- Embrace a daring adventure into the realm of options trading. Picture yourself at the core of a fast-paced financial ecosystem, unraveling the mysteries of volatility, probabilities, and calculated risks. Let’s embark on a thrilling expedition through the diverse panorama of options trading careers.

Image: the5ers.com

Options Trading: Defining the Territory

-

Options trading, a realm of informed risks and calculated bets, revolves around contracts that grant the buyer the right, not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. This dynamic market offers an arena for savvy investors to speculate on price movements, hedge against risk, and potentially enhance returns.

-

Options traders navigate a multifaceted market, with each role demanding a unique blend of skills and expertise. From the analytical prowess of the options strategist to the swift execution capabilities of the floor trader, the options trading landscape presents a diverse array of captivating career paths.

Types of Options Trading Jobs

-

1. Equity Options Trader: Immerse yourself in the buying and selling of options contracts derived from underlying equity securities. This adrenaline-inducing role requires a discerning eye for stock price movements and the ability to execute trades with lightning-fast precision.

-

2. Index Options Trader: As an index options trader, your focus shifts to options based on market indices like the S&P 500 or Nasdaq Composite. This role demands a deep understanding of macroeconomic factors and an eagle-eyed vigil on global markets.

-

3. Commodity Options Trader: Join the ranks of commodity options traders, where options contracts are centered around underlying commodities such as oil, gold, or agricultural products. In this role, you’ll require proficiency in analyzing supply-demand dynamics and staying abreast of geopolitical events.

-

4. Volatility Trader: Embrace the thrill of volatility trading, where the spotlight falls on options that speculate on the future volatility of an underlying asset. This role calls for a keen understanding of historical volatility patterns and an ability to anticipate market fluctuations.

-

5. Convertible Bond Arbitrageur: As a convertible bond arbitrageur, you’ll navigate the intersection of bonds and options, exploiting price discrepancies between convertible bonds and their underlying stocks. This role demands a multidisciplinary skill set, blending fixed income and equity analysis.

Recent Trends and Developments

-

Artificial Intelligence (AI): AI is rapidly reshaping the options trading landscape, empowering traders with sophisticated algorithms for data analysis, trade execution, and risk management. This technological revolution is paving the way for enhanced efficiency, precision, and speed in options trading.

-

Blockchain Technology: Blockchain technology is also making its mark on options trading, enabling the creation of transparent, secure, and decentralized options marketplaces. This disruptive technology promises to revolutionize settlement processes and open up new avenues for liquidity.

-

Exchange-Traded Funds (ETFs): The rise of ETFs has opened up new investment opportunities for options traders. ETFs that track options strategies, such as volatility ETFs, offer a convenient and cost-effective way to access the options market.

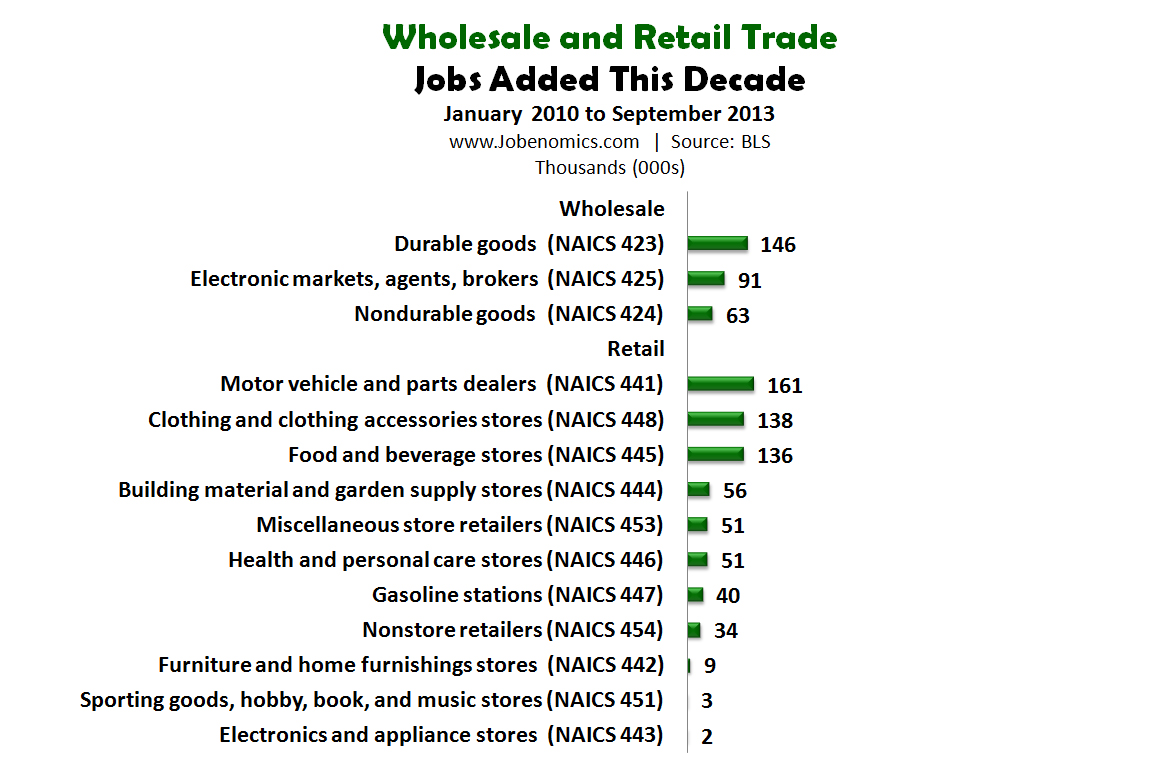

Image: jobenomics.com

Tips for Success in Options Trading

-

1. Develop a Strong Foundation: Begin by mastering the fundamentals of options trading, including concepts like call and put options, strike prices, and expiration dates. Seek guidance from reputable sources, such as online courses or educational platforms.

-

2. Choose a Trading Strategy: Identify a trading strategy that aligns with your risk tolerance, investment goals, and market outlook. Backtest your strategies thoroughly before deploying real capital.

-

3. Manage Risk Effectively: Risk management is paramount in options trading. Establish clear stop-loss levels and position sizing guidelines to protect your capital from adverse market movements. Monitor your positions closely and adjust as needed.

FAQ on Options Trading Jobs

- Q: What educational background is required for options trading jobs ?

A: While a formal education in finance or economics is preferred, it is not a strict requirement. Many successful options traders have backgrounds in STEM fields, engineering, or even the military.

- Q: Is options trading a high-risk career ?

A: Due to the inherent volatility of options contracts, options trading can indeed be a high-risk profession. However, it’s crucial to remember that risk can be effectively managed through knowledge, discipline, and a sound trading strategy.

Types Of Options Trading Jobs

Image: tradeveda.com

Calling out to every keen and curious mind

-

Take the first step towards a potentially rewarding career in options trading. Whether you’re a seasoned professional seeking a new challenge or a fresh graduate eager to explore the world of finance, the various options trading roles offer an unparalleled opportunity to put your analytical, strategic, and risk-taking abilities to the test.

-

Seize the opportunity and equip yourself with the knowledge and skills needed to navigate this dynamic and thrilling market. The world of options trading awaits – dare you take the plunge?