In the fast-paced world of day trading, option straddles stand out as a profitable strategy for harnessing market volatility. A straddle involves the simultaneous purchase of both a call and a put option with the same strike price and expiration date on a specific underlying security. This strategic positioning allows traders to capitalize on price fluctuations, regardless of the direction of the market.

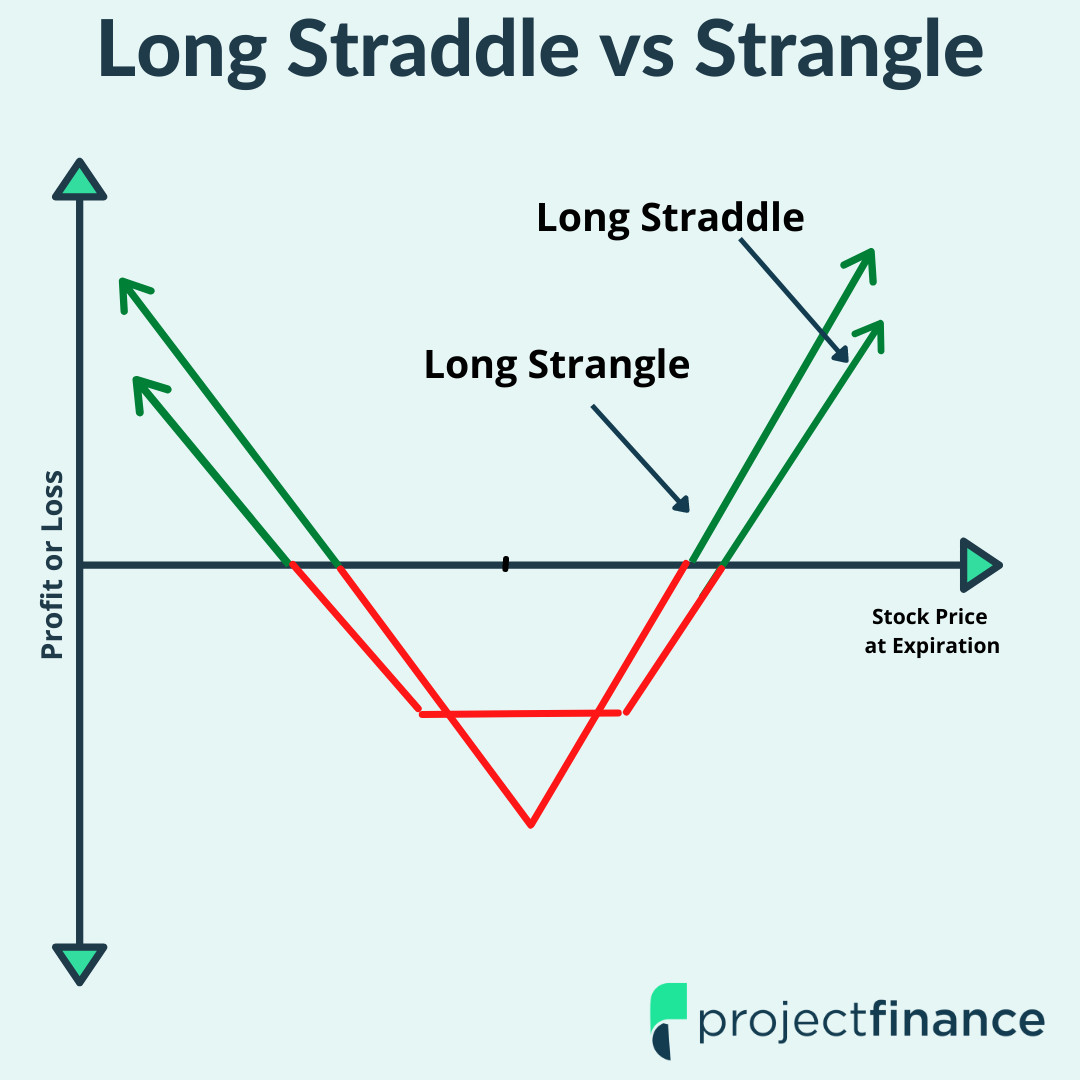

Image: www.projectfinance.com

Understanding the Basics:

When a stock exhibits high volatility, its price swings can be unpredictable. A straddle strategy caters to this uncertainty by simultaneously buying an out-of-the-money call and an out-of-the-money put option. The call option gives the trader the right to buy the stock at a specified strike price, while the put option offers the right to sell stock at that same strike price on or before the expiration date. This construct effectively creates a “neutral zone” where profit potential exists regardless of whether the stock price rises or falls.

Mechanism and Profitability:

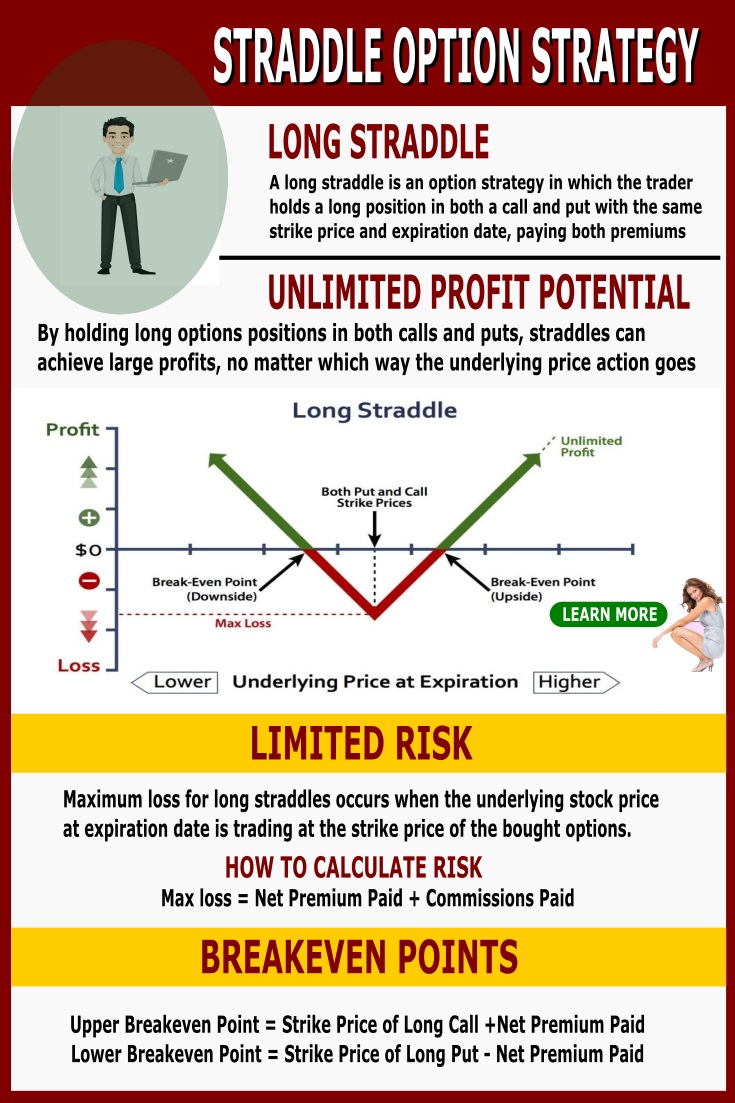

The key to success with straddles lies in exploiting time decay. As the option’s expiration date approaches, the premium value erodes due to the diminished timeframe for the options to reach profitability. This decay favors the straddle strategy when the underlying stock’s price remains within the boundary set by the strike prices of the call and put options purchased. As long as the stock price hovers near the strike price, both the purchased call and put options retain significant intrinsic value, resulting in profits for the trader.

Traps and Considerations:

While straddles have the potential to be highly rewarding, they also carry inherent risks. The premium paid for the purchase of both call and put options represents a significant investment that must be recouped through profitability. Additionally, straddles are most effective in highly volatile markets where substantial price fluctuations are anticipated. In range-bound markets or during periods of low volatility, a straddle strategy may result in losses. Traders should carefully assess market conditions before implementing this strategy.

Image: www.options-trading-mastery.com

Day Trading Option Straddles

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-06_2-b0aa70d4f6004811811f8b07f034efd4.png)

Image: www.investopedia.com

Conclusion:

Day trading option straddles offer a unique advantage to profit from market volatility, regardless of its direction. By capitalizing on time decay and volatility, this strategy can generate substantial rewards. However, it is crucial to fully grasp the risks and subtleties of straddles before engaging in such trading activities. Thorough research and prudent execution are essential for success in this demanding yet rewarding endeavor.