Are you ready to unlock the gateway to financial success in the thrilling world of option trading? Join us on an in-depth exploration of this multifaceted investment strategy, where we’ll decipher the complexities, uncover hidden opportunities, and guide you towards the path of maximizing profits.

Image: www.etoro.com

Option trading presents a dynamic arena where traders can navigate market fluctuations by speculating on the future price movements of underlying assets, such as stocks, commodities, currencies, or indices. Whether you’re a seasoned investor or a budding enthusiast, understanding the nuances of option trading can empower you to make informed decisions and potentially generate substantial returns.

Laying the Foundation: Understanding Options and Their Mechanics

At the heart of option trading lies a fundamental concept—the right, but not the obligation, to buy or sell an underlying asset at a predefined price on or before a specific date. This flexibility offers traders the chance to capitalize on market trends while mitigating potential losses.

Let’s delve into the two main types of options: calls and puts. Call options grant the holder the right to purchase an asset at a set price (strike price) before its expiration date. On the other hand, put options provide the right to sell an asset at the strike price within the specified time frame.

Decoding the Language of Option Pricing: The Complexities Unveiled

The valuation of options is a intricate art that hinges on several crucial factors, including the underlying asset’s price, time to expiration, expected volatility, and prevailing interest rates. This intricate dance of variables presents both challenges and opportunities for traders who can decipher its complexities.

In the case of call options, their value increases as the underlying asset’s price rises. Conversely, put options gain value when the underlying asset’s price falls. Time decay is another element in play, with options losing value as they approach their expiration date.

Striking Strategies: Embracing Option Trading Techniques

The vast landscape of option trading strategies invites traders to tailor their approach to their individual risk tolerance and market outlook. From straightforward long positions to sophisticated spreads and combinations, the choice is vast.

Covered calls, a popular strategy, involve selling a call option while simultaneously owning the underlying asset. This approach generates income by capitalizing on the premium paid by option buyers. Alternatively, a trader might opt for a protective put strategy, purchasing a put option to hedge against potential losses in a long position.

Image: app.bangnovan.com

Mastering the Nuances: Unlocking the Secrets of Expiration and Settlement

Understanding the dynamics of option expiration and settlement is paramount for successful trading. On the expiration date, options that are in-the-money (meaning the strike price is favorable for the holder) are exercised. In contrast, out-of-the-money options (where the strike price is unfavorable) expire worthless.

Settlement of exercised options typically occurs two business days following expiration. For call options, this involves the buyer acquiring the underlying asset at the strike price. Conversely, for put options, the seller delivers the underlying asset to the buyer at the strike price.

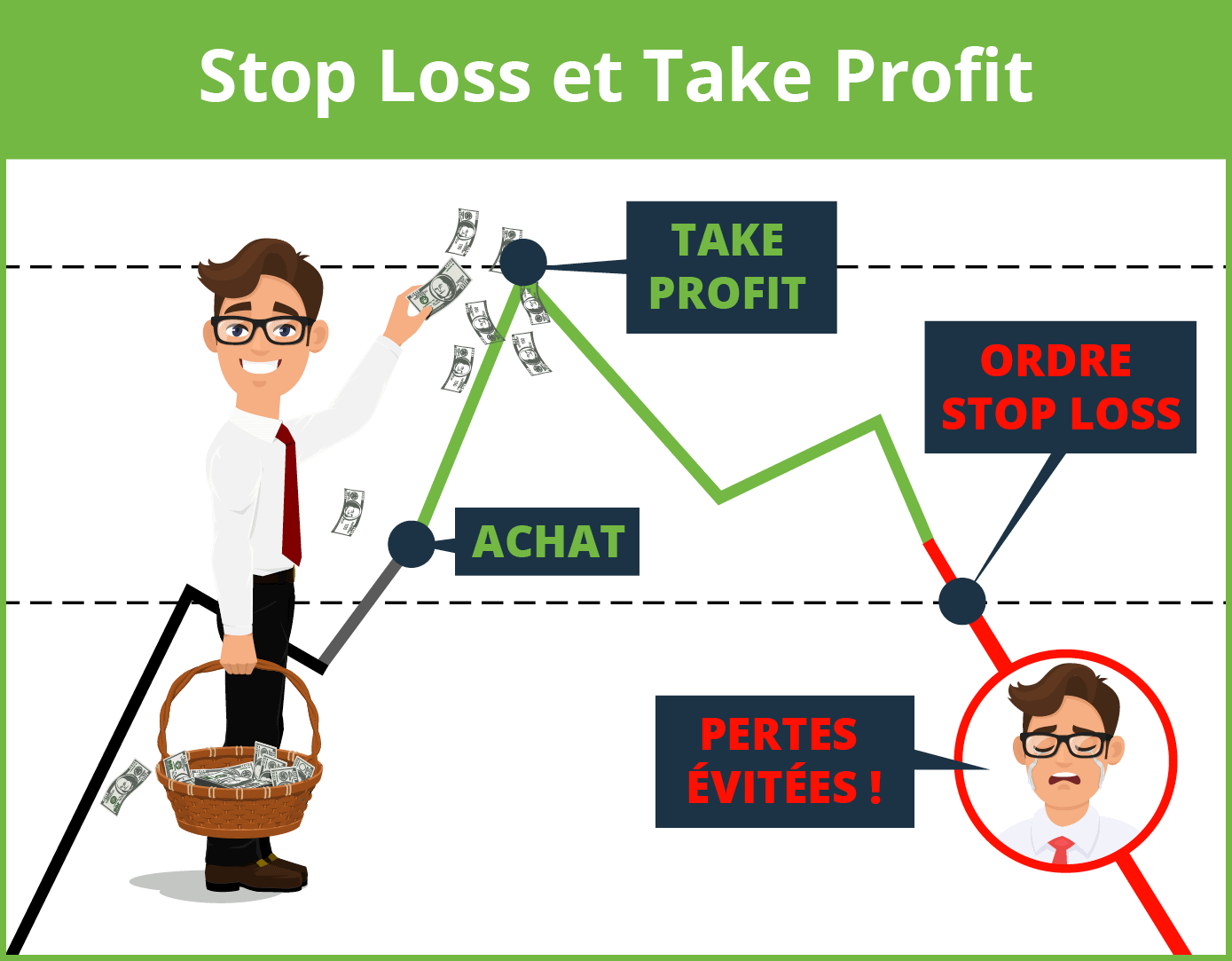

Embracing Risk Management: A Cornerstone of Option Trading

The world of option trading is not devoid of risks, and prudent risk management strategies are essential to safeguard your investments. Diversifying your portfolio across different assets and employing thoughtful position sizing can help mitigate potential losses.

Moreover, understanding implied volatility—a measure of expected price fluctuations—becomes critical. Elevated implied volatility can inflate option premiums, while low implied volatility may result in reduced premiums. Traders should carefully gauge these factors before entering into any trades.

Expert Insights and Actionable Tips: Illuminating the Path to Success

Seeking guidance from seasoned professionals can accelerate your journey towards option trading mastery. Proven strategies and invaluable insights abound, enriching your decision-making process.

One expert emphasizes the importance of defining your trading objectives before venturing into the market. Another advises traders to thoroughly research underlying assets and identify potential trading opportunities. The consensus among experts highlights the significance of continuous learning and adapting to evolving market conditions.

How To Get Profit In Option Trading

https://youtube.com/watch?v=ZzpJlOKHp9E

Conclusion: Empowering you towards Financial Triumph

The realm of option trading presents a dynamic avenue for investors seeking both income and capital appreciation. By unraveling its complexities and embracing sound strategies, you can harness the power of options to potentially maximize profits.

Embark on this journey of knowledge and empowerment, delving into the vast resources available to you. Remember, the path to financial success in option trading lies not only in technical proficiency but also in a keen understanding of market dynamics and a disciplined approach to risk management.