For many aspiring investors, achieving financial freedom often seems like an elusive dream. But what if there was a way to generate a regular monthly income from the comfort of your home? Monthly income options trading strategies offer an enticing solution, enabling you to leverage your financial savvy to create passive income.

Image: optionstradingiq.com

Options trading involves the buying and selling of contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. By carefully crafting options trading strategies, it’s possible to generate a consistent stream of income each month.

Decoding the World of Options Trading

Options come in two main flavors: calls and puts. Call options grant the holder the right to buy an underlying asset at the agreed-upon price, while put options confer the right to sell. The strike price is the predetermined price at which the buyer has the option to execute their contract.

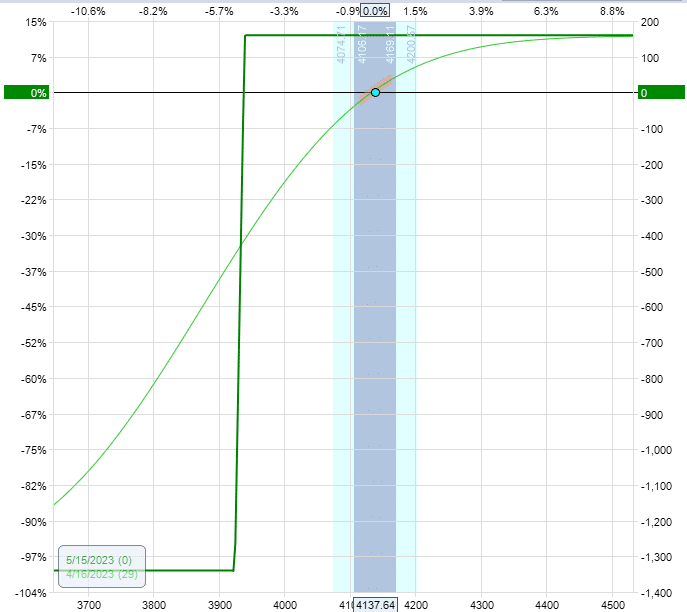

The value of an option contract is influenced by several factors, including the price of the underlying asset, time to expiration, and market volatility. By understanding how these variables interact, you can develop trading strategies that maximize return potential while mitigating risks.

Exploring a Myriad of Monthly Income Options Trading Strategies

Covered Calls

Covered calls involve selling a call option while owning the underlying asset. This strategy generates income from the premium received for selling the option. However, if the underlying asset’s price exceeds the strike price, the holder may be obligated to sell their shares, potentially limiting their upside profit.

Cash-Secured Puts

Similar to covered calls, cash-secured puts involve selling a put option while holding cash equal to the underlying asset’s value. If the underlying asset’s price falls below the strike price, the holder may be obligated to buy the asset, providing an opportunity to acquire shares at a reduced cost.

Collar Strategy

A collar strategy combines both a call and a put option to define a range of acceptable prices for the underlying asset. This strategy generates income from premium selling while limiting potential gains and losses.

Covered Strangle

Covered strangles involve selling both a call and a put option at different strike prices. This strategy benefits from market volatility and generates income from the premiums received for selling both options.

Iron Condor

An iron condor is an advanced strategy that sells a naked put option and a naked call option at lower strike prices, while simultaneously buying a call option and a put option at higher strike prices. This strategy targets a specific price range for the underlying asset and generates income from both premium selling and option spread profits.

Seeking Expert Guidance for Enhanced Success

While monthly income options trading strategies offer significant potential, it’s crucial to approach them with caution and sound knowledge. Consulting with experienced financial professionals or reputable trading academies can provide invaluable insights and guidance, helping you navigate the complexities of options trading and maximize your chances of success.

Image: globaltradingsoftware.com

Monthly Income Options Trading Strategies

https://youtube.com/watch?v=81_U0reK5Jc

Conclusion

Monthly income options trading strategies can empower you to transform your financial future, creating a steady source of passive income that complements your other financial endeavors. By understanding the fundamentals, meticulously developing strategies, and seeking expert advice when needed, you can harness the power of options trading to achieve your financial goals with confidence. Remember, financial freedom is not a distant dream but a path that can be paved with careful planning and disciplined execution. So, delve into the world of options trading, embrace the learning journey, and unlock the potential for monthly income generation that awaits you.