Imagine embarking on a thrilling adventure where you have the potential to harness market volatility and unlock new trading opportunities. Options trading straddles present such an avenue, offering a fascinating strategy that empowers you to navigate the unpredictable financial landscape with renewed confidence.

Image: www.xtremetrading.net

In the realm of financial instruments, options reign supreme as versatile tools that bestow upon traders the right, but not the obligation, to buy (if it’s a call option) or sell (in case of a put option) an underlying asset at a predetermined price until a specified expiration date. Straddle options, a unique variation within this options universe, provide a strategic advantage by simultaneously combining both call and put options concerning the same underlying security.

Understanding Straddles: A Comprehensive Guide

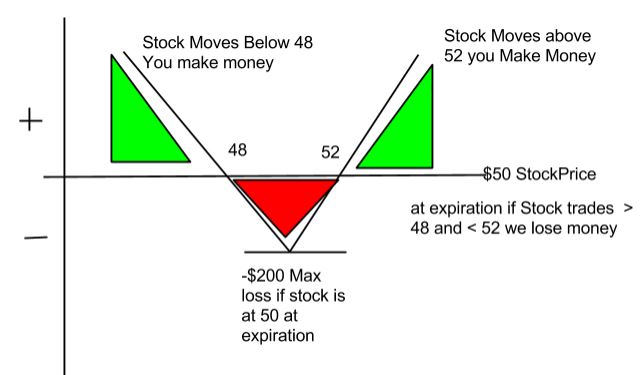

Delving into the intricacies of straddles unveils a tailored approach where investors can potentially harness market uncertainty to their advantage. By simultaneously acquiring both a call option and a put option with the same exercise price and expiration date, a straddle position is established.

This strategic combination provides a trader the flexibility to capitalize on significant price movements in either direction while minimizing the directional risk. The call option grants the trader the right to purchase the asset at the strike price, while the put option confers the right to sell at the same strike price.

The allure of straddles lies in their ability to potentially secure profits during periods of heightened volatility, regardless of the underlying asset’s direction. When substantial price fluctuations occur, the value of one of the options within the straddle tends to increase, potentially offsetting any losses incurred on the other.

However, it’s imperative to acknowledge that straddles come with inherent risks. The premium, or the cost of acquiring the straddle, constitutes an upfront investment regardless of whether the desired price movement materializes, potentially leading to losses if the market remains stagnant.

Navigating Market Volatility with Straddles: A Strategic Approach

In the turbulent waters of the financial markets, straddles emerge as instruments that can potentially provide traders with a measure of stability and control. When the tides of uncertainty rise, straddles provide a strategic refuge, offering protection against both upward and downward price movements by creating a neutral position.

Straddles possess a unique ability to thrive in moments of heightened volatility, a scenario where other trading strategies may encounter difficulties. As the underlying asset’s price undergoes dramatic swings, the value of the straddle tends to rise, presenting adept traders with the potential to harness these market fluctuations to their advantage.

Expert Insights: Unlocking the Secrets of Straddle Mastery

To navigate the complexities of straddle options effectively, it is essential to heed the wisdom of those who have traversed these markets before us. We sought invaluable insights from renowned options trading expert, Mr. Alexandro Cohen, who shared his invaluable insights into the art of straddle trading:

- Patience is a Virtue: Straddle trading demands patience and discipline. Avoid hasty decisions driven by short-term market fluctuations. Let the market dictate your actions and capitalize on opportunities that align with your strategy.

- Manage Risk Prudently: Establishing a well-defined risk management framework is non-negotiable. Carefully consider position sizing and never risk more capital than you can afford to lose.

- Harness Volatility to Your Advantage: Straddles flourish in volatile markets. Identify periods of heightened uncertainty and position yourself to potentially capitalize on price swings in either direction.

Image: tradingthesetup.com

Options Trading Straddles

Image: medium.com

Conclusion: Embracing Straddles as a Strategic Tool

Options trading straddles embody a powerful financial instrument that has the potential to expand your trading horizons. By embracing the concept of straddle options, you empower yourself with a strategic tool to navigate market volatility with confidence.

Remember, the world of options trading is a dynamic landscape that requires continuous learning and adaptation. Embrace the opportunity to seek knowledge, consult with experts, and refine your techniques over time.

Embrace the captivating world of options trading straddles, and unlock the potential to navigate market uncertainties with newfound confidence. Begin your journey today and experience the transformative power of this versatile trading strategy firsthand.