In the realm of investing, where volatility reigns, option trading presents a powerful tool to navigate market uncertainties and potentiate returns. By harnessing the synergy between option trading strategies and fundamental analysis, investors can gain an edge in predicting future price movements and positioning their portfolios for success.

Image: www.pinterest.com

Fundamental Analysis: Laying the Foundation for Informed Trading

Fundamental analysis serves as the cornerstone of sound investment decisions, delving into the intrinsic value of an underlying asset. This in-depth examination considers factors such as a company’s financial performance, industry dynamics, and macroeconomic trends. By understanding the fundamentals driving an asset’s performance, investors can assess its potential and identify potential opportunities for growth or decline.

Option Trading: Empowering Predictive Agility

Options, versatile financial instruments, confer the ability to capitalize on future price fluctuations. Option traders utilize these contracts to hedge risks, speculate on price movements, and enhance their returns. Understanding the intricacies of option pricing, including factors such as strike price, expiration date, and volatility, empowers investors to make informed trading decisions.

Synergizing Option Trading and Fundamental Analysis

The marriage of option trading and fundamental analysis creates a potent framework for investment success. By combining the predictive power of fundamental analysis with the flexibility of options, investors can harness insights into future market movements and position their portfolios accordingly.

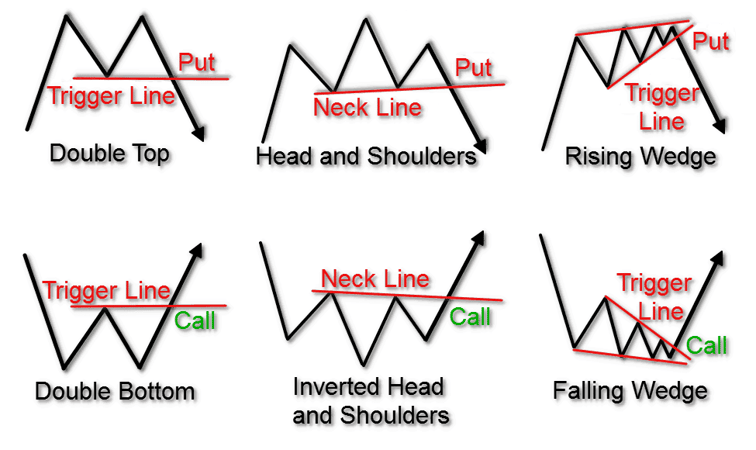

For instance, a fundamental analysis suggesting a bullish outlook for a particular stock could lead an investor to purchase a call option. This option provides the right to buy the stock at a specified strike price within a predetermined time frame. If the stock’s price appreciates, the value of the call option will also increase, allowing the investor to profit from the price rise.

Conversely, if fundamental analysis indicates a bearish sentiment towards a stock, an investor might consider purchasing a put option. This option grants the investor the right to sell the stock at a specified strike price within a predetermined time frame. If the stock’s price declines, the value of the put option will increase, enabling the investor to profit from the price drop.

Image: www.youtube.com

Enhancing Returns and Mitigating Risks

The harmonious interplay between option trading and fundamental analysis empowers traders to optimize their returns and manage risks inherent in market fluctuations.

Hedging: By identifying potential downside risks through fundamental analysis, investors can purchase protective put options to limit their losses in case of adverse price movements.

Diversification: Options offer a versatile tool for diversifying investment portfolios. Traders can construct strategies involving multiple options contracts with varying strike prices and expiration dates, reducing concentration risks.

Tail Risk Protection: Option trading can serve as a safety net against unforeseen market events that could significantly impact a portfolio’s value. Tail risk hedging strategies, such as purchasing downside put spreads, can provide additional protection against extreme price movements.

Option Trading Withfundamental Analysis

Image: www.tradingsim.com

Mastering the Art of Option Trading with Fundamental Analysis

Harnessing the synergy between option trading and fundamental analysis requires a prudent understanding of both disciplines. While fundamental analysis provides the foundation for assessing intrinsic value, option trading strategies demand a deep comprehension of option pricing models and risk management techniques.

Through continuous learning and practice, investors can cultivate proficiency in both areas, empowering them to navigate market complexities and unlock the full potential of option trading. By merging fundamental analysis with option trading strategies, investors can transcend the limitations of traditional investing and embark on a path towards informed and profitable decisions.