Are you looking to amplify your options trading returns while limiting risks? If so, the trading options grid strategy might be your ideal solution. This sophisticated strategy entails simultaneously buying and selling multiple options contracts at different strike prices and expiration dates, forming a grid-like structure. By implementing this strategy, traders aim to capitalize on market fluctuations within a defined range, potentially generating consistent income regardless of the market’s direction.

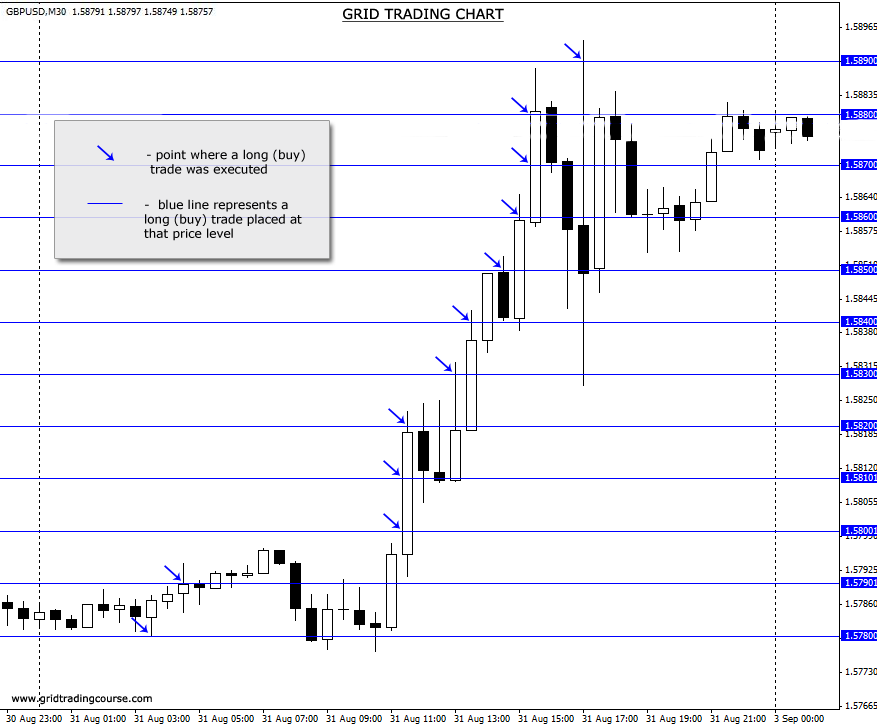

Image: gridtradingcourse.com

Navigating the Trading Options Grid Strategy: Key Concepts and Applications

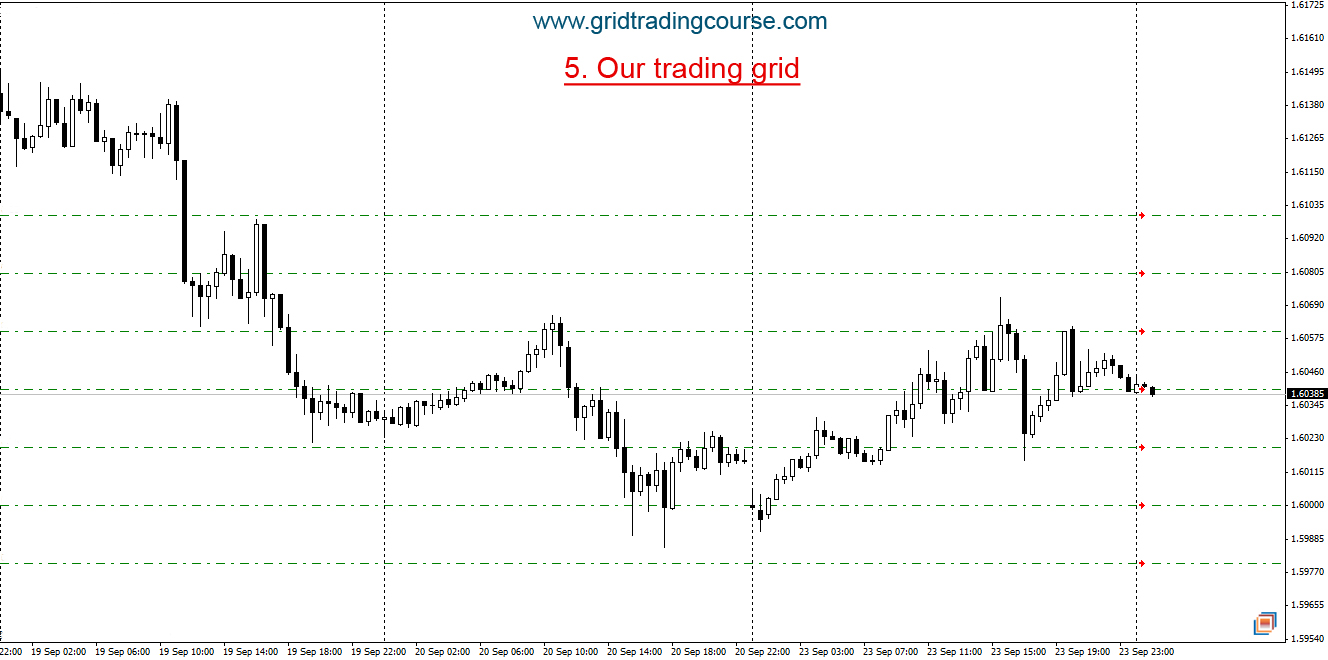

The trading options grid strategy is a two-dimensional approach involving several options contracts bought or sold at specific price points (strike prices) and time frames (expirations). The grid is constructed based on a trader’s market outlook and risk tolerance. For instance, if a trader anticipates a stock’s price to hover within a particular range, they could construct a grid with strike prices above and below the current market price.

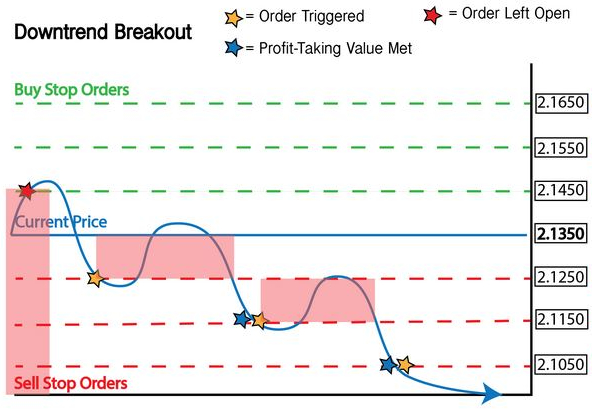

The trading options grid strategy offers several advantages, including its ability to cap potential losses, generate returns in range-bound markets, and leverage portfolio diversification. By concurrently buying and selling options contracts with varying strike prices, traders can mitigate risks associated with price movements outside their anticipated range. Additionally, this strategy can be adapted to different market conditions, making it a versatile tool for both experienced and novice options traders.

To effectively execute a trading options grid strategy, it’s crucial to consider factors such as market volatility, underlying stock price, and time decay. Volatility, represented by the Greeks (delta, theta, vega, and gamma), significantly impacts option pricing and, consequently, the grid’s performance. Understanding the influence of these Greeks is vital for strategic decision-making.

Unlocking the Secrets of Trading Options Grid: A Step-by-Step Guide

-

Choose a suitable underlying asset: The first step involves selecting an underlying stock, index, or commodity that aligns with your market outlook. Thorough research and analysis of the asset’s historical price movements and future prospects are essential.

-

Determine Strike Prices: Next, it’s crucial to identify strike prices for your grid. These prices should encompass a range within which you expect the underlying asset’s price to move.

-

Set Expiration Dates: Selecting appropriate expiration dates ensures the grid is aligned with your trading timeframe. Expiration dates for different grid levels should be staggered to optimize risk and reward potential.

-

Decide the Number of Contracts: The number of contracts bought or sold at each strike price and expiration date should be based on your risk tolerance and capital availability.

-

Manage Risk: Implementing risk management strategies, such as stop-loss or limit orders, is essential to protect against substantial losses.

To hone your trading options grid skills, practicing with a simulated trading platform or paper trading is highly recommended. This allows you to test different scenarios and refine your strategy before committing real capital.

Navigating Market Dynamics with Trading Options Grid: Real-World Applications

The trading options grid strategy can be applied across various market environments, demonstrating its adaptability in different trading conditions:

-

Range-bound markets: In markets characterized by limited price movement, the grid strategy can yield consistent returns by capturing minor fluctuations within a defined range.

-

Volatile markets: While volatility can impact option pricing, the grid strategy, when managed effectively, can capitalize on market swings and generate significant returns.

-

Trending markets: Even in trending markets, strategic adjustments to the grid, such as rolling or adjusting strike prices, can help capture profits while managing risks.

Image: www.gridtradingcourse.com

Trading Options Grid

Image: www.broker-forex.eu

Epilogue: Embracing the Trading Options Grid Strategy for Success

The trading options grid strategy stands out as a powerful tool with the potential to unlock consistent income and mitigate risks in options trading. By carefully considering the factors discussed above and implementing sound risk management strategies, traders can harness the grid’s potential for success. Remember, continuous learning and adaptation are key to mastering the intricacies of this versatile trading strategy, allowing you to navigate market complexities and potentially achieve your trading objectives.