A Personal Anecdote: Stumbling Into Financial Alchemy

My foray into options trading began with a chance encounter at a coffee shop. As I eavesdropped on a conversation nearby, I couldn’t help but overhear the buzzwords “options,” “leverage,” and “exponential returns.” Intrigued, I decided to delve deeper into this enigmatic world of financial alchemy.

Image: derivbinary.com

Options Trading: Unveiling the Basics

Options trading is a derivative strategy that allows you to speculate on the future price of an underlying asset. Unlike buying and selling stocks outright, options give you the right, but not the obligation, to buy (call option) or sell (put option) a specific asset at a specified price, known as the strike price, on or before a set date, called the expiration date. This unique characteristic opens doors to a myriad of strategies, from hedging against potential losses to generating leveraged returns.

Call Options: Betting on Ascending Prices

Call options are contracts that provide you with the right to buy an underlying asset at or above the strike price. If the market price of the underlying asset exceeds the strike price, you can exercise your option, profiting from the price difference.

Put Options: Capitalizing on Declining Prices

Put options, on the other hand, grant you the right to sell an underlying asset at or below the strike price. If the market price of the asset falls below the strike price, you can exercise your option, again profiting from the price discrepancy.

Image: www.the-pool.com

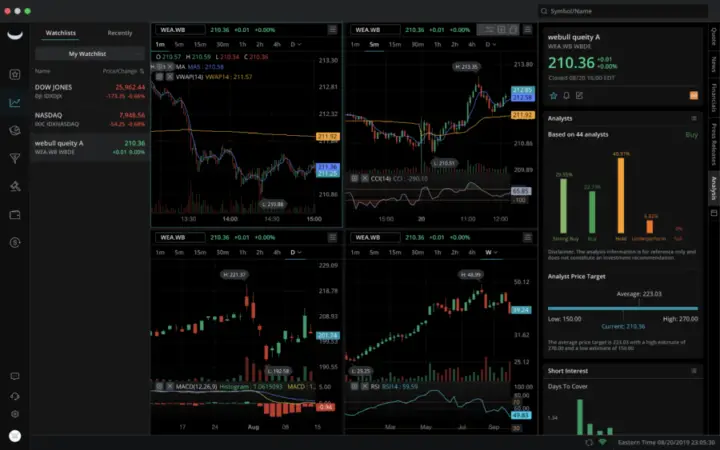

Webull: Your Gateway to Options Trading

Webull has emerged as a formidable force in the world of online brokerages, offering a diverse selection of trading instruments, including options. Its user-friendly platform and commission-free trading options make it an ideal choice for both novice and seasoned options traders.

Webull Platform: A Trader’s Oasis

The Webull platform is designed with simplicity, transparency, and functionality in mind. Its intuitive interface allows you to navigate the intricacies of options trading with ease. Real-time quotes, customizable charts, and advanced order types empower you to make informed decisions on the go.

Commission-Free Trading: Unleashing Your Potential

Webull breaks down traditional barriers by offering commission-free options trading. This means you can execute trades without worrying about hefty fees, freeing up capital for lucrative opportunities. With Webull, you can seize market trends without facing financial constraints.

Mastering Options Trading: Essential Tips

Navigating the dynamic waters of options trading requires a combination of strategy, discipline, and a keen understanding of risks. Embrace these invaluable tips to empower your trading journey.

1. Study the Underlying Asset: Delve into the Fundamentals

Before embarking on any options trade, conduct thorough research on the underlying asset. Understand its historical performance, market trends, and economic factors that may influence its price. Informed decisions stem from a comprehensive knowledge of the underlying asset’s dynamics.

2. Define Your Risk Tolerance: Setting Boundaries

Risk tolerance plays a pivotal role in options trading success. Carefully assess your financial situation and risk appetite. Determine an acceptable level of risk before entering any trades. Remember, the potential for high returns comes hand-in-hand with the potential for significant losses.

3. Monitor Market Trends: Unlocking Hidden Opportunities

Stay attuned to market movements and economic news that could impact your options strategies. Use technical analysis tools, such as chart patterns and indicators, to identify trading opportunities and potential price inflection points. Proactive monitoring enhances your ability to make strategic decisions.

4. Practice with Paper Trading: Refining Your Skills

Test your trading prowess without risking real capital by utilizing paper trading platforms. These virtual environments allow you to simulate real-time trading conditions, honing your strategies and gaining valuable experience.

5. Seek Mentorship and Education: Embracing Continuous Learning

Never stop seeking knowledge in the ever-evolving landscape of options trading. Engage with experienced traders, attend webinars, and delve into educational material to expand your understanding. The pursuit of knowledge fuels your success as a trader.

Common FAQs on Options Trading

Q: Can anyone trade options?

A: Not everyone is cut out for options trading. Beginners should start with less complex investment instruments and gradually progress to options trading as they gain experience and knowledge.

Q: How much money is needed to start options trading?

A: The minimum amount needed varies depending on the brokerage firm and the options contract you choose. It’s always advisable to start with a small amount you’re comfortable losing.

Q: What are the risks involved in options trading?

A: Options trading carries the risk of losing your entire investment. Carefully evaluate the risks involved before entering any trades.

Q: How do I choose a good options trading strategy?

A: There are numerous options trading strategies. The best strategy depends on your risk tolerance and trading goals. Research different strategies and seek guidance from experienced traders.

Q: What is the best options trading platform?

A: The best platform depends on your individual needs. Consider factors such as user-friendliness, trading tools, and commission fees. Webull is a beginner-friendly platform with commission-free trading options.

Options Trading Level Webull

Image: www.youtube.com

Conclusion: Unleashing the Power of Options Trading

Options trading empowers you to leverage market movements and generate potentially exponential returns. By embracing a well-rounded approach that encompasses research, risk management, and a proactive understanding of market trends, you can unlock the transformative power of options trading.

Are you ready to venture into the dynamic realm of options trading? Embark on your journey today and experience the exhilarating world of leveraged returns.