In the realm of options trading, the straddle strategy stands out as a potent tool for capturing market volatility. Imagine entering a bustling marketplace with the ability to speculate on both the upward and downward movement of stock prices. The straddle strategy empowers you to do just that, granting you the flexibility to make a profit even when the market direction remains uncertain.

Image: www.quantsapp.com

The premise of a straddle is simple: you simultaneously buy a call option and a put option with the same strike price and expiration date. This duality of options allows you to profit from a significant price swing in either direction, effectively hedging your bets against market uncertainty.

Straddle Options Trading: An Overview

A call option grants you the right, but not the obligation, to buy a specific stock at a predetermined price (the strike price) on or before a certain date (the expiration date). On the other hand, a put option gives you the right to sell the stock at the strike price within the specified timeframe.

In a straddle strategy, you simultaneously purchase a call option and a put option with the same strike price and expiration date. This strategic combination creates a range of profitability. If the stock price rises significantly, your call option will yield profits, while the put option will likely expire worthless. Conversely, if the stock price plummets, your put option will deliver gains, while the call option will probably expire out of the money.

Understanding the Mechanics of a Straddle

Executing a straddle strategy involves several key considerations:

- **Strike Price:** When choosing the strike price, consider the current market price of the stock and your预期 volatility.

- **Expiration Date:** The expiration date determines the duration of your trade. Longer-term options offer more potential for profit but also carry higher risk.

- **Option Premium:** The cost of the straddle strategy is the combined premium you pay for both the call and put options.

To illustrate the potential profitability of a straddle, consider the following example: Suppose you purchase a straddle on Apple (AAPL) stock with a strike price of $170 and an expiration date of one month. You pay a premium of $5 per share for the call option and $5 per share for the put option, resulting in a total premium of $10 per share.

If AAPL’s stock price rises to $180 by the expiration date, your call option will yield a profit of $10 per share, offset by a loss of $5 per share on your put option. Your overall profit would be $5 per share, not accounting for transaction costs.

Conversely, if AAPL’s stock price falls to $160 by the expiration date, your put option will generate a profit of $10 per share, while your call option will expire worthless. Again, your total profit would be $5 per share, excluding fees.

Recent Developments and Expert Insights

The straddle strategy has gained traction among options traders seeking to navigate market volatility. Recent market trends, including rising interest rates and geopolitical uncertainties, have fueled increased demand for volatility-hedging strategies like straddles.

Expert advice suggests that straddles are best suited for experienced traders who understand the nuances of options pricing and implied volatility. It’s crucial to carefully evaluate market conditions, select appropriate strike prices, and monitor the underlying stock’s price movements closely.

Image: sophisticatedinvestor.com

Tips and Expert Advice for Straddle Traders

To enhance your straddle trading success, consider these valuable tips and expert advice:

- **Trade with a Plan:** Define your trading objectives, risk tolerance, and profit targets before executing any trades.

- **Manage Your Risk:** Straddles involve significant potential losses. Limit your risk by trading with a portion of your capital and using stop-loss orders.

- **Understand Implied Volatility:** Implied volatility measures the market’s预期 volatility. Higher implied volatility favors straddle strategies.

- **Monitor the Underlying:** Constantly track the price movements of the underlying stock to make informed decisions about your options positions.

Remember, successful straddle trading requires a thorough understanding of options pricing, risk management, and market dynamics. By adhering to these expert recommendations, you can enhance your chances of profitability.

FAQs on Straddle Options Trading

Q: Is a straddle profitable if the stock price does not move significantly?

A: No, straddle trades profit from significant price swings in either direction. If the stock price remains within a narrow range, both options may expire worthless, resulting in a loss.

Q: How do I determine the right strike price for a straddle?

A: Consider the current market price, expected volatility, and your trading objectives. It’s often advisable to choose a strike price slightly out of the money to reduce the initial premium cost.

Q: What are the risks associated with straddle trading?

A: Straddle trading involves the potential for significant losses. The combined premium you pay for both options represents your maximum loss if both options expire worthless. Time decay also erodes the value of options over time.

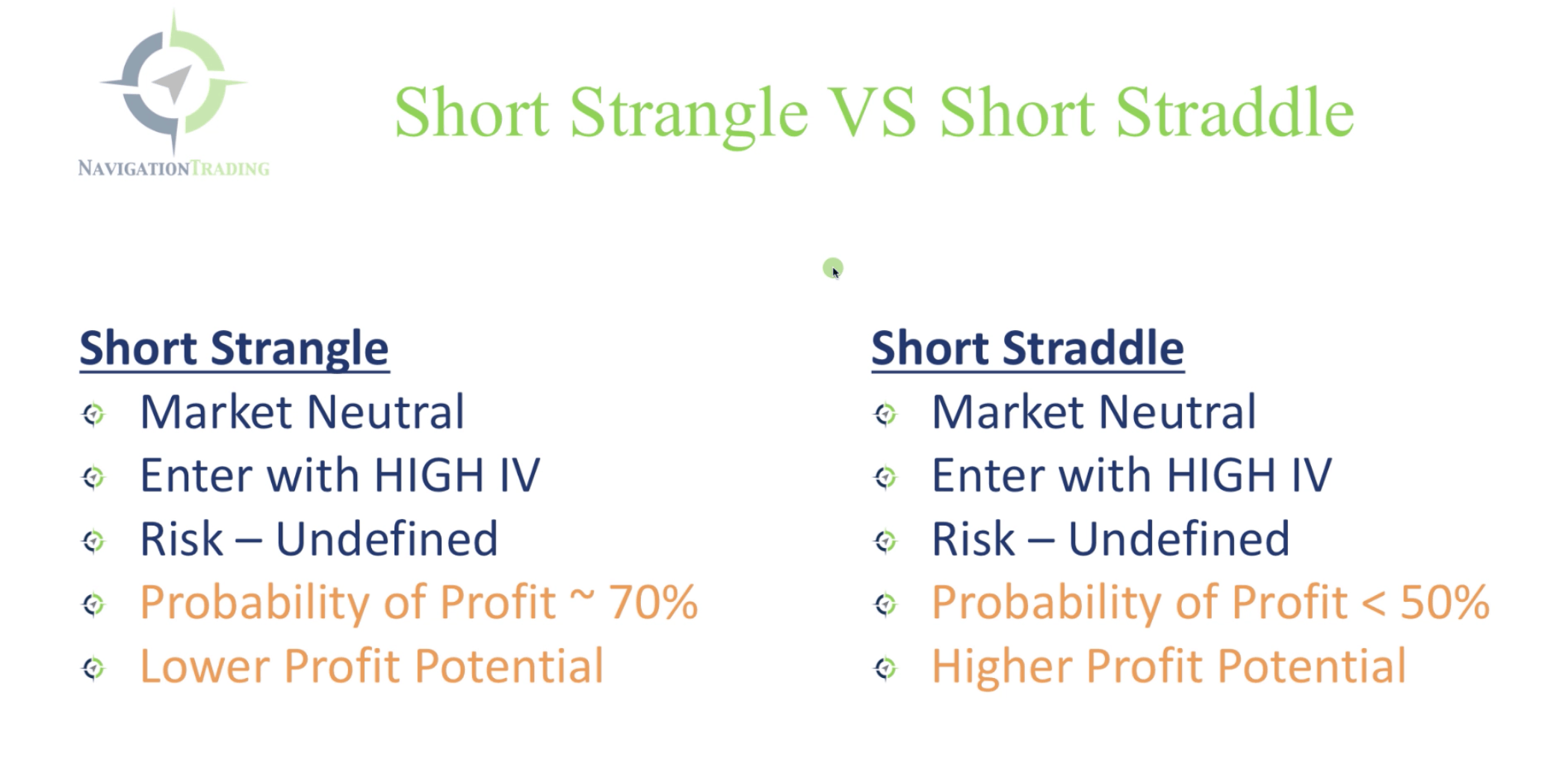

Options Trading Strategy Straddle

Image: navigationtrading.com

Conclusion

The straddle options trading strategy provides a powerful method for profiting from market volatility. By simultaneously buying a call and a put option, you create a range of profitability that benefits from significant price movements in either direction. However, it’s essential to approach straddle trading with a comprehensive understanding of options pricing, risk management, and market dynamics.

Are you ready to explore the exciting world of straddle options trading? With careful planning and execution, you can harness the power of volatility to enhance your trading portfolio.