As an avid options trader, I’ve witnessed firsthand the dynamic world of derivatives. While the allure of substantial profits beckons, it’s crucial to grasp the foundational concepts of option trading to navigate this complex terrain. Two pivotal approaches within this realm are delivery-based and intraday trading. In this comprehensive guide, we’ll embark on a journey to unveil the intricacies of each option, providing you with the tools to make informed decisions.

Image: a5theory.com

**Understanding Delivery-Based Options: The Long-Term Hold**

When embarking on delivery-based option trading, the trader assumes the role of a potential owner or seller of the underlying asset. These options grant the holder the right to buy (call option) or sell (put option) the underlying security at a specified price (strike price) on or before a predetermined date (expiration date). Delivery-based options are suited for individuals seeking long-term exposure to the underlying asset’s price movements. Traders may hold these options until expiration or exercise their rights to buy or sell the asset.

**Key Points of Delivery-Based Options:**

- Involve the potential ownership or sale of the underlying asset.

- Offer long-term exposure to the underlying asset’s price fluctuations.

- Can be held until expiration or exercised before expiration.

**Intraday Option Trading: The Short-Term Hustle**

In contrast to delivery-based options, intraday option trading involves buying and selling options within the same trading day, aiming to capitalize on short-term price movements. Intraday traders seek to profit from price fluctuations throughout the day, entering and exiting positions before the market closes. This agile approach requires a deep understanding of market dynamics and the ability to make quick decisions.

Image: www.youtube.com

**Key Points of Intraday Option Trading:**

- Involves buying and selling options on the same trading day.

- Leverages short-term price movements for profit.

- Demands swift decision-making and market expertise.

**Advantages and Disadvantages: Weighing the Options**

Both delivery-based and intraday option trading possess unique advantages and disadvantages. Delivery-based options offer long-term exposure to the underlying asset, enabling traders to potentially reap significant gains over extended periods. However, they also carry the risk of holding an option until expiration, potentially resulting in losses if the asset’s price doesn’t move favorably.

Intraday option trading, on the other hand, provides opportunities for quick profits by exploiting short-term price movements. However, it requires a high level of skill and risk tolerance, as rapid decisions are necessary to navigate the fast-paced market environment.

**Expert Tips for Successful Option Trading**

Mastering the art of option trading requires a blend of knowledge, experience, and strategy. Here are a few expert tips to enhance your trading prowess:

- Diligent Research and Education: Immerse yourself in the world of options trading, studying market trends, and comprehending the intricacies of different strategies.

- Risk Management Discipline: Establish clear risk parameters and adhere to them strictly. Never risk more capital than you can afford to lose.

- Patience and Discipline: Avoid impulsive trading decisions and maintain a disciplined approach to option trading. Patience and persistence are key to long-term success.

**Frequently Asked Questions on Option Trading Delivery vs. Intraday**

- Q: What is the main difference between delivery-based and intraday option trading?

A: Delivery-based options involve the potential ownership or sale of the underlying asset, while intraday options are traded within the same trading day. - Q: Which trading approach is better?

A: The best approach depends on your trading objectives and risk tolerance. - Q: Can I make a lot of money with option trading?

A: While option trading offers profit potential, it also involves risk. Traders should approach it with a realistic understanding of both potential gains and losses.

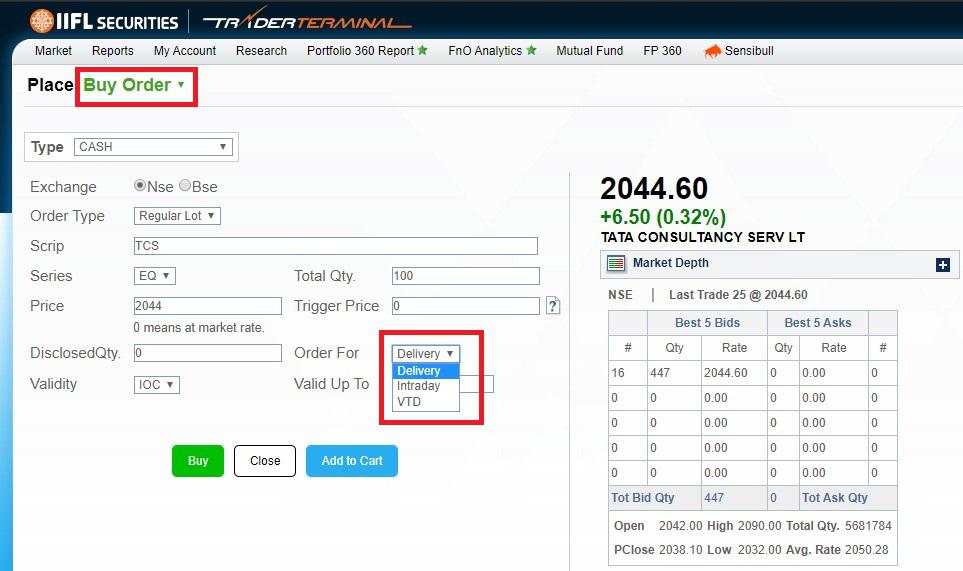

Option Trading Delivery Vs Intraday

Image: ttweb.indiainfoline.com

**Conclusion**

The world of option trading is a captivating and complex realm that can yield both rewards and challenges. Understanding the nuances of delivery-based and intraday trading empowers you to tailor your approach to your specific goals and risk tolerance. Remember to embrace a disciplined approach, continuously educate yourself, and seek expert guidance when necessary. Whether you embark on the long-term horizon of delivery-based options or the fast-paced arena of intraday trading, the key to success lies in knowledge, strategy, and a resolute mindset.

I would love to hear from our esteemed readers: Are there any specific aspects of option trading delivery vs. intraday that you would like to delve deeper into? Share your thoughts and questions below, and let’s embark on a collaborative journey to unravel the complexities of this fascinating trading domain.