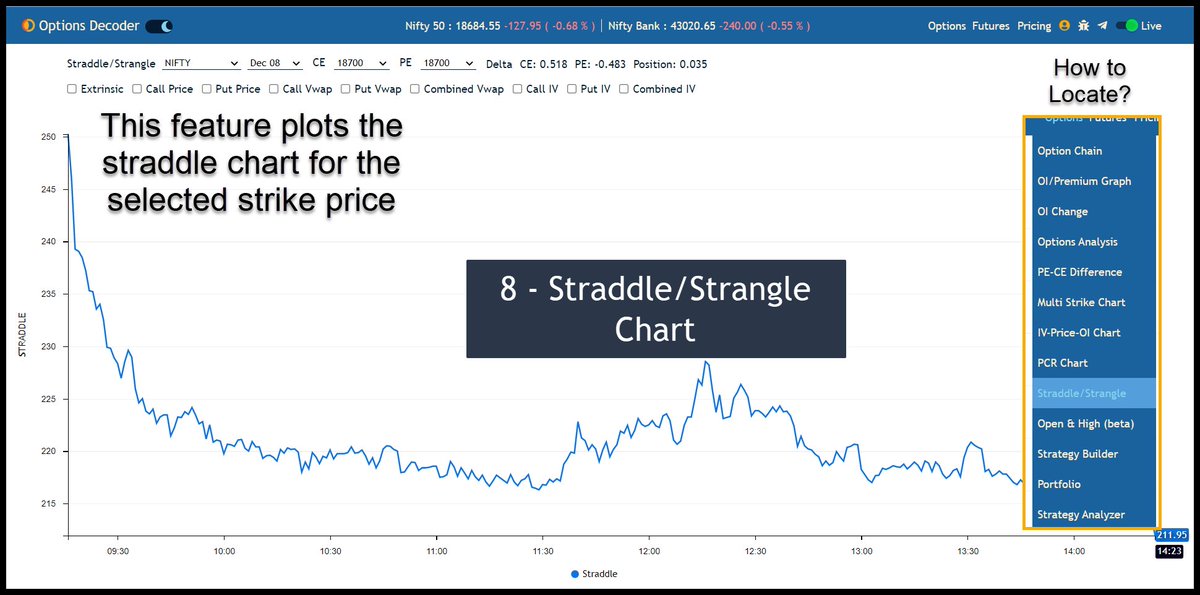

Nse Option Trading Straddle And Strangle Strategy

Image: en.rattibha.com

Conclusion:

Straddle and strangle strategies in NSE option trading offer traders the opportunity to potentially generate significant returns by leveraging market volatility. However, these strategies are not without their risks and require a thorough understanding of the underlying mechanics and risk management principles. By carefully considering market conditions, selecting appropriate strike prices and expiration dates, and implementing sound risk management techniques, traders can harness the power of straddle and strangle strategies to enhance their trading performance in the dynamic NSE marketplace.