A Tale of Two Strategies: My First Options Trade

As a novice in the options trading arena, I stumbled upon the intriguing world of straddles and strangles. Eager to test the waters, I armed myself with a modest investment and embarked on my first trade. Little did I know the rollercoaster ride that lay ahead.

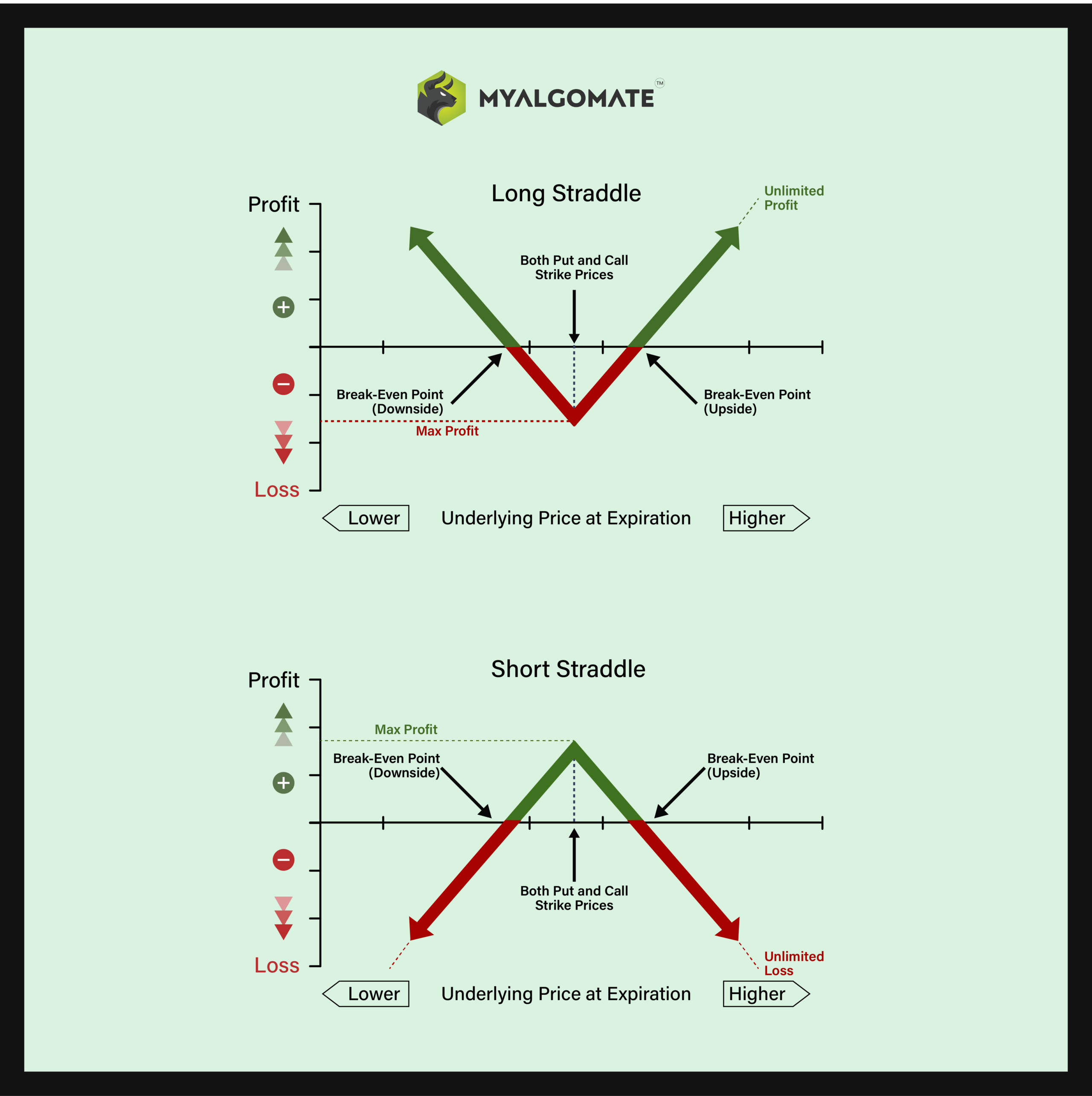

Image: www.myalgomate.com

Opting for a straddle strategy, I purchased both a call and a put option with the same strike price and expiration date on a stock I believed would experience significant volatility. Initially, the trade flourished, and I basked in the glory of early gains. However, as the underlying stock’s price remained largely unchanged, time decay gradually eroded my profits. In the end, I exited the trade with a small loss but a valuable lesson: options trading can be a double-edged sword.

Straddles vs. Strangles: Defining the Difference

Straddles and strangles, both neutral strategies in the options trading landscape, aim to capitalize on market volatility. Their modus operandi, however, differs significantly. Straddles involve the simultaneous purchase of an at-the-money (ATM) call option and an ATM put option, both with the same expiration date. This strategy thrives on expectations of significant price fluctuations, as it profits from upward or downward movements of the underlying security.

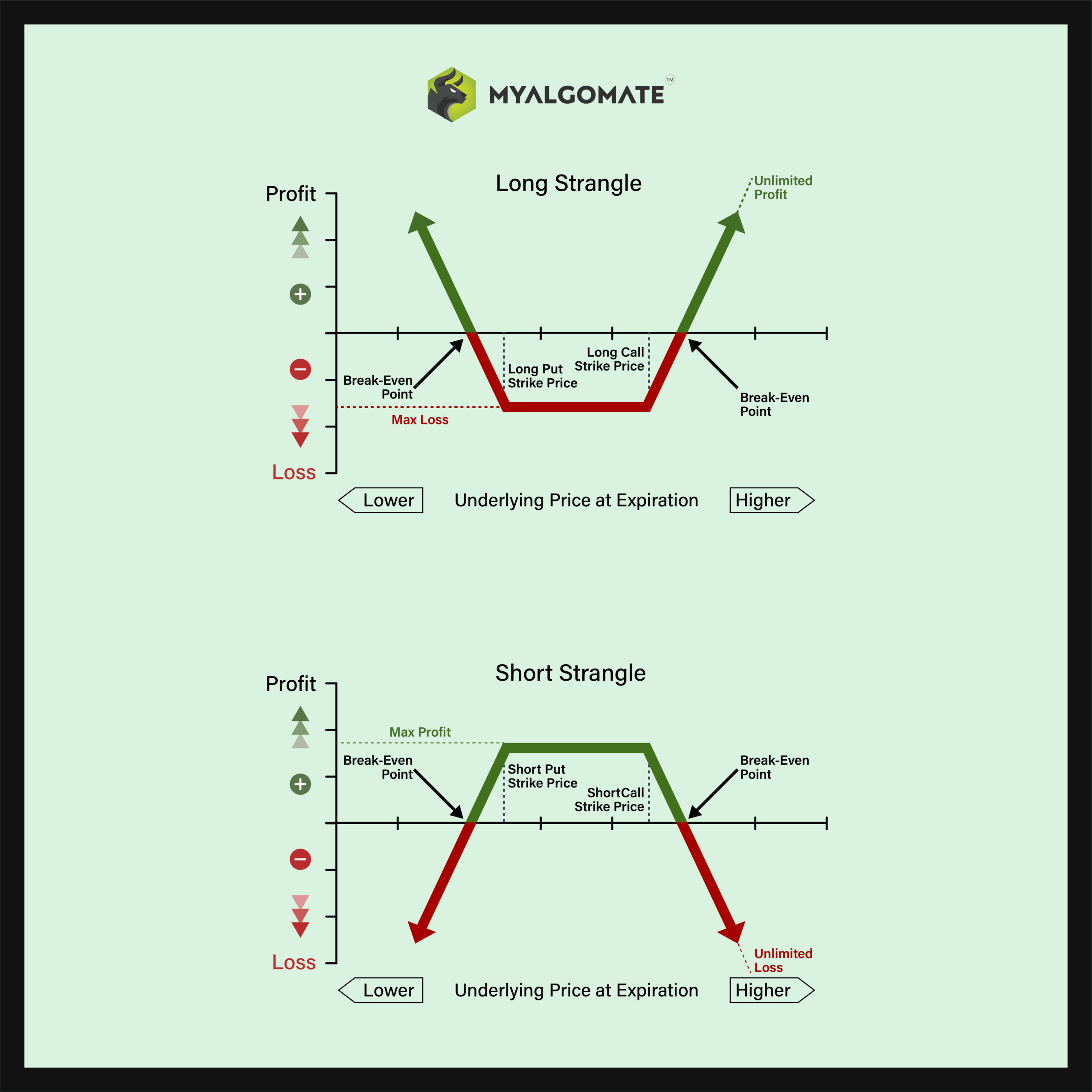

Strangles, on the other hand, mimic straddles but employ out-of-the-money (OTM) call and put options. Unlike straddles, which aim for extreme price swings, strangles are geared towards moderate price movements. This modified approach reduces the premium costs associated with ATM options, making strangles more affordable.

Key Characteristics and Considerations

Navigating the intricacies of straddle and strangle strategies necessitates a comprehensive understanding of their distinct characteristics:

-

Profitability: Straddles and strangles both target market volatility, seeking to profit from substantial price fluctuations.

-

Premiums: Straddles, utilizing ATM options, command higher premiums compared to strangles with OTM options.

-

Risk Management: Strangles offer a more conservative risk profile due to the reduced premium costs and wider strike prices.

-

Time Decay: The inexorable march of time poses a significant threat to the profitability of both straddles and strangles.

-

Trading Tactics: Employing straddles calls for precise timing and conviction in the predicted direction of the underlying asset’s price movement. Strangles, with their broader range of potential outcomes, afford greater flexibility and time leniency.

Riding the Waves of Market Volatility: Tips and Expert Advice

To navigate the turbulent waters of options trading, heed the wisdom of seasoned experts:

-

Thoroughly Research: Before venturing into the trading arena, equip yourself with in-depth knowledge of options trading strategies, market dynamics, and underlying security characteristics.

-

Start Small: Modest beginnings can mitigate the risks associated with options trading, providing a valuable learning curve for aspiring traders.

-

Embrace Patience: Options trading isn’t a sprint; it’s a marathon. Cultivating patience and discipline will serve you well in the long run.

-

Manage Risk: Understanding and mitigating risks is the cornerstone of successful options trading. Employ prudent risk management techniques to safeguard your capital.

-

Stay Informed: Constantly monitor market trends, news, and economic indicators to remain abreast of potential trading opportunities and emerging risks.

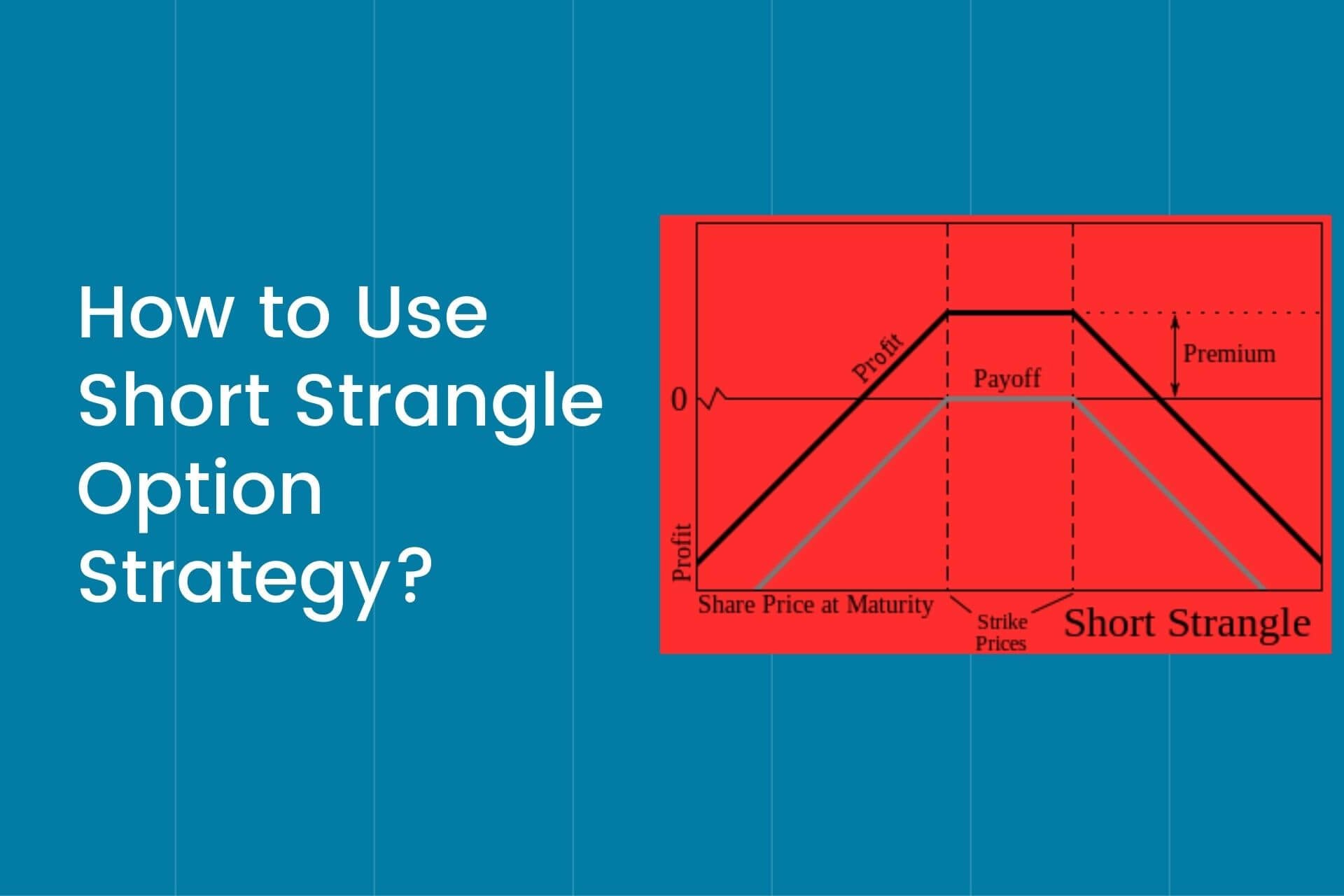

Image: tradebrains.in

Frequently Asked Questions (FAQs)

Q: Which strategy is more suitable for beginners – straddle or strangle?

A: Strangles are generally considered more appropriate for beginners due to their lower premium costs and wider range of potential outcomes.

Q: How do straddles differ from strangles in terms of their profit potential?

A: Straddles have a higher profit potential but require a more precise prediction of the direction of the underlying asset’s price movement.

Q: What is the impact of time decay on straddles and strangles?

A: Time decay erodes the value of both straddles and strangles, making it crucial to time entries and exits strategically.

Options Trading Straddle Strangle

Image: www.myalgomate.com

Conclusion

Straddles and strangles, potent options trading strategies, offer opportunities for harnessing market volatility. While straddles demand greater precision and timing, strangles provide a more conservative approach with reduced risk. Understanding the nuances of each strategy, embracing sound trading principles, and staying attuned to market dynamics are vital for maximizing the potential of these trading tools.

Are you intrigued by the world of options trading? Join the discussion and share your experiences with straddles and strangles below!