Introduction

The Australian Securities Exchange (ASX) is the primary stock exchange in Australia. Along with stocks and bonds, the ASX also offers options trading, which allows traders to speculate on the future price of an underlying asset, such as a stock, index, or currency.

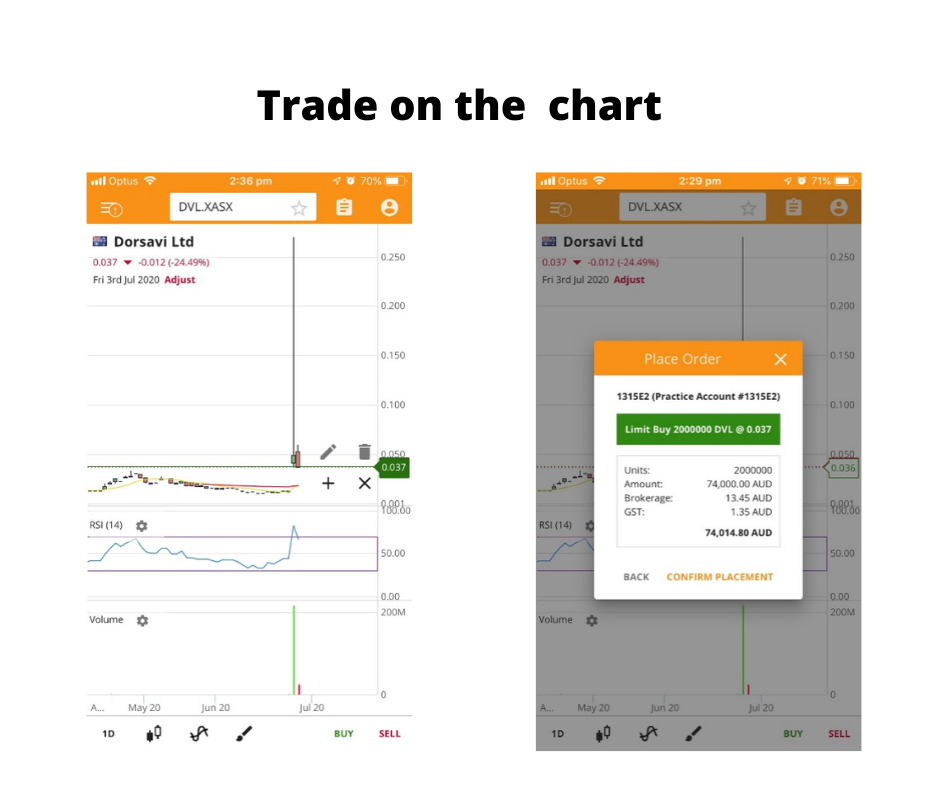

Image: stockhead.com.au

Option trading can be a complex and sophisticated investment strategy, but it can also be a rewarding one. In this article, we will provide a comprehensive overview of ASX option trading, including its definition, history, and meaning. We will also discuss the latest trends and developments in option trading, and provide some tips and expert advice for traders of all levels.

Understanding ASX Option Trading

What is an Option?

An option is a financial instrument that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price (the strike price) on or before a specified date (the expiration date).

Types of Options

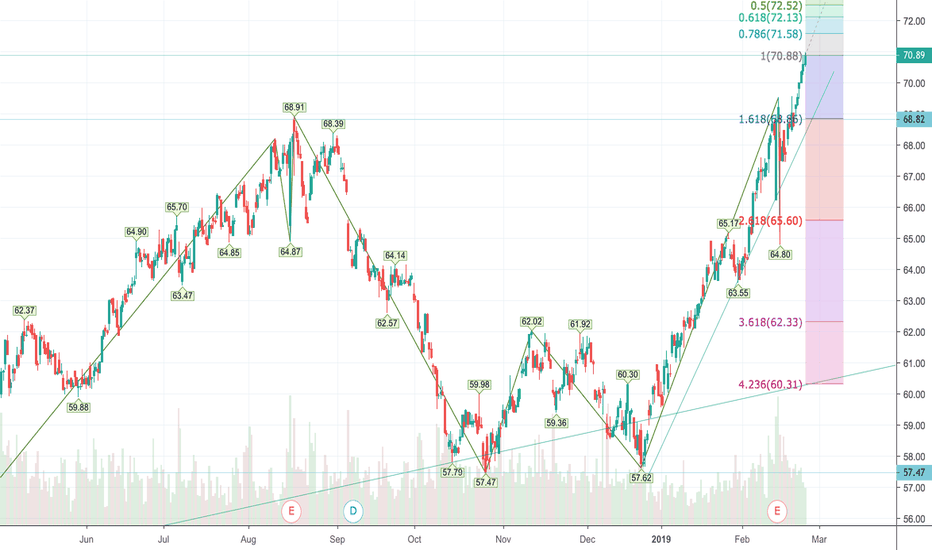

There are two types of options: calls and puts. A call option gives the buyer the right to buy the underlying asset, while a put option gives the buyer the right to sell the underlying asset.

Image: www.tradingview.com

How Options Are Traded

Options are traded on the ASX in a similar way to stocks. Options contracts are standardized, meaning that they have a fixed size and expiration date. Traders can buy or sell options contracts on the ASX through a broker.

The Benefits of ASX Option Trading

There are a number of benefits to trading options on the ASX. These benefits include:

- Leverage: Options can be used to gain leverage, which means that traders can control a large position with a relatively small amount of capital.

- Flexibility: Options can be used to create a variety of trading strategies, from simple to complex.

- Limited Risk: The maximum loss on an option trade is the premium paid for the contract.

Tips for ASX Option Trading

If you are new to ASX option trading, there are a few things you should keep in mind. These tips include:

- Start small: When you are first starting out, it is important to start small. This will help you to get a feel for the market and to learn how to manage risk.

- Do your research: Before you trade any options, it is important to do your research. This includes understanding the underlying asset, the option contract, and the risks involved.

- Use a broker: A broker can help you to execute trades and to manage your risk.

FAQs About ASX Option Trading

Here are some of the most frequently asked questions about ASX option trading:

Q: What is the difference between a call option and a put option?

A: A call option gives the buyer the right to buy the underlying asset, while a put option gives the buyer the right to sell the underlying asset.

Q: What is the strike price of an option?

A: The strike price is the price at which the buyer can buy or sell the underlying asset.

Q: What is the expiration date of an option?

A: The expiration date is the date on which the option contract expires.

Asx Option Trading

Conclusion

ASX option trading can be a rewarding investment strategy, but it is important to understand the risks involved. By following the tips and advice in this article, you can increase your chances of success in the options market.

We hope you enjoyed this article. If you have any further questions, please feel free to contact us.