Introduction

In the world of investing, options trading is a powerful tool that can potentially amplify profits and mitigate risks. However, understanding options trading can be a daunting task for beginners, navigating complex concepts and market dynamics. This guide will provide a comprehensive overview of options trading, demystifying key concepts and empowering investors to make informed decisions.

Image: www.pinterest.jp

What is Options Trading?

Options trading involves contracts that grant the buyer the option, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specific date. These contracts give investors flexibility and the potential for significant returns, but also carry significant risks.

Types of Options

There are two primary types of options:

- Call options give the buyer the right to buy an asset at a specified price, known as the strike price, on or before a specified date, known as the expiration date.

- Put options give the buyer the right to sell an asset at the strike price on or before the expiration date.

Mechanics of Options Trading

Options trading occurs on standardized exchanges, where buyers and sellers come together to trade contracts. The price of an option, known as the premium, is determined by factors such as the underlying asset’s price, volatility, time to expiration, and interest rates.

Image: yoyofabol.web.fc2.com

Options Strategies

Options traders can employ various strategies to achieve different investment objectives. Common strategies include:

- Covered calls: Selling call options against underlying assets owned by the trader to generate income.

- Protective puts: Purchasing put options to protect against declines in the underlying asset’s value.

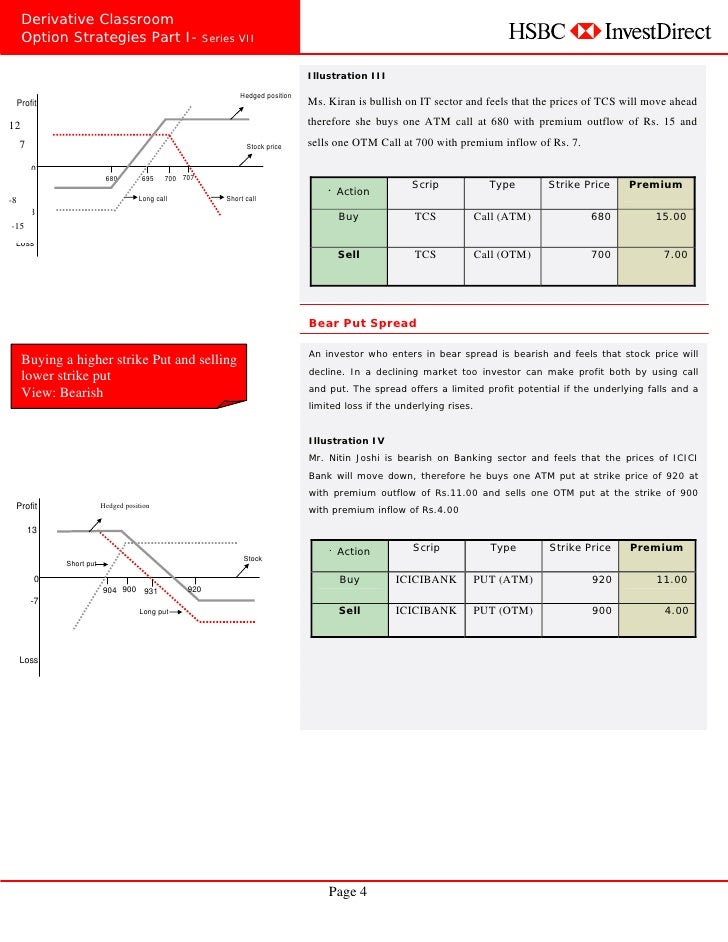

- Spreads: Combining multiple options with different strike prices and expiration dates to create customized strategies.

Benefits of Options Trading

Options trading offers several potential benefits, including:

- Leverage: Using a small amount of capital to gain exposure to a larger asset.

- Flexibility: Options provide investors with the flexibility to tailor their investments to specific market scenarios.

- Potential for significant returns: Leveraging market movements can lead to high returns, though always accompanied by risks.

Risks of Options Trading

Options trading also carries significant risks that investors should be aware of:

- Loss of premium: The option premium can expire worthless if the underlying asset’s price does not move in the expected direction.

- Unlimited loss potential: Unlike underlying assets, options have the potential for unlimited losses.

- Complexity: Options trading can be complex, requiring a thorough understanding of market dynamics and risk management techniques.

Expert Insights

“Options trading is a powerful tool, but it’s important to approach it with a clear understanding of the risks involved,” advises John Smith, a seasoned options trader. “Educate yourself thoroughly, practice with paper trading, and consult with a financial advisor before making significant investments.”

Actionable Tips

For those interested in exploring options trading, consider these tips:

- Start by educating yourself through books, articles, and online courses.

- Practice with paper trading to gain a practical understanding of options strategies without risking capital.

- Consult with a qualified financial advisor to tailor an options trading strategy to your investment goals and risk tolerance.

Understanding Options Trading Pdf

https://youtube.com/watch?v=rNJhmFN19W0

Conclusion

Understanding options trading is a journey that requires continuous learning and careful risk management. By embracing the concepts outlined in this guide, investors can unlock the potential of options trading to enhance their investment returns while mitigating risks. Remember to approach this powerful tool with a balanced understanding of its benefits and pitfalls, and always seek professional advice when required.