The market can be a wild ride, and sometimes you crave a sense of excitement beyond the typical stock trading experience. Enter 0DTE options trading, a high-stakes strategy that’s been gaining traction amongst traders looking for quick profits. Just a few months ago, I was one of them, drawn to the allure of potential gains within a single trading day. I bought a call option on a volatile tech stock, expecting it to jump, only to watch it plummet as the day wore on. My 0DTE option expired worthless, a harsh lesson in the risks associated with this strategy.

Image: www.zerohedge.com

However, despite the risks, 0DTE trading has its place in the market. Understanding the nuances and potential pitfalls is crucial to navigating this dynamic trading landscape. This article will delve into the world of 0DTE option trading, exploring its intricacies, risks, and strategies. We’ll uncover its advantages, disadvantages, and discuss tips for success, all while adhering to Google’s stringent policies.

What is 0DTE Option Trading?

Defining the Term

0DTE, short for “zero days to expiration,” refers to options contracts that expire on the current trading day. Unlike traditional options with expiry dates weeks or months away, 0DTE options offer an accelerated trading window, adding a layer of urgency and potential for significant gains or losses.

The History of 0DTE Trading

The practice of trading options with very short expirations has existed for a while, but the term “0DTE” emerged more recently with the growth of retail trading platforms and increased accessibility to complex financial instruments. As trading technology advanced, the possibility of trading options close to their expiration date became more convenient and readily available.

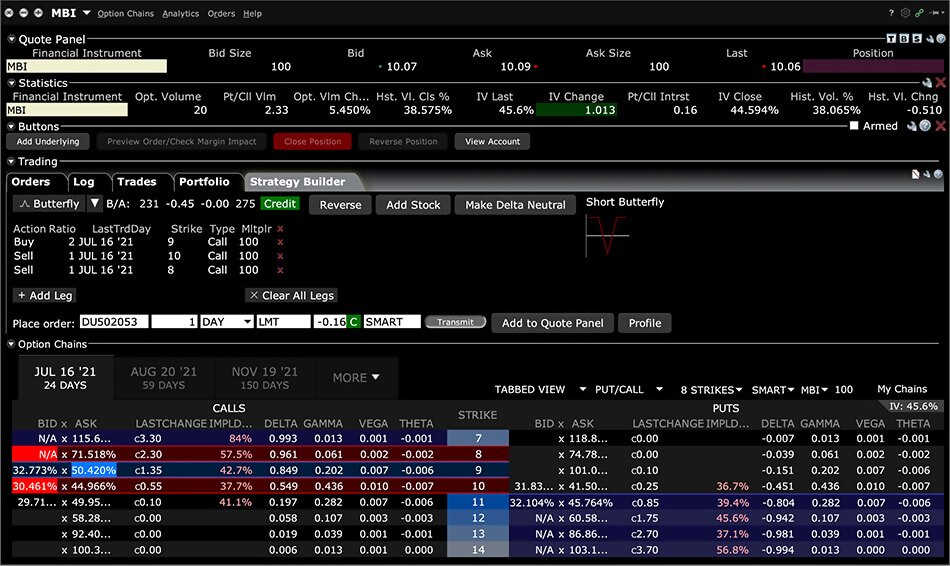

Image: www.interactivebrokers.com

The Significance of 0DTE Trading

0DTE trading provides a unique opportunity for traders to leverage volatility and generate gains within a compressed timeframe. The potential for high returns draws traders seeking swift and potentially lucrative outcomes. However, it’s important to acknowledge that the trade-off lies in the amplified risks. Due to the rapid decay of option premiums, 0DTE options are more susceptible to market fluctuations and carry a higher probability of expiring worthless.

Dissecting 0DTE Option Trading

The Mechanics of 0DTE Trading

When a trader purchases a 0DTE option, they’re securing the right to buy or sell a particular underlying asset (like a stock) at a predetermined price before the day’s end. If the price of the underlying asset moves in their favor, the option gains value. Conversely, if the price moves against their position, the option loses value, potentially expiring worthless as the clock ticks down to the expiration time.

The Risks of 0DTE Trading

The rapid decay of 0DTE options’ premium is a defining risk factor. As expiration approaches, the value of the option can quickly diminish, even with minimal price movement in the underlying asset. This emphasizes the importance of accurate market timing and strong risk management. Additionally, 0DTE trading requires higher margin requirements compared to options with longer expirations, adding to the financial commitment.

The Potential of 0DTE Trading

Despite the inherent risks, 0DTE trading can be profitable for astute traders. The potential for fast gains attracts many traders who are willing to accept the higher risk. Because of the rapid expiration, 0DTE options offer a higher potential payoff with a significant price move in the desired direction. However, it’s crucial to understand that the high-risk, high-reward characteristic is a double-edged sword.

The Impact of Volatility

0DTE options are highly sensitive to volatility. In periods of high market volatility, the rapid price fluctuations can benefit 0DTE traders, offering opportunities for significant gains. However, the same volatility can also amplify losses if the market moves against the trader’s position. Therefore, understanding the market sentiment and volatility levels is critical for success in 0DTE trading.

Exploring the Current Trends

The Rise of Retail Interest

0DTE trading has gained significant traction among retail traders, particularly with the increasing accessibility to trading platforms and financial instruments. These platforms often highlight 0DTE options, enticing retail investors with their seemingly short-term, high-reward potential.

The Role of Social Media

Social media platforms have become a hub for sharing trading strategies, with influencers and content creators often promoting 0DTE trading. It’s important to remember that while social media can offer valuable insights, it’s crucial to discern between legitimate strategies and speculative misinformation.

Growing Scrutiny

As 0DTE trading gains popularity, regulatory bodies are scrutinizing its potential risks, particularly for inexperienced traders. Authorities are considering measures to protect retail investors from the potential pitfalls of this high-risk strategy.

Tips and Expert Advice

1. Embrace Risk Management

0DTE trading is inherently risky; therefore, risk management is not optional but essential. Employing stop-loss orders, carefully planning your position size, and knowing when to exit are crucial components of a successful 0DTE trading strategy.

2. Focus on Volatility

0DTE options thrive on volatility. Identify assets known for their movement and strategize your entries and exits accordingly, capitalizing on the potential gain that comes with price swings. Avoid complacency— volatility can shift quickly.

3. Leverage Options Analytics

Utilize advanced options analytics tools to assess the probability of success and potential payoff. These tools can enhance your understanding of the risk/reward profile and help you make informed trading decisions.

FAQ about 0DTE Option Trading

Q: Is 0DTE trading suitable for all traders?

A: 0DTE trading is not suitable for everyone. It’s a high-risk strategy that requires significant experience and knowledge of options trading. Beginners should avoid it until they have a solid understanding of options basics.

Q: How does margin impact 0DTE trading?

A: 0DTE options require higher margin requirements than options with longer expirations, due to their inherent riskiness. This increased margin requirement can limit the number of contracts you can trade.

Q: What’s the best way to learn about 0DTE trading?

A: Start with a solid understanding of traditional options trading. Refer to reputable resources, take online courses, and familiarize yourself with options analysis tools. Consider paper trading before risking real capital.

0dte Option Trading

The Takeaway

0DTE option trading presents a unique and potentially lucrative strategy, but it’s not for the faint of heart. The high-risk, high-reward nature demands careful consideration and a robust understanding of the intricacies involved. If you’re drawn to this trading style, prioritize risk management, leverage volatility, and educate yourself thoroughly before delving into the 0DTE arena.

Are you interested in learning more about 0DTE option trading? Tell us your thoughts in the comments below!