Introduction

In the realm of options trading, two prominent strategies stand out: strangle and straddle. Understanding the nuances between these options can empower traders to make judicious decisions and increase their chances of success. This article delves into the complexities of strangle vs. straddle strategies, arming you with valuable knowledge and actionable insights.

Image: tickertape.tdameritrade.com

Understanding the Basics

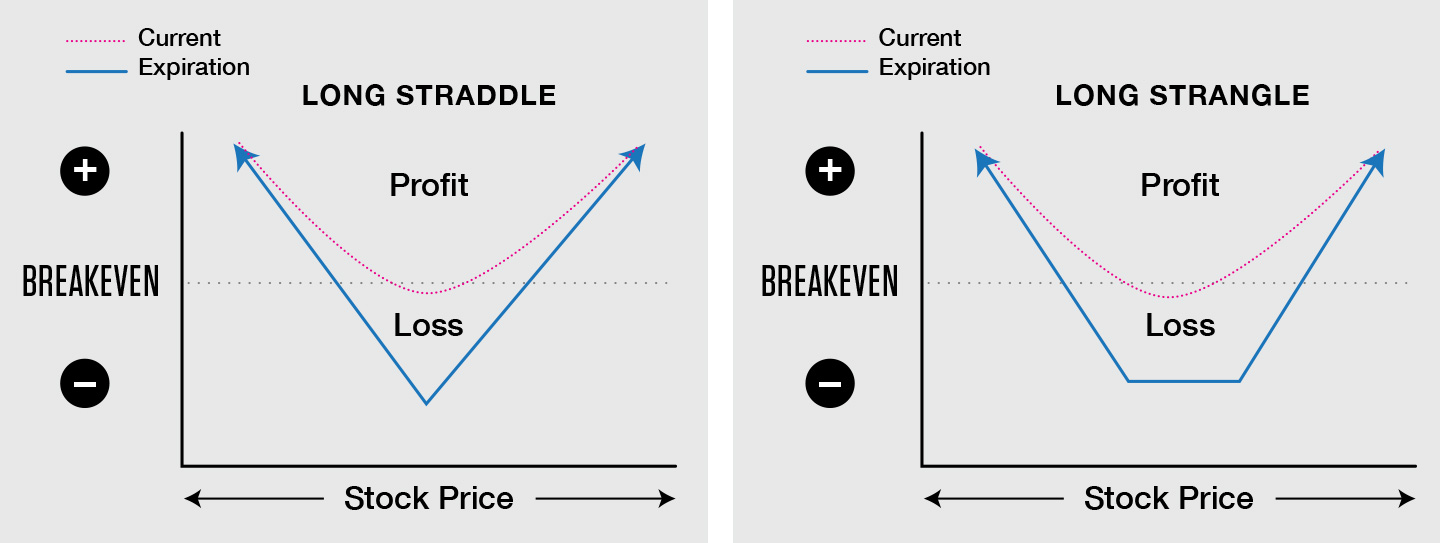

An option strangle involves purchasing both a call and a put option at different strike prices with the same expiration date. The call option gives the right to buy the underlying asset at a specific strike price, while the put option grants the right to sell at a different strike price. By creating a strangle, the trader aims to profit from a significant price movement in either direction while limiting the potential downside.

In contrast, an option straddle is similar to a strangle, but both the call and put options have the same strike price. This strategy is typically employed when the trader expects high volatility in the underlying asset but is uncertain about the direction of price movement. The straddle provides the opportunity to profit from a sharp move in either direction.

Key Differences and Similarities

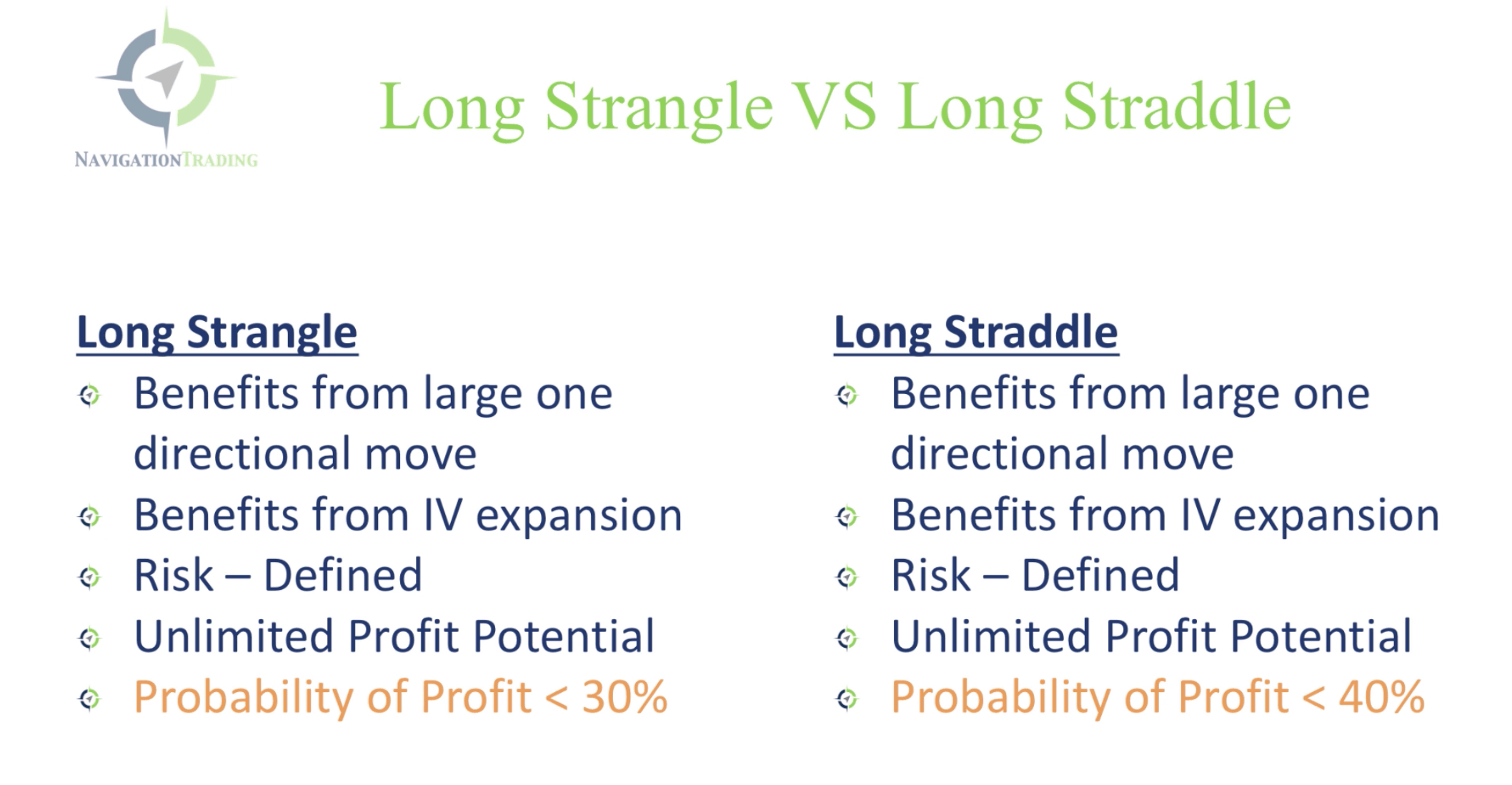

The primary difference between a strangle and a straddle lies in their strike prices. While a strangle involves different strike prices, a straddle features the same strike price for both the call and put options. Another key distinction is the premium paid for each strategy. Strangles typically have a higher premium than straddles due to the increased probability of profit.

However, both strategies share certain similarities. They are both non-directional, meaning they do not have a specific bias for price movement. They also have limited risk and reward, as the potential loss is capped at the premium paid. Additionally, both strangle and straddle strategies require careful analysis of volatility and market conditions.

Expert Insights

“The choice between a strangle and a straddle largely depends on the trader’s expectations regarding price volatility,” advises renowned options trader Mark Sebastian. “If you anticipate large price swings, a strangle may be a more suitable option. However, if you expect moderate volatility, a straddle might offer a better risk-reward ratio.”

“It’s crucial to thoroughly research the underlying asset and the market conditions before implementing either strategy,” adds options expert Karen Finerman. “Options trading involves both potential profits and risks, so it’s imperative to manage your positions with discipline and risk management principles.”

Image: navigationtrading.com

Actionable Tips for Traders

-

Research the Underlying Asset: Before jumping into option trading, meticulously study the underlying asset’s historical price movements, volatility patterns, and market dynamics. This knowledge will inform your decision-making and enhance your chances of success.

-

Determine Your Risk Tolerance: Options trading carries inherent risks. It’s essential to determine your risk tolerance and trade only within your financial capabilities. Always consider the potential for losses before entering a position.

-

Monitor the Market: Market dynamics play a crucial role in options trading. Regularly monitor the news, economic data, and other market indicators that may impact the price of the underlying asset.

Trading Option Strangle Vs Straddle

Image: www.ispag.org

Conclusion

Whether you choose a strangle or a straddle, thorough knowledge and prudent decision-making are paramount. By embracing the insights shared in this article, you can equip yourself with the expertise to navigate the intricacies of options trading effectively. Remember to seek guidance from reliable sources, manage your risks, and stay informed about the markets. With dedication and perseverance, you can harness the power of these strategies to achieve your financial goals.