In the labyrinthine world of financial markets, skilled traders seek an edge over the competition. Among the arsenal of strategies, the enigmatic “SPY options trading system” stands out as a formidable tool, empowering traders to navigate market volatility with finesse and precision. Join us as we delve into the captivating realm of SPY options trading, unveiling its secrets and equipping you with the knowledge to conquer financial horizons.

Image: optionstradingauthority.com

Introduction to the SPY Options Trading System

The SPY, an exchange-traded fund (ETF), captures the pulse of the S&P 500, the bellwether index that mirrors the performance of the broader US market. Options contracts, financial instruments that grant the holder the right but not the obligation to buy or sell an underlying asset, offer traders a versatile means to harness market movements and generate substantial returns. The SPY options trading system seamlessly blends these elements, enabling traders to exploit market trends and hedge against risk with surgical precision.

SPY options provide traders with a spectrum of strategies, allowing them to tailor their approach to suit their risk appetite and market outlook. By combining deep market insights, technical analysis, and risk management principles, traders can craft option strategies that maximize profit potential while minimizing potential losses. Embark on a journey of financial empowerment as we unravel the intricacies of SPY options trading, transforming you into a formidable market strategist.

The S&P 500 ETF: A Market Barometer

The S&P 500, a renowned stock market index, tracks the performance of the 500 largest publicly traded companies in the United States. Its composition mirrors the pulse of the US economy, making it a widely recognized indicator of market sentiment and economic health. The SPDR S&P 500 ETF Trust (SPY) is a barometer of this iconic index, allowing traders to participate in the S&P 500’s performance without investing directly in individual stocks.

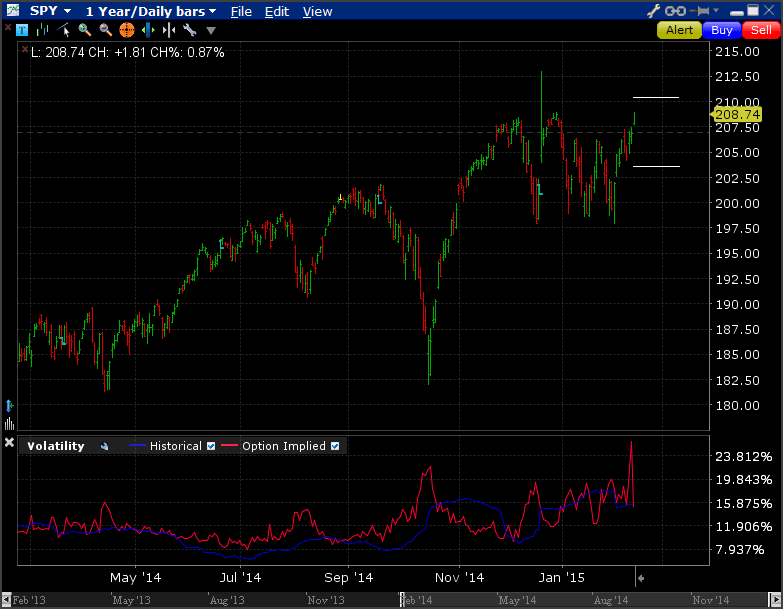

SPY Options: Trading Market Volatility

Options contracts, financial derivatives that grant the right but not the obligation to buy or sell an underlying asset at a specified price on a specified date, offer traders a potent tool to capitalize on market volatility. SPY options, based on the S&P 500 ETF, provide traders with a versatile means to speculate on future market movements and hedge against risk.

Image: kovivygoqabut.web.fc2.com

Types of SPY Options

Traders can choose between two primary types of SPY options:

-

Calls: Provide the holder the right to buy a specific number of SPY shares at a predetermined price, known as the strike price, on or before the specified expiration date.

-

Puts: Grant the holder the right to sell a specific number of SPY shares at a predetermined strike price, on or before the specified expiration date.

Unveiling the SPY Options Trading System

The SPY options trading system empowers traders with a range of strategies, enabling them to adapt to diverse market conditions and capitalize on market inefficiencies. At the core of this system lies the ability to anticipate future market behavior and craft option strategies accordingly.

1. Call Options: Capitalizing on Market Uptrends

When traders anticipate a rise in the SPY price, they can employ call options. By purchasing a call option, they secure the right to buy SPY shares at a predetermined strike price, regardless of the actual market price. If the market indeed rises, the value of the call option will increase, allowing traders to reap substantial profits.

2. Put Options: Hedging Against Market Downturns

Conversely, traders who anticipate a market decline can utilize put options. By purchasing a put option, they secure the right to sell SPY shares at a predetermined strike price, regardless of the actual market price. If the market falls, the value of the put option will increase, providing traders with a hedge against potential losses on their existing investments or an opportunity to profit from market downturns.

3. Arbitrage Strategies: Exploiting Market Inefficiencies

The SPY options trading system also provides opportunities for astute traders to exploit market inefficiencies through arbitrage strategies. By simultaneously buying and selling options with different strike prices and expiration dates, traders can capture price differentials and generate profits that exceed the underlying market movement.

Spy Options Trading System

Image: www.youtube.com

Conclusion

The SPY options trading system is a powerful tool that enables skilled traders to navigate market volatility with precision and reap substantial returns. By combining deep market insights, technical analysis, and risk management principles, traders can craft option strategies tailored to their individual risk appetite and market outlook. Remember, while options trading offers immense potential for profit, it also carries inherent risks. Education, discipline, and sound risk management practices are essential to maximize potential returns and minimize potential losses. As you master the SPY options trading system, you will evolve into a formidable market strategist, equipped to conquer financial horizons and achieve your financial aspirations.