Introduction

I first heard about Tesla option trading in 2019, and I was immediately and completely intrigued. at the time. As a long-time Tesla investor, I was blown away by the potential profits that could be made by trading Tesla options. But, unfortunately, I didn’t quite understand them well enough to get started.

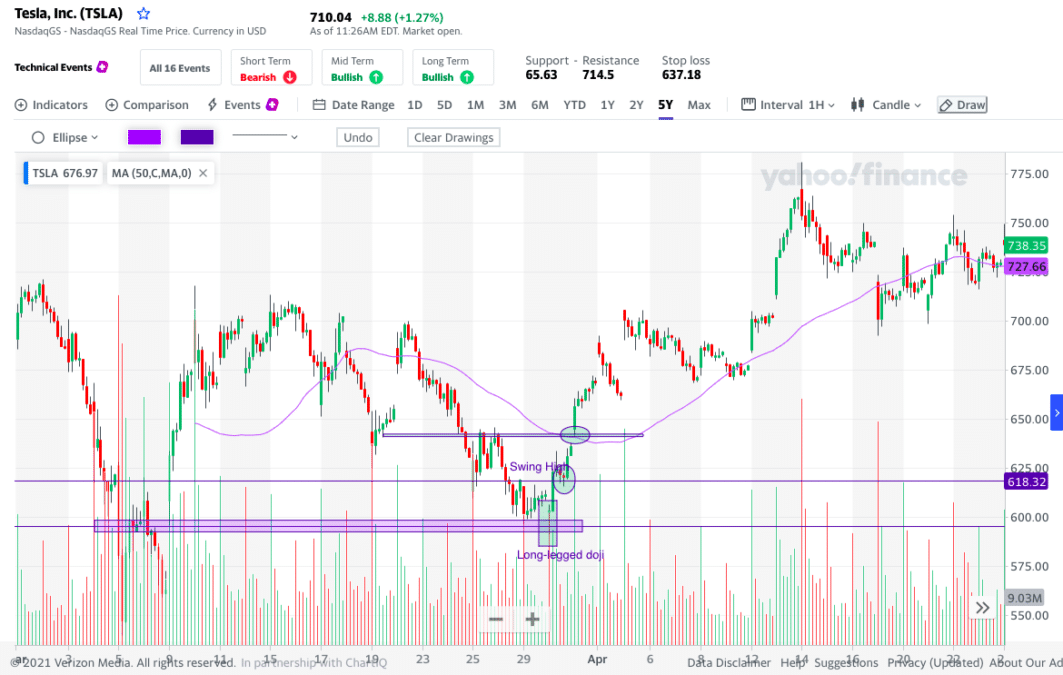

Image: investluck.com

After several months of research and reading, I finally made my first Tesla option trade. And let me tell you, I haven’t looked back since. Since then, I’ve also learned a lot about trading options in general and option trading on TSLA stock.

Hey there! Take a deep dive into the world of Tesla option trading! If you’re a seasoned Tesla investor looking to take your trading to the next level or an options trading newbie eager to get started in this exciting field, this comprehensive blog post has got something for everyone.

What is Tesla Option Trading?

Tesla option trading is a type of investment strategy that involves buying or selling contracts that give the holder the right, but not the obligation, to buy or sell shares of Tesla stock. Unlike traditional trading, you don’t actually own the underlying shares of Tesla. Instead, you’re speculating on the future price movements using option contracts.

Types of Tesla Options

There are two primary types of Tesla options: calls and puts.

- Call options give the holder the right to buy Tesla shares at a set price, known as the “strike price,” on or before a specific date, known as the “expiration date.”

- Put options, on the other hand, give the holder the right to sell Tesla shares at the strike price on or before the expiration date.

Benefits of Trading Tesla Options

There are several advantages to trading Tesla options:

- Potential for high returns: Tesla’s stock price has been highly volatile, leading to significant fluctuations in the value of Tesla options contracts.

- Flexibility: Options can be bought or sold at any time during their life, offering flexibility in trading strategies.

- Hedging: Options can be used to hedge against potential losses on Tesla stock investments.

- Limited risk: Unlike traditional stock trading, the maximum loss on an options contract is limited to the premium paid to purchase the contract.

- Leverage: Options can provide leverage, allowing traders to control a large number of Tesla shares with a smaller investment.

Image: equity.guru

Risks of Trading Tesla Options

While there are many benefits to trading Tesla options, it’s crucial to be aware of the risks involved:

- Volatility: Tesla’s stock price is highly volatile, which can lead to significant losses if the stock price moves against the trader’s prediction.

- Limited time: Options have a limited lifespan, meaning that they expire on a specific date. If the trader does not exercise or sell the option before the expiration date, they lose their entire investment.

- Complex strategies: Some options trading strategies can become quite complex, requiring a deep understanding of the market and options trading concepts.

How to Get Started with Tesla Option Trading

Getting started with Tesla option trading requires understanding a few key concepts such as:

- Strikes: The price at which you can buy or sell Tesla shares using the option contract.

- Expiration dates: The date on which the option contract expires.

- Premiums: The price you pay to purchase an option contract.

- Call options: The right to buy Tesla shares.

- Put options: The right to sell Tesla shares.

Once you understand these concepts, you can start trading Tesla options by:

- Choosing a broker: Select a reputable broker that offers Tesla option trading.

- Opening an account: Fund your trading account with enough capital to cover potential losses.

- Researching and analyzing: Study the Tesla stock market and news to make informed trading decisions.

- Placing a trade: Buy or sell an option contract at a specific strike price and expiration date.

- Managing your risk: Monitor your trades closely and adjust your strategy as needed to mitigate risks.

Tips for Successful Tesla Option Trading

There are several things you can do to increase our chances of success when trading Tesla options:

- Start small: Begin with small trades to limit your risk and gain experience.

- Understand the risks: Thoroughly research and comprehend the risks associated with options trading before getting started.

- Use a demo account: Practice trading options risk-free using a demo account before committing real capital.

- Learn technical analysis: Develop skills in identifying trading opportunities using technical analysis techniques.

- Stay informed: Keep up-to-date with Tesla-related news and market trends to make informed decisions.

Frequently Asked Questions about Tesla Option Trading

Q: What is the best strategy for trading Tesla options?

The best strategy depends on individual risk tolerance, trading style, and market conditions. However, some popular strategies include buying calls during bull markets, buying puts during bear markets, or using a combination of calls and puts to hedge positions.

Q: How much money do I need to start trading Tesla options?

The minimum amount required to trade Tesla options varies depending on the broker, but it’s typically between $500 and $1,000. However, it’s important to have additional capital to cover potential losses.

Q: Can I make money trading Tesla options?

Yes, it’s possible to make money trading Tesla options by accurately predicting the stock’s price movements. However, it’s essential to manage risk effectively and understand that losses are also a possibility.

Q: Is Tesla option trading risky?

Yes, Tesla option trading involves significant risk due to market volatility and the limited life of options contracts. Traders should be aware of the potential for losses and trade within their tolerance for risk.

Tesla Option Trading

Image: www.pinterest.com.mx

Conclusion

Tesla option trading offers the potential for high returns and unique trading opportunities, but it’s crucial to approach it with caution, a solid understanding, and proper risk management strategies.

If you’re new to Tesla option trading, we highly recommend starting with a demo account or seeking guidance from an experienced trader. By implementing these tips and gaining knowledge, you can enhance your chances of success and navigate the world of Tesla options trading with confidence.

Are you interested in learning more about the exciting field of Tesla option trading? Share your thoughts and experiences in the comments below!