Exercising an option contract grants the option holder the right to buy (in the case of a call option) or sell (in the case of a put option) an underlying asset at a predetermined price, known as the strike price. In general, exercising an option contract is not a requirement. Exercising typically makes financial sense if the option is in-the-money, meaning that the difference between the strike price and the current market price of the asset (also known as its intrinsic value) is positive. In this article, we delve into the details surrounding option exercise and help you determine whether exercising an option aligns with your investment goals.

Image: club.ino.com

Understanding the Option Exercise Process

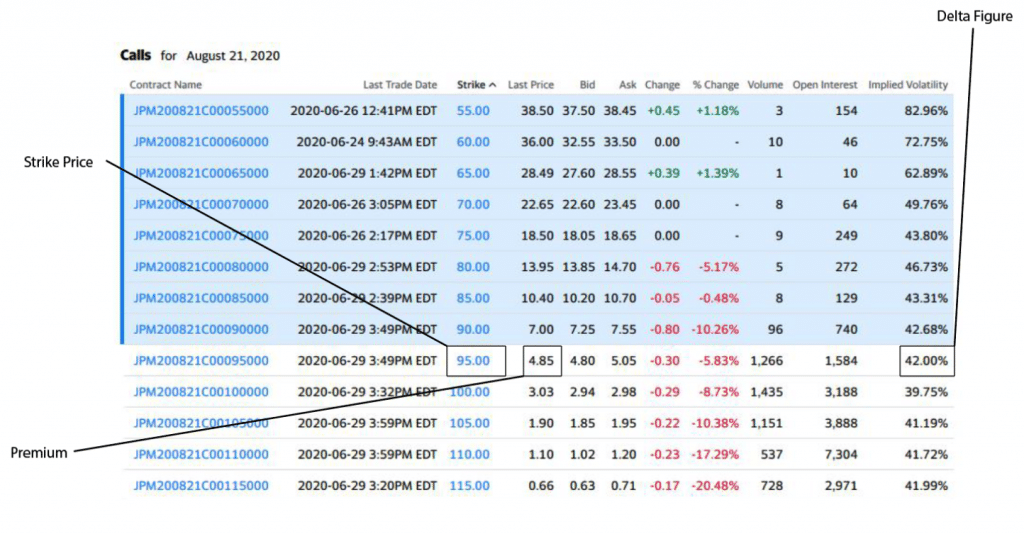

Before diving into the decision-making process, it’s crucial to grasp the nuts and bolts of option exercise. Exercising a call option involves purchasing the underlying asset at a price equal to the strike price, while exercising a put option entails selling the asset at the strike price. It’s important to note that the option premium, which represents the price paid to acquire the option contract, is forfeited when an option is exercised. Additionally, exercise typically involves paying commissions or fees to the broker.

When to Exercise an Option Contract

Deciding whether or not to exercise an option contract hinges on several key factors:

-

Time remaining until expiration: Options have limited lifespans. Exercising near expiration may be advantageous if the option is deeply in-the-money to maximize potential gains. On the other hand, options close to expiration may have little time value left, which could make exercising less financially viable.

-

Intrinsic value: As mentioned earlier, intrinsic value refers to the difference between the strike price and the market price of the underlying asset. Exercising an option is typically beneficial if the intrinsic value is positive (for call options when the underlying price is above the strike price, or for put options when the underlying price is below the strike price).

-

Volatility: Implied volatility is a crucial element to consider when making option exercise decisions. Higher implied volatility suggests that the underlying asset’s price is expected to fluctuate more, potentially leading to significant gains (or losses) in the option’s value.

-

Investment goals: Ultimately, the decision of whether or not to exercise an option should align with your investment goals. If your aim is to lock in a profit, exercising an in-the-money option might be a prudent move. Alternatively, if you anticipate continued price movement in your desired direction, it may be preferable to hold onto the option and potentially sell it for a higher premium.

Alternatives to Exercising

In some cases, exercising an option may not be the most optimal option. Alternative strategies worth considering include:

-

Selling the option: Selling an in-the-money option contract, also known as selling to close, can generate a profit and eliminate the need to take physical possession of the underlying asset.

-

Rolling the option: Rolling involves selling an existing option and simultaneously buying a new option with a different strike price or expiration date. This strategy is viable when you want to adjust your position or extend the life of the option.

:max_bytes(150000):strip_icc()/BuyingPuts-4c4a647e895a41b8a828761e38465e1a.png)

Image: idahc.com

Option Trading Do I Need To Excercise An Option

Image: www.asktraders.com

Conclusion

The decision of whether or not to exercise an option contract requires an analysis of intrinsic value, time decay, and volatility. Exercising may make sense when the option is in-the-money and aligns with your investment objectives. However, alternative strategies such as selling or rolling an option should also be explored to determine the most suitable course of action for your individual needs. It’s imperative to consider all aspects of option exercise and consult with a financial advisor if necessary to make informed decisions and maximize your potential returns.