The VIX, or the CBOE Volatility Index, is a critical market indicator that gauges the market’s expectation of volatility over the following 30 days. Understanding and trading VIX options can unlock significant alpha-generating opportunities for astute investors. This guide delves into the intricacies of VIX options, shedding light on their potential benefits and guiding you towards a successful trading strategy.

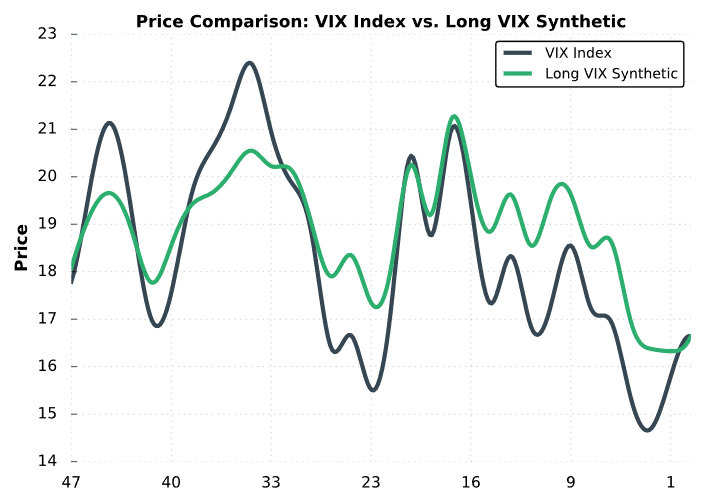

Image: www.projectfinance.com

Understanding VIX Options

VIX options are derivative instruments that derive their value from the underlying VIX index. They enable investors to speculate on the future direction of market volatility, providing a unique way to hedge against market downturns or capitalize on heightened volatility.

VIX options consist of call and put options. Call options confer the right but not the obligation to buy the VIX at a predetermined price on a specified date (expiration date). Put options, conversely, grant the right to sell the VIX at the predefined price on the expiration date.

Types of VIX Trading Options

- VIX Futures Options: Traded on the CBOE Futures Exchange (CFE), these options provide exposure to the future price of the VIX futures contract.

- VIX Index Options: These options, also traded on the CFE, are based on the spot VIX index and offer a more direct way to trade market volatility expectations.

Unlocking Alpha with VIX Options

VIX options offer several alpha-generating strategies, including:

- Hedging Strategies: Utilizing VIX options to protect a portfolio against market downturns can reduce its overall volatility.

- Volatility Trading: Speculating on the rise or fall of market volatility can yield substantial gains for experienced traders.

- Income Generation: Selling VIX options premiums can generate regular income while providing a buffer against portfolio losses during periods of high volatility.

Image: optionvol.blogspot.com

Tips for Successful VIX Trading

- Understand the Underlying Volatility: Analyze the historical volatility of the VIX and identify market conditions that favor VIX options trading.

- Choose the Right Strategy: Match your trading style and risk tolerance to the appropriate VIX options strategy.

- Manage Your Risk: Employ prudent risk management techniques, such as position sizing and stop-loss orders, to mitigate potential losses.

- Monitor Market Trends: Keep abreast of geopolitical events, economic releases, and other factors that may impact market volatility.

Frequently Asked Questions About VIX Trading

Q: How do I calculate the VIX?

A: The VIX is computed using a complex formula that incorporates the implied volatilities of S&P 500 index options over 30 trading days.

Q: Why is VIX options trading considered risky?

A: VIX options are highly leveraged instruments, amplifying both potential gains and losses. Therefore, it’s crucial to understand the underlying volatility dynamics and manage risks effectively.

Vix Trading Options Alpha

Image: ezikipayipobo.web.fc2.com

Conclusion

VIX trading options can enhance your trading portfolio and unlock alpha potential. By understanding the intricacies of VIX options, implementing sound trading strategies, and adhering to risk management principles, you can capitalize on market volatility and achieve your financial goals. Embrace this opportunity to delve deeper into VIX options and unleash their alpha-generating power.

Are you interested in learning more about VIX trading options? Explore our website and educational resources to gain expert insights and optimize your trading strategies.