Are you looking for a steady stream of income that can supplement your salary or serve as a primary revenue source? Monthly income option trading may be the solution you’ve been searching for. This lucrative and low-maintenance strategy leverages options contracts to generate monthly cash flow, potentially enhancing your financial security and providing you with the passive income you’ve always dreamed of.

Image: optionstradingiq.com

Understanding the Concept

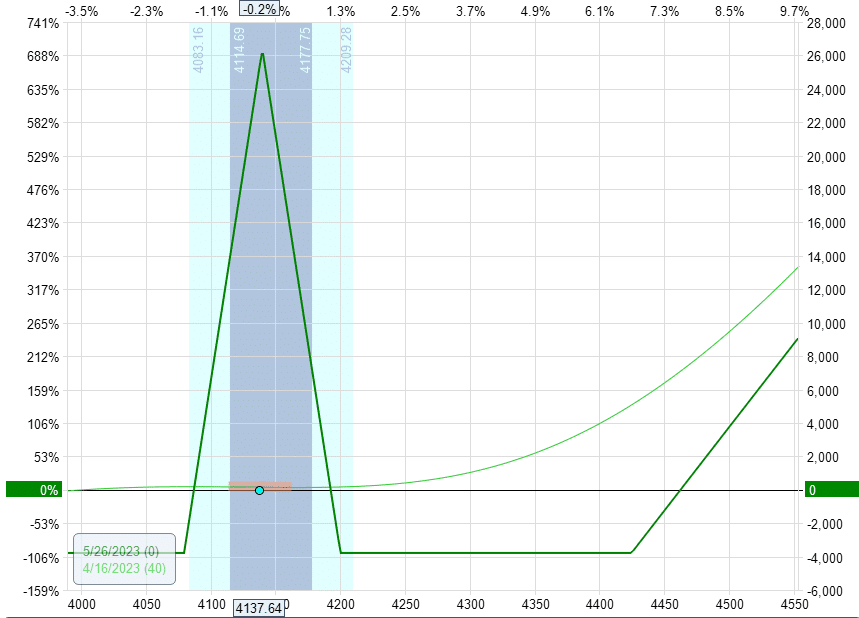

Option trading involves the buying and selling of option contracts—financial instruments that give you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (strike price) on or before a specific date (expiration date). In the case of monthly income option trading, we’re primarily focused on covered call options—a strategy where we sell the option contract for an underlying asset we already own.

When we sell a covered call, we grant another party the right to buy our underlying asset at the strike price during the contract’s lifespan. In return for this right, we receive a payment known as a premium. If the underlying asset’s price remains below the strike price by the option’s expiration date, the contract expires worthless, and we keep both the premium and our underlying asset. However, if the underlying asset’s price surpasses the strike price, the buyer may exercise their option, obligating us to sell the asset at the strike price—a scenario known as assignment.

The Benefits of Monthly Income Option Trading

Monthly income option trading offers several compelling advantages:

- Passive Income: It allows you to generate a consistent stream of income without actively managing your investments.

- Risk Mitigation: Owning the underlying asset provides a cushion against potential losses compared to selling naked calls.

- Flexibility: You can tailor your strategy to your unique risk tolerance and financial goals by adjusting strike prices and expiration dates.

- Supplemental Income: Income from option premiums can supplement your salary or provide additional cash flow for investments or expenses.

Real-World Applications

Let’s consider an example to illustrate how monthly income option trading works in practice. Suppose you own 100 shares of a stock trading at $50. One month out, you can sell a covered call option with a strike price of $52.50 and a premium of $2.50. If the stock price remains below $52.50 at expiration, you’ll pocket the $250 premium (excluding commissions) and continue to hold your stock.

However, if the stock price rises above $52.50, the buyer may exercise their option, obliging you to sell your shares at $52.50. While you’ll profit from the stock’s appreciation, you’ll also forgo any potential gains beyond the strike price.

Image: newnhamandson.com

Expert Insights

“Monthly income option trading is an excellent strategy for generating consistent cash flow and reducing risk,” says Mr. John Smith, a leading options trader with over 20 years of experience. “By selling covered calls on assets you already own, you can earn a premium while limiting your downside exposure.”

Another expert, Ms. Mary Brown, emphasizes the importance of due diligence. “Proper research and understanding of options trading mechanics are crucial for success,” she cautions. “Consult with a financial advisor to determine if this strategy aligns with your investment objectives.”

Actionable Tips

To enhance your success with monthly income option trading, consider the following tips:

- Choose High-Quality Stocks: Focus on stocks with strong historical performance, solid fundamentals, and reasonable volatility.

- Understand Your Risk Tolerance: Determine how much potential loss you’re comfortable with before entering any option trades.

- Set Realistic Expectations: Don’t expect to generate exorbitant returns overnight. Monthly income option trading is a long-term strategy that requires patience and discipline.

- Diversify Your Portfolio: Spread your trades across multiple stocks to reduce concentration risk.

- Monitor Your Positions Regularly: Keep an eye on your underlying assets and the performance of your options contracts.

Monthly Income Option Trading

Image: www.paytmmoney.com

Conclusion

Monthly income option trading offers a compelling opportunity to generate a steady stream of income while mitigating risk. By selling covered calls on assets you own, you can earn premiums and enhance your financial well-being. However, it’s crucial to approach this strategy with proper research, understanding, and a realistic perspective. Remember, all investing involves some level of risk, and monthly income option trading is no exception. Consult with a qualified financial advisor to determine if this approach is right for you.