Options trading has become increasingly popular among investors seeking to generate consistent monthly income streams. Unlike traditional stock investments, options offer greater flexibility and the potential for substantial returns. This article will delve into the world of options trading, providing a comprehensive guide to strategies and expert advice that can help you leverage options to supplement your monthly income.

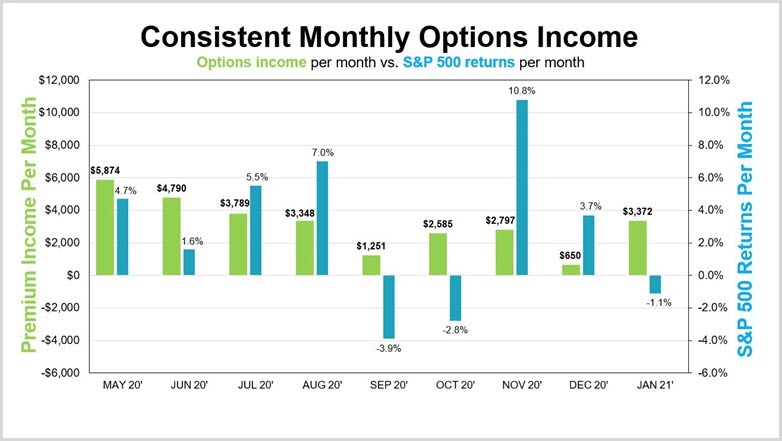

Image: www.xtremetrading.net

Demystifying Options Trading

An option is a financial contract that grants the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before a specific expiration date. The buyer of an option pays a premium for this right, while the seller of the option collects the premium and assumes the obligation to fulfill the contract if exercised.

Covered Call Strategy for Monthly Income

One popular strategy for generating monthly income from options trading is the covered call strategy. In this strategy, the investor owns the underlying asset and sells (or writes) a call option against it. The call option gives the buyer the right to purchase the asset at a specified (strike) price before the expiration date. By selling the call option, the investor receives a premium that represents a portion of the potential profit from the underlying asset’s price increase.

If the share price rises during the option’s lifetime, the buyer of the call option may exercise their right to buy the asset at the strike price, forcing the investor to sell the asset at that price. While the investor will have to relinquish potential profits exceeding the strike price, they will still profit from the initial sale of the call option.

Other Options Strategies for Monthly Income

- Cash-Secured Puts: Sell (write) a put option against cash (margin account). If the stock price falls below the strike price, the investor is obligated to buy the underlying asset at the strike price.

- Selling Put Credit Spreads: Sell (write) a put option and simultaneously buy (purchase) a put option with a lower strike price. This strategy benefits from a decline in the underlying asset’s price.

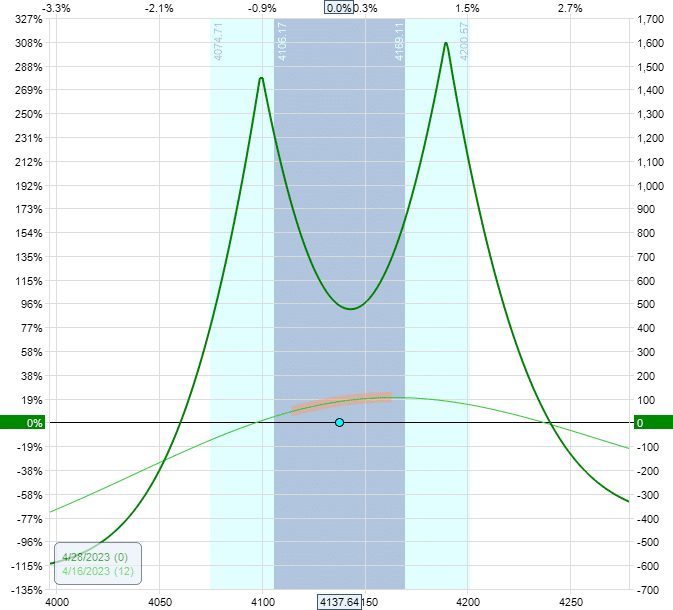

Image: www.ino.com

Trade Management and Advice

Effective options trading requires careful trade management and expert advice. Here are some essential tips to consider:

- Choose the Right Strategies: Select option strategies appropriate for your risk tolerance, capital, and market conditions.

- Manage Risk: Use stop-loss orders to mitigate potential losses, and avoid overleveraging your portfolio.

- Timing and Execution: Enter and exit trades at optimal times, considering underlying asset trends and market volatility.

- Seek Professional Guidance: Consult with a financial advisor experienced in options trading to guide you through the complexities.

FAQs About Options Trading

Q: What are the risks associated with options trading?

A: Options trading involves risks, including potential losses exceeding the initial investment and assignment risk where the investor may be obligated to buy or sell the underlying asset at an unfavorable price.

Q: Is options trading suitable for all investors?

A: No, options trading is not appropriate for all investors. It requires a thorough understanding of options contracts, market dynamics, and a high tolerance for risk.

Options Trading For Monthly Income

Image: optionstradingiq.com

Conclusion

Options trading offers investors the opportunity to generate monthly income through innovative strategies. By leveraging options, investors can enhance their portfolios and pursue consistent returns. However, it is imperative to remember that options trading carries risks. Therefore, it is crucial to approach it with knowledge, prudence, and a willingness to seek expert guidance.

Are you interested in exploring options trading for monthly income? Share your thoughts and questions in the comments section below.