Embark on the Journey: Unveiling Day Trading Out-of-the-Money Options

Introduction

Image: www.youtube.com

As an avid trader, I’ve witnessed firsthand the exhilaration that comes with day trading options. But venturing into the realm of out-of-the-money (OTM) options demands a distinct approach. These options reside beyond the current market price, offering both potential rewards and risks. This guide will delve into the intricacies of day trading OTM options, empowering you with knowledge and strategies to navigate this dynamic market.

What are Out-of-the-Money (OTM) Options?

OTM options are options contracts that have a strike price noticeably below (for calls) or above (for puts) the underlying asset’s current market price. Due to their OTM nature, they are less expensive than at-the-money (ATM) or in-the-money (ITM) options. This cost-effectiveness presents a compelling entry point for traders seeking leverage.

Dynamics of Day Trading OTM Options

Day trading OTM options involves buying and selling these contracts within a single trading day. These options carry certain unique characteristics:

- Volatility Dependence: OTM options are highly sensitive to changes in volatility. A sudden increase in volatility can significantly enhance their premiums.

- Limited Profit Potential: OTM options have a lower chance of expiring ITM, limiting their potential profits compared to ITM options.

- Higher Probability of Loss: The likelihood of losing your investment in OTM options is higher due to their unfavorable strike prices.

Navigating the Market: Strategies for Successful Day Trading

Seasoned traders navigate the OTM options market with a refined strategy. Here are proven tactics to enhance your trading:

- Leverage Volatility: Identify stocks or assets with expected high volatility and consider buying OTM call options to benefit from potential price increases.

- Trade Spreads: Engage in vertical spreads involving the sale of ITM options and purchase of OTM options to reduce overall risk while capturing premium decay.

- Manage Risk: Implement stop-loss orders to protect your capital in case of adverse price movements. Consider using smaller position sizes and diversifying across multiple assets.

Expert Insights

“Day trading OTM options offers an opportunity for aggressive traders to maximize profits and leverage market volatility,” says renowned trader Jack Carter. “However, it requires a comprehensive understanding of the risks involved and a disciplined approach.”

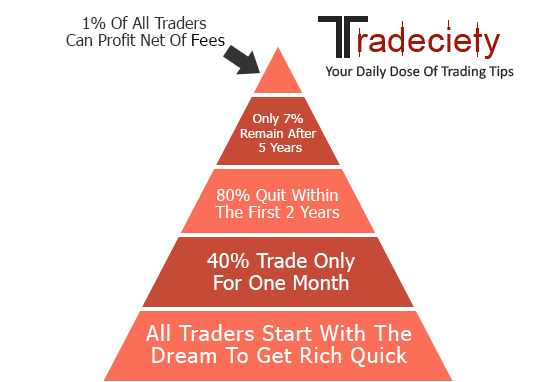

Image: tradeciety.com

Day Trading Out Of The Money Options

![[LIVE Profit Trading] Day Trading E-Mini S&P 500 Futures (28th May 2020 ...](https://i.ytimg.com/vi/_qI3ocGwQ8U/maxresdefault.jpg)

Image: www.youtube.com

Unveiling the Intricacies: Factors Influencing OTM Option Pricing

Option Premium: The premium of an OTM option is determined by the underlying asset’s price, strike price, time to expiration, interest rates, and volatility.

Volatility Premium: Volatility is the key driver of OTM option premiums. Higher implied volatility implies a greater probability of significant price fluctuations, leading to higher premiums.

Time Decay: OTM options lose value as they approach expiration. As time progresses, the premium decays, making it crucial to manage trades strategically.

Implied Volatility vs. Historical Volatility: Implied volatility reflects market expectations of future volatility, while historical volatility measures past volatility. Matching your trading strategy to the appropriate volatility level is essential.

Frequently Asked Questions (FAQs)

- Is day trading OTM options a viable strategy for beginners? While experienced traders can employ it effectively, beginners should start with less volatile options until they develop a nuanced understanding of the market.

- How do I identify suitable OTM options for trading? Look for assets with high implied volatility, a favorable risk-to-reward ratio, and a predictable movement pattern.

- What are some common pitfalls of day trading OTM options? Underestimating risk, ignoring time decay, and chasing losses are prevalent mistakes.

Conclusion: Embracing the Potential of OTM Options

Day trading OTM options presents a unique opportunity for traders to capitalize on market volatility and leverage. However, it necessitates a profound understanding of the risks involved and the implementation of sound strategies. Embrace the challenge, harness the insights presented, and embark on a journey of informed decision-making in the dynamic world of OTM options.

Are you ready to delve deeper into the captivating realm of day trading OTM options? Let the pursuit of knowledge and the thrill of trading guide your path to success.