Title: Unlock the Gateway to Financial Success: A Comprehensive Guide to Stock Option Trading Platforms

Image: zeliskurt.blogspot.com

Introduction:

In the ever-evolving landscape of financial markets, stock option trading has emerged as a powerful tool for investors seeking to enhance their returns. Option trading platforms have revolutionized the way investors access and manage these complex financial instruments, opening up a world of possibilities that were once out of reach.

Navigating the intricate world of stock option trading can be a daunting task, but with the right platform, it becomes an accessible and potentially lucrative opportunity. In this comprehensive guide, we will delve into the intricacies of stock option trading platforms, exploring their history, applications, and the latest trends that are shaping this dynamic field.

Delving into Stock Option Trading Platforms:

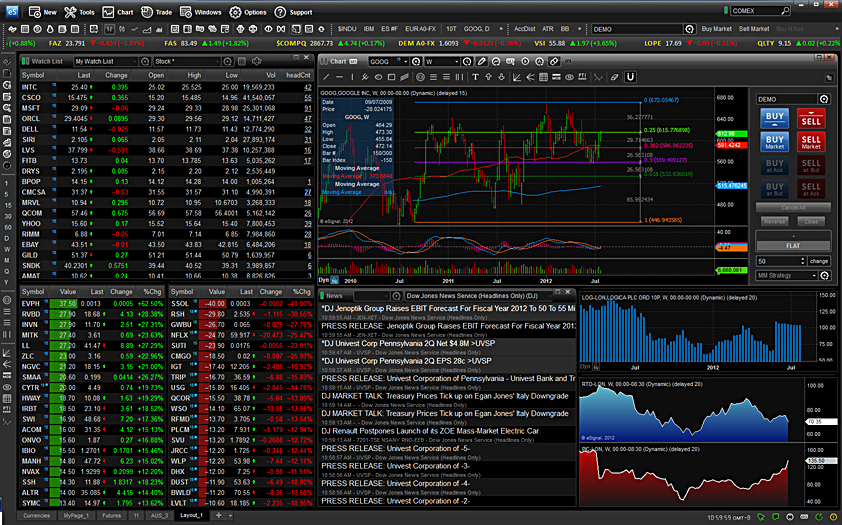

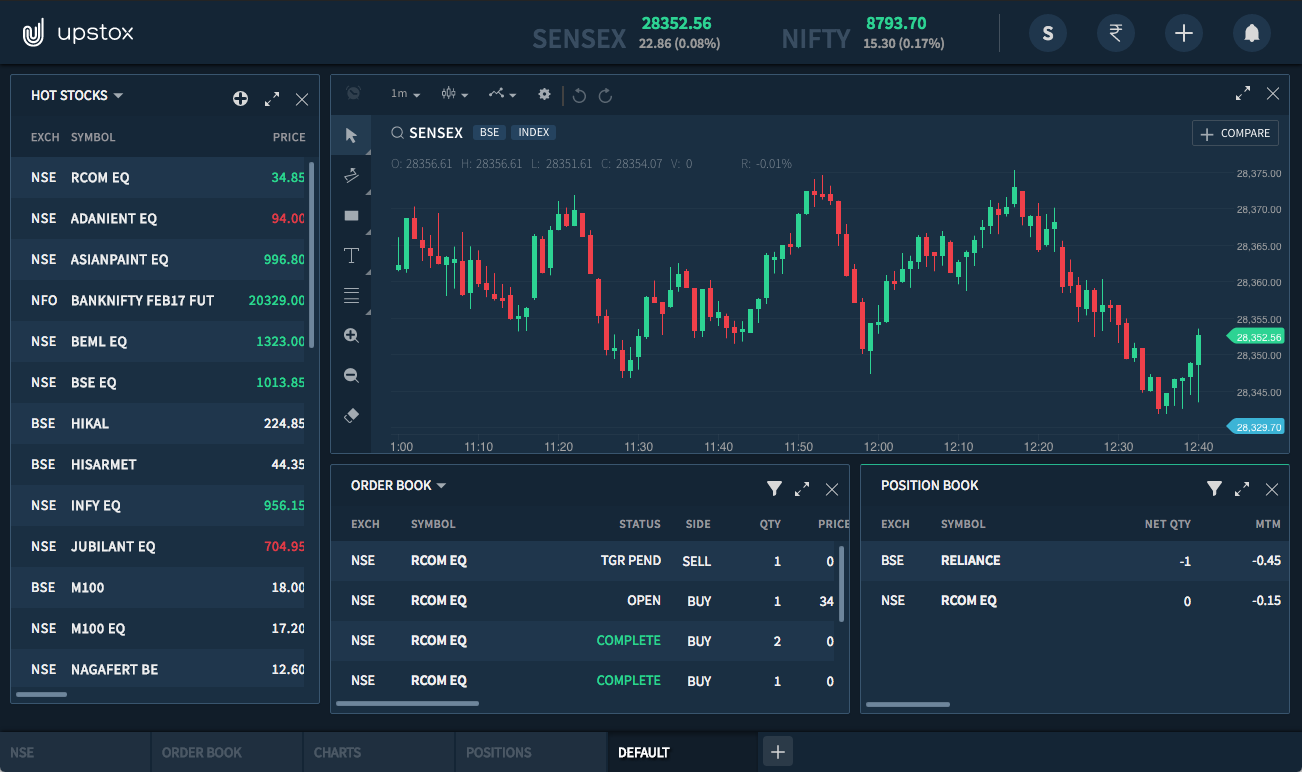

Stock option trading platforms are specialized online tools that provide investors with access to a wide range of options, real-time market data, analysis tools, and order execution capabilities. These platforms empower investors to buy and sell options, track their performance, and make informed decisions based on sophisticated data analysis.

Initially, option trading was reserved for institutional investors and experienced traders, but the advent of user-friendly platforms has made it accessible to a broader audience of individual investors. Today, these platforms offer a variety of features tailored to the needs of all levels of traders, from beginners to seasoned professionals.

Real-World Applications of Option Trading Platforms:

Option trading platforms have countless applications in the financial world, enabling investors to pursue a range of strategies, including:

- Hedging against market risk

- Enhancing returns through leverage

- Generating income through premium selling

- Speculating on market direction

Key Considerations When Choosing an Option Trading Platform:

Selecting the right option trading platform is crucial for fulfilling your investment goals. Here are some essential factors to consider:

-

Accessibility and Usability: Opt for platforms that offer intuitive interfaces and comprehensive user documentation.

-

Range of Options and Instruments: Choose platforms that provide access to a wide variety of options and underlying assets.

-

Data and Analysis Tools: Evaluate platforms based on their data offerings, charting capabilities, and technical analysis tools.

-

Pricing and Fees: Compare the commission structures and fees of different platforms to find one that aligns with your trading budget.

-

Customer Support: Ensure that the platform offers reliable and responsive customer support to assist you with any queries or issues.

Expert Insights and Practical Tips:

Renowned options expert, Mark Sebastian, emphasizes the importance of understanding the underlying principles of option trading before venturing into actual trades. He recommends starting with paper trading simulations and building a strong foundation before risking real capital.

Conclusion:

Stock option trading platforms have revolutionized the way investors access and manage options, providing them with powerful tools to enhance their financial strategies. By embracing the insights and tips outlined in this guide, you can harness the potential of these platforms and unlock a world of financial opportunities. Remember, the key to successful option trading lies in a deep understanding of the concepts, diligent research, and a disciplined approach to risk management.

Image: niyudideh.web.fc2.com

Stock Option Trading Platforms

Image: equityblues.com