In a volatile stock market that demands nimble investing strategies, grasping the intricacies of Tesla stock options trading can unlock a world of profit potential. These options, with their inherent leverage and time-sensitive nature, allow investors to bet on the speculative future of this automotive innovator. Delving into the realm of Tesla stock options trading reveals a pulsating rhythm of opportunity for those willing to navigate its unique elements.

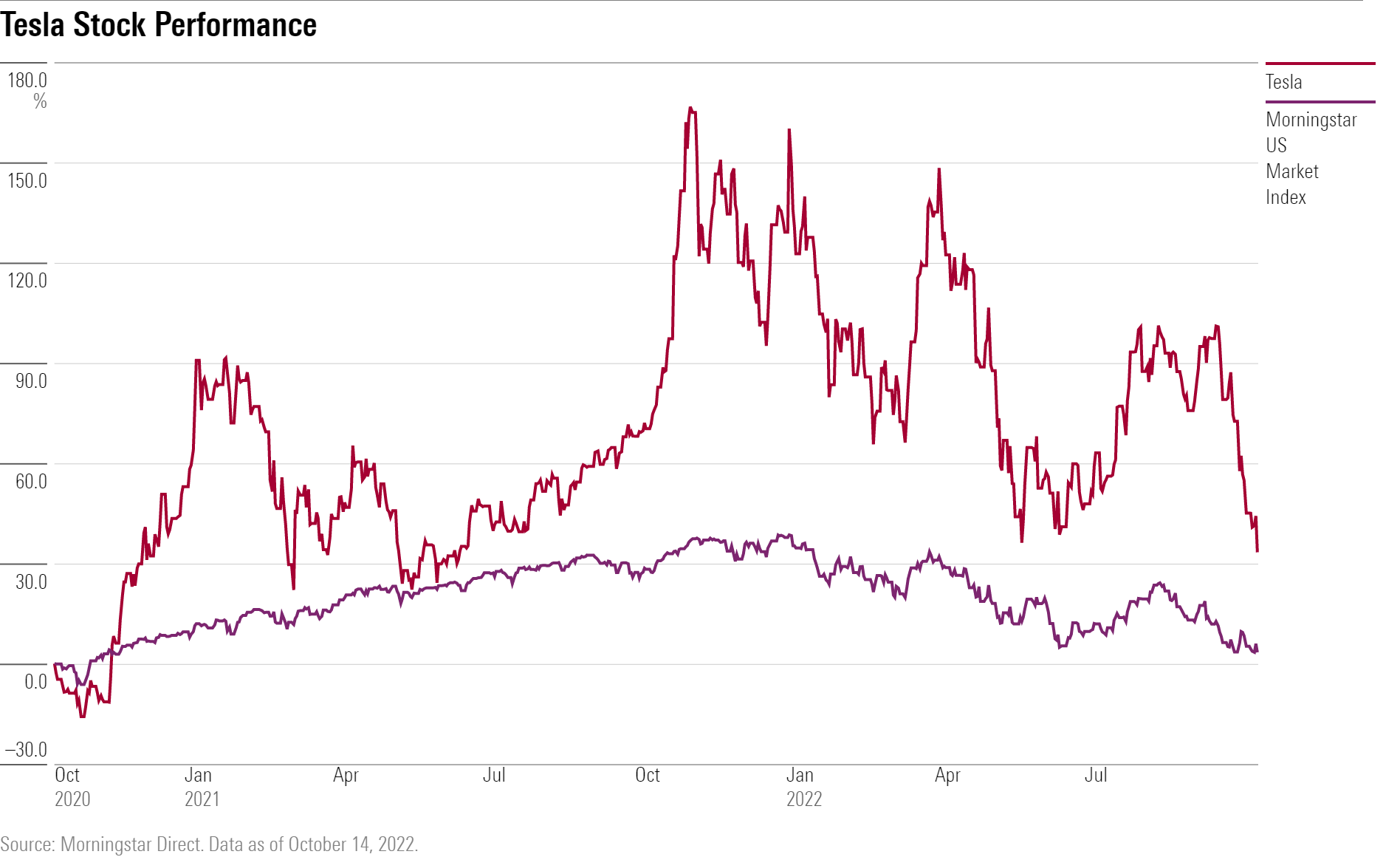

Image: www.morningstar.com

Understanding Tesla stock options trading requires a firm grasp of these specialized instruments. When investing, you’re not directly purchasing the underlying shares of Tesla stock but rather betting on the future price trajectory. Tesla stock options come in two primary flavors: calls and puts. Calls convey the right to buy the stock at a predetermined price within a fixed timeframe, while puts grant the right to sell. The price at which you can exercise this right is known as the strike price, with the options expiring on a specified date.

What makes Tesla stock options trading particularly alluring is its inherent leverage. With a fraction of the capital outlay required to directly purchase the shares, you can control the exposure to a much larger position. This magnification of potential returns, however, amplifies both the upside and downside risk. Understanding your tolerance for risk becomes crucial in this game.

The ever-evolving dynamics of Tesla’s share price have created fertile ground for options traders. Every fluctuation, every announcement, and every anticipation of future growth or challenges is reflected in the pricing of these options. Whether you anticipate a surge in demand for Tesla’s electric vehicles or speculate on a regulatory headwind, the options market provides a stage to position yourself and capitalize on the prediction.

However, timing is paramount in Tesla stock options trading. Each contract carries a ticking expiration clock. If your prediction proves inaccurate, as the expiration date approaches, the value of the option decays relentlessly. This time-sensitive nature introduces an element of urgency, forcing traders to monitor market conditions with eagle-eyed precision.

Recent regulatory shifts are reshaping the landscape of Tesla stock options trading. The Securities and Exchange Commission (SEC) has proposed tighter restrictions on the use of options, potentially reducing their accessibility for retail investors. These regulations aim to mitigate the risks associated with complex financial instruments, highlighting the importance of thoroughly understanding the implications before diving in.

As you voyage into Tesla stock options trading, immerse yourself in the intricate details. Master the lingo, learn to decipher option chains, and develop a keen eye for identifying trading opportunities. The depth of knowledge you acquire will serve as a compass, guiding you through the tumultuous waves of market volatility.

Foremost, remember that Tesla stock options trading amplifies both the potential rewards and perils. Venture forth armed with prudent risk management strategies, leaving behind any vestige of recklessness. The ever-changing panorama of the stock market demands a flexible and vigilant approach – be ready to adjust course as conditions evolve.

Tesla stock options trading offers an electrifying avenue for savvy投资者, but the ride can be bumpy. With a firm grasp of the concepts, a sharp eye for market movements, and a touch of audacity, you can harness the velocity of these options

Image: www.youtube.com

Tesla Stock Options Trading

Image: www.youtube.com