In the realm of financial trading, options emerge as versatile instruments that confer the power to navigate market volatility. Among the diverse strategies that traders employ, the straddle technique stands out as a prudent approach to capitalize on market uncertainty. This article delves into the intricacies of a straddle in option trading, unraveling its fundamentals, applications, and the potential rewards it holds.

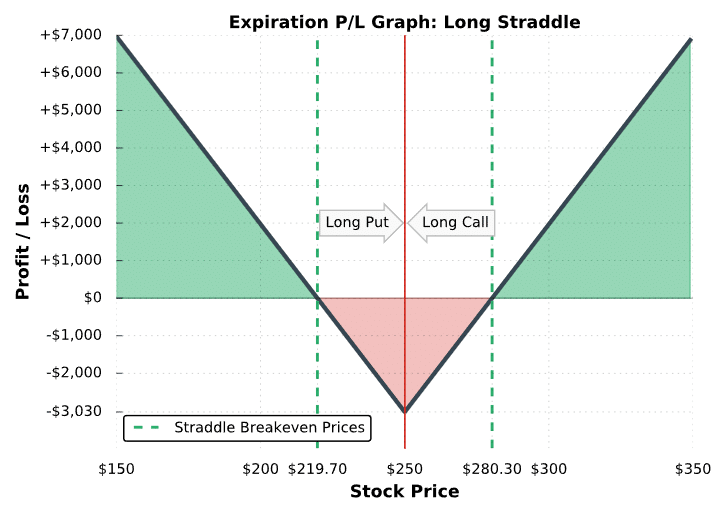

Image: www.projectfinance.com

Understanding the Straddle: A Strategy for Volatility

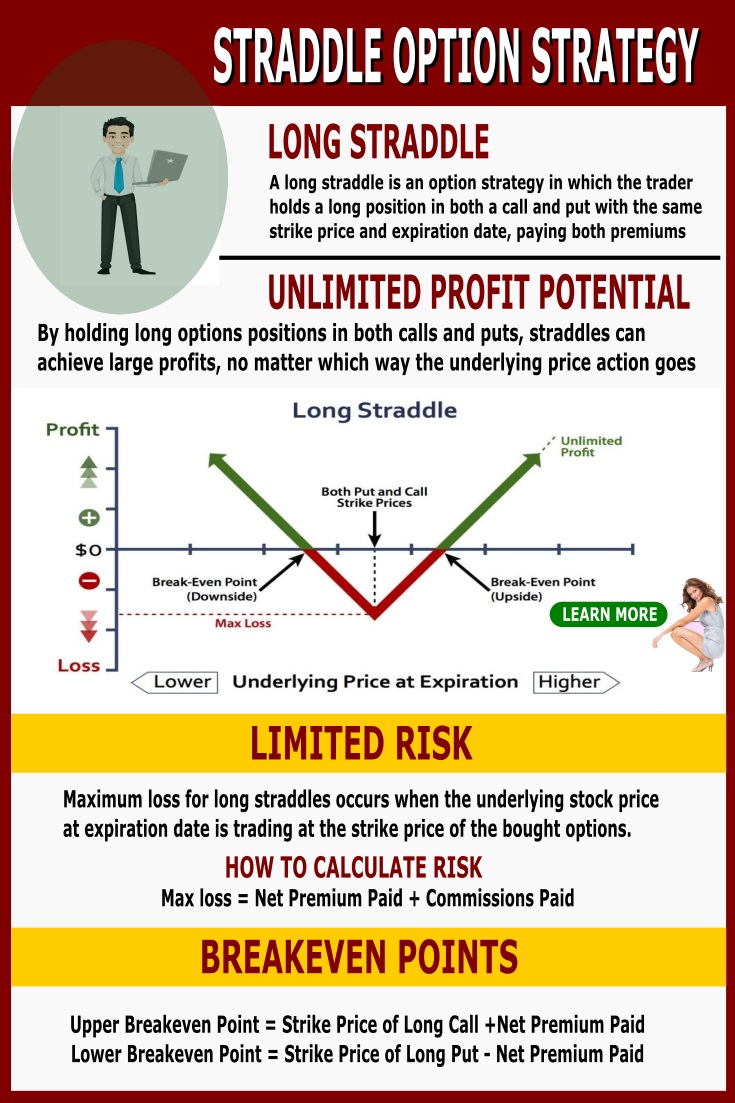

A straddle is an option strategy that involves simultaneously purchasing both a call and a put option with identical strike prices and expiration dates. The underlying asset can be stocks, indices, or any other eligible security. The essence of a straddle lies in its ability to profit from significant price fluctuations, irrespective of the direction of the movement.

Imagine a scenario where you anticipate a substantial price swing for a particular stock. However, uncertainty lingers as to whether the price will soar or plunge. In such a situation, a straddle empowers you to position yourself to profit from either outcome.

Anatomy of a Straddle

A succinct breakdown of a straddle unveils its key components:

-

Call Option: Grants the holder the right (but not the obligation) to buy the underlying asset at the specified strike price before expiration.

-

Put Option: Confers the right (but not the obligation) to sell the underlying asset at the specified strike price before expiration.

-

Strike Price: The price level at which the option can be exercised.

-

Expiration Date: The date on which the option contract expires and becomes worthless.

The Profit Potential of a Straddle

The payoff profile of a straddle exhibits a distinctive shape. Maximum profits are realized when the underlying asset’s price moves significantly away from the strike price, either upwards or downwards. As the price deviates further, the profits escalate.

Conversely, a straddle faces maximum losses when the underlying asset’s price remains relatively stable, hovering near the strike price. In this scenario, both the call and put options expire worthless, resulting in a complete loss of the premium paid.

Image: www.myjourneytomillions.com

Real-World Applications of the Straddle Strategy

Despite its simplicity, the straddle strategy finds practical applications in various market conditions:

-

Capitalizing on Events: A straddle can be employed to benefit from sudden market events, such as earnings announcements, economic data releases, or political developments, which may trigger heightened volatility.

-

Protecting Existing Positions: Traders can utilize a straddle to hedge against existing positions in the underlying asset, mitigating potential losses from adverse price movements.

-

Speculating on Directionless Markets: When the market lacks a clear trend, a straddle provides an opportunity to capitalize on large price fluctuations, regardless of the direction.

Examples of Straddle Trading

To illustrate the mechanics of a straddle, consider the following example:

A trader anticipates a surge in volatility for Apple stock (AAPL). The current market price is $150. The trader purchases both an AAPL call option with a strike price of $160 and an AAPL put option with a strike price of $160, both expiring in one month.

-

If AAPL surges to $170: The call option becomes profitable, while the put option expires worthless. The trader realizes a profit of $10 per share.

-

If AAPL plummets to $140: The put option becomes profitable, while the call option expires worthless. Again, the trader secures a profit of $10 per share.

-

If AAPL remains stable at $155: Both the call and put options expire worthless, and the trader loses the premium paid.

Advantages and Risks of Straddle Trading

Like any trading strategy, straddle trading entails both advantages and potential risks:

Advantages

- Potential for substantial profits in volatile markets.

- No directional bias required, making it suitable for uncertain conditions.

- Effective hedging tool to reduce portfolio risk.

Risks

- Premium costs can be high, especially during periods of low volatility.

- Requires careful timing and strike price selection.

- Potential for significant losses if the underlying asset’s price remains stagnant.

Tips for Success in Straddle Trading

To enhance your success with straddle trading, consider the following tips:

-

Choose Liquid Markets: Opt for underlying assets with high trading volume and open interest to ensure adequate liquidity.

-

Manage Your Risk: Determine an appropriate position size that aligns with your risk tolerance and account balance.

-

Set Realistic Expectations: Understand that a straddle strategy is designed for high-volatility environments. Adjust your profit targets accordingly.

-

Monitor Market Conditions: Stay abreast of market news and economic data that may impact the underlying asset’s price.

-

Consider Alternative Volatility Strategies: Explore other option strategies, such as a strangle or butterfly spread, to cater to different market scenarios.

Straddle In Option Trading

Image: www.options-trading-mastery.com

Conclusion: Embracing Uncertainty with Straddles

A straddle in option trading offers a strategic approach to navigate market uncertainty and capitalize on substantial price fluctuations. By simultaneously embracing both bullish and bearish possibilities, traders can position themselves for success. However, it is crucial to approach this strategy with a comprehensive understanding of its dynamics, risk profile, and potential rewards. Through careful market analysis, prudent risk management, and a disciplined mindset, straddle trading can unlock significant opportunities in the ever-evolving financial landscape.