Introduction

Image: www.tradingview.com

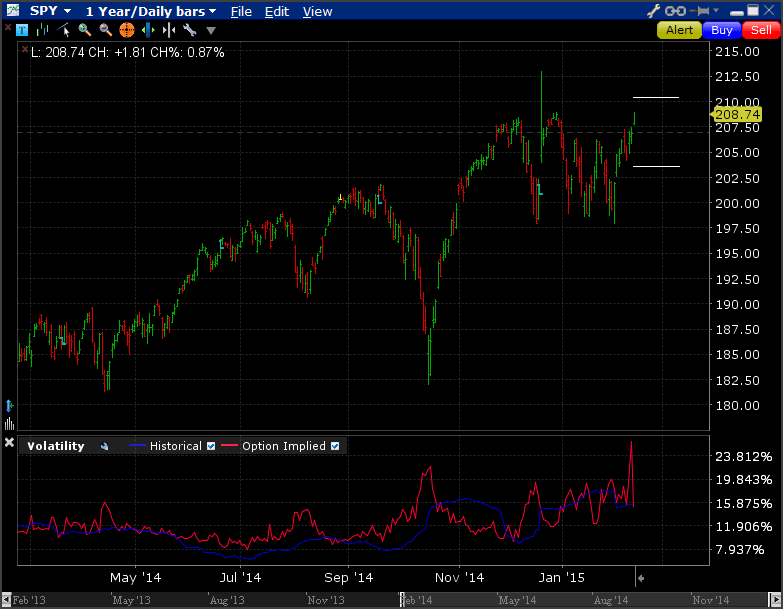

In the dynamic and ever-evolving world of finance, options trading has emerged as a potent tool for savvy investors seeking to navigate market volatility and maximize returns. Among the myriad option strategies available, the SPY option trading strategy stands out as a versatile and effective approach that leverages the S&P 500 Index (SPY). This comprehensive guide will delve into the intricacies of SPY option trading, exploring its history, key concepts, and practical applications, empowering investors with the knowledge and insights to harness its potential.

The SPY Index, a benchmark for the overall performance of the US stock market, represents a weighted average of the 500 largest publicly traded companies. SPY options, representing derivatives tied to the price movements of the underlying index, provide investors with the flexibility to speculate on the direction of the market without directly owning the underlying securities. By understanding the dynamics of the SPY Index and the intricacies of option contracts, investors can effectively exploit the opportunities presented by this powerful trading strategy.

Understanding Option Contract Basics

Before delving into SPY option trading, it is imperative to establish a solid foundation in the fundamentals of option contracts. Options are financial instruments that confer upon their holders the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a specific date. Two primary types of options exist: calls and puts. Call options convey the buyer with the right to purchase the underlying asset, while put options grant the holder the right to sell.

Each option contract encompasses three critical elements: the strike price, the expiration date, and the premium. Strike prices represent the price at which the buyer can exercise the option to buy or sell the underlying asset. Expiration dates signify the last day on which this option can be exercised. Premiums are the prices paid by the buyer to the option seller in exchange for the option contract.

SPY Call Options

Incorporating SPY call options into a trading strategy involves speculating that the SPY Index will ascend in value. When purchasing a SPY call option, the investor pays a premium to acquire the right to buy the underlying index at a specified strike price on or before the expiration date. If the market conditions align with the investor’s prediction and the price of the SPY Index rises above the strike price, the option holder has the choice to exercise the option, taking delivery of the underlying shares at the favorable strike price.

Savvy investors employ call options to take advantage of bullish market expectations, leveraging the potential for substantial gains should the market trend upward. However, it is crucial to recognize that if the SPY Index remains flat or declines in value, the call options may expire worthless, resulting in the loss of the initial premium paid.

SPY Put Options

Conversely, SPY put options are strategically deployed when an investor anticipates a downward trajectory in the SPY Index. By purchasing a SPY put option, the investor secures the right to sell the underlying index at a predetermined strike price on or before the expiration date. Should the market materialize in line with the investor’s bearish forecast and the SPY Index declines in value, the put option empowers the holder to sell the underlying shares at the advantageous strike price, profiting from the depreciated market conditions.

In essence, put options shield investors against adverse market conditions, hedging against losses and facilitating returns even during market downturns. While call options thrive in bullish environments, put options shine in bearish markets, providing investors with a versatile strategy for fluctuating market conditions.

Image: kovivygoqabut.web.fc2.com

Spy Option Trading Strategy

SPY Option Trading Strategies

Seasoned investors have devised an array of SPY option trading strategies, each tailored to specific market conditions and individual risk appetites. Two prevalent strategies include the Long Call Strategy and the Covered Call Strategy.

The Long Call Strategy, suitable for market