Imagine stepping into the fast-paced world of options trading, where time is everything. What if you could enter a trade and have the option to exercise it within the same trading day? Introducing zero day options trading, a thrilling strategy that puts you in the driver’s seat with immediate action.

Image: www.asktraders.com

Zero day options trading allows you to buy or sell an option and exercise it on the same trading day. This lightning-fast approach requires a sharp eye for market movements and a calculated strategy to maximize potential gains.

Delving into Zero Day Options Trading

Zero day options trading offers a unique set of advantages. With the ability to exercise your option on the same day, you can quickly capitalize on short-term market fluctuations or hedge against potential risks. This flexibility allows for swift decision-making and the ability to fine-tune your strategies.

However, zero day options trading also comes with inherent risks due to its time-sensitive nature. Rapid market movements can result in potential losses if not carefully managed. Traders must have a comprehensive understanding of options pricing, implied volatility, and risk management techniques to navigate this dynamic market effectively.

Zero Day Options Trading: A Historical Perspective

Options trading has a long and illustrious history, dating back to the Dutch Golden Age in the 17th century. However, zero day options trading is a relatively recent development. In the early days of options trading, contracts typically had longer lifespans, often extending several months or even years.

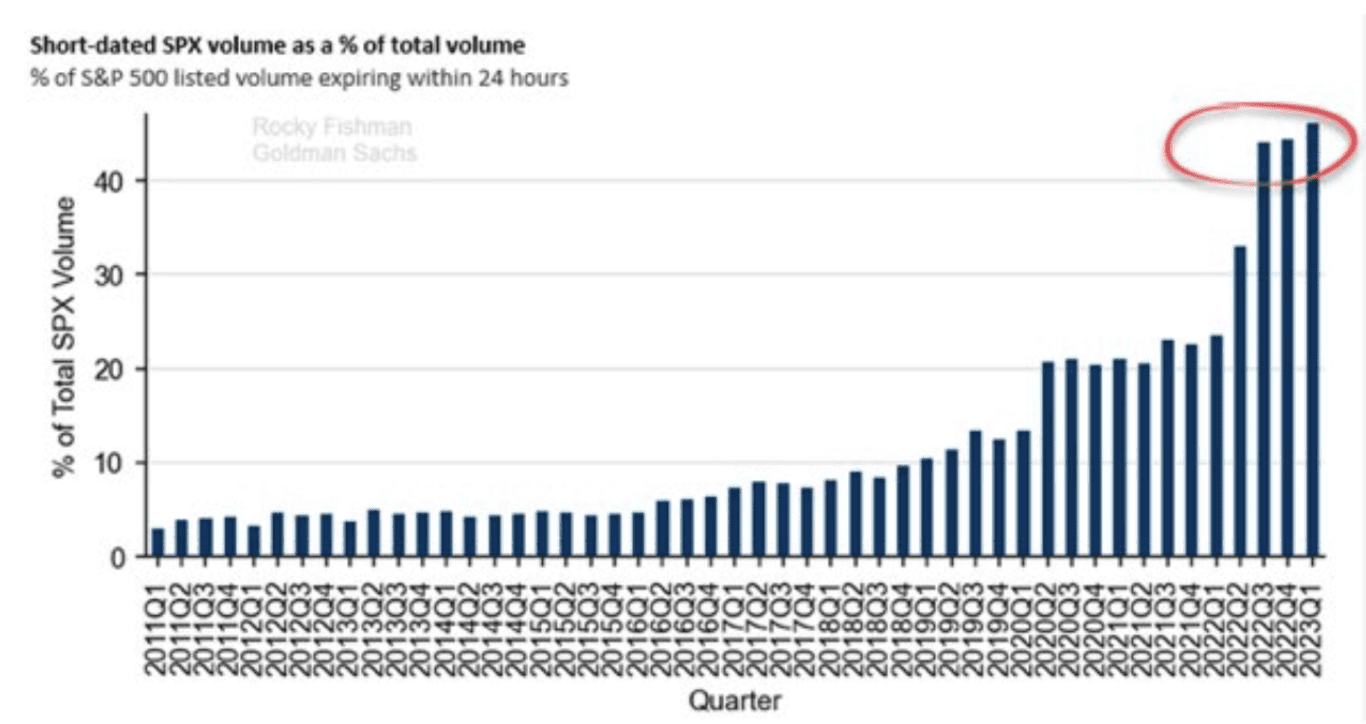

As technology advanced and markets became more volatile, the need for shorter-term options emerged. Zero day options, with their intraday exercise feature, became an attractive option for traders seeking to exploit rapid market movements.

How Zero Day Options Work

To understand zero day options trading, let’s break down the process. When you purchase a zero day option, you acquire the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) before the end of the trading day.

Crucially, unlike traditional options with expiration dates extending beyond the trading day, zero day options expire within the same day they are purchased. This means that traders need to exercise their option or close their position before the market closes to realize any gains or minimize potential losses.

Image: www.cheddarflow.com

Tips and Expert Advice for Zero Day Options Trading

To succeed in zero day options trading, it’s essential to follow these expert tips:

- Gain a Deep Understanding: Thoroughly research options pricing models, implied volatility, and risk management strategies before venturing into zero day options trading.

- Monitor Market Trends: Stay abreast of economic news, geopolitical events, and other factors that may impact market volatility and option prices.

- Manage Your Risks: Employ stop-loss orders and position-sizing techniques to manage potential losses and protect your trading capital.

FAQ on Zero Day Options Trading

To clarify any doubts, here’s a comprehensive FAQ on zero day options trading:

- Q: What are the benefits of zero day options trading?

- A: Flexibility, quick profits, and hedging opportunities due to intraday exercise and expiration.

- Q: What are the risks associated with zero day options trading?

- A: Time constraints, high volatility, and potential for rapid losses if not managed properly.

- Q: How do I get started with zero day options trading?

- A: Open an options trading account, educate yourself, and practice with paper trading before risking real capital.

What Is Zero Day Options Trading

Conclusion: Embracing the Thrill of Zero Day Options Trading

Zero day options trading offers a dynamic and challenging trading experience that can provide ample opportunities for profit and hedging. By understanding the mechanics, risks, and rewards involved, traders can navigate this exciting market and potentially enhance their trading strategies. Are you ready to embrace the thrill of zero day options trading?