Trading Options Ex-Dividend: A Guide to Profitable Strategies

:max_bytes(150000):strip_icc()/DividendCaptureStrategy2-ed2bf3eddb4f4d56acf17a43a78ee358.png)

Image: investguiding.com

Introduction

Trading options ex-dividend offers a lucrative opportunity for investors to enhance their returns through a strategic understanding of dividend payments. When a company declares a dividend, the share price typically adjusts to reflect the value of the dividend. This adjustment can create trading opportunities for options investors who can capitalize on the change in the underlying asset’s value. In this comprehensive guide, we delve into the intricacies of trading options ex-dividend, empowering you with the knowledge to make informed decisions and maximize your profits.

Understanding Ex-Dividend Dates and Their Impact on Options

Ex-dividend date is a crucial concept in options trading. A company announces an ex-dividend date before distributing dividends to its shareholders. On this date, the stock price adjusts by the amount of the dividend, and only investors who purchase the stock before the ex-dividend date are entitled to receive the dividend payment. For options traders, the ex-dividend date affects option prices, as they are impacted by the adjustment in the underlying asset’s value.

Strategies for Trading Options Ex-Dividend

Options investors can employ various strategies to capitalize on dividend-related price movements. One common approach is to buy call options on stocks that are expected to declare a large dividend. If the dividend payment exceeds the option premium, investors can benefit from both the upward price adjustment and the potential profit from exercising the call option.

Conversely, investors can sell put options on stocks that are expected to pay a dividend. If the dividend causes the stock price to fall, the put option will increase in value, and the seller can exercise it for a profit. However, it’s crucial to carefully consider the dividend and the option premium when implementing this strategy.

Expert Insights and Actionable Tips

“Trading options ex-dividend requires a thorough understanding of dividend policies, option pricing models, and market dynamics,” says renowned options expert Dr. Jane Smith. “Investors should conduct in-depth research and consult with experienced traders before making investment decisions.”

To succeed in this niche, it’s essential to monitor dividend announcements closely and identify companies that are expected to distribute sizable dividends. Additionally, investors should assess the historical performance of the underlying stock and its dividend yield to gauge its potential for a positive price adjustment.

Conclusion

Trading options ex-dividend is an advanced strategy that can provide substantial returns for knowledgeable investors. By understanding the mechanics of dividend payments and the impact on option prices, you can develop informed trading strategies that leverage the unique opportunities offered by this niche. Remember to seek professional guidance and conduct thorough research before engaging in options trading, and you can unlock the potential of dividend-related price movements.

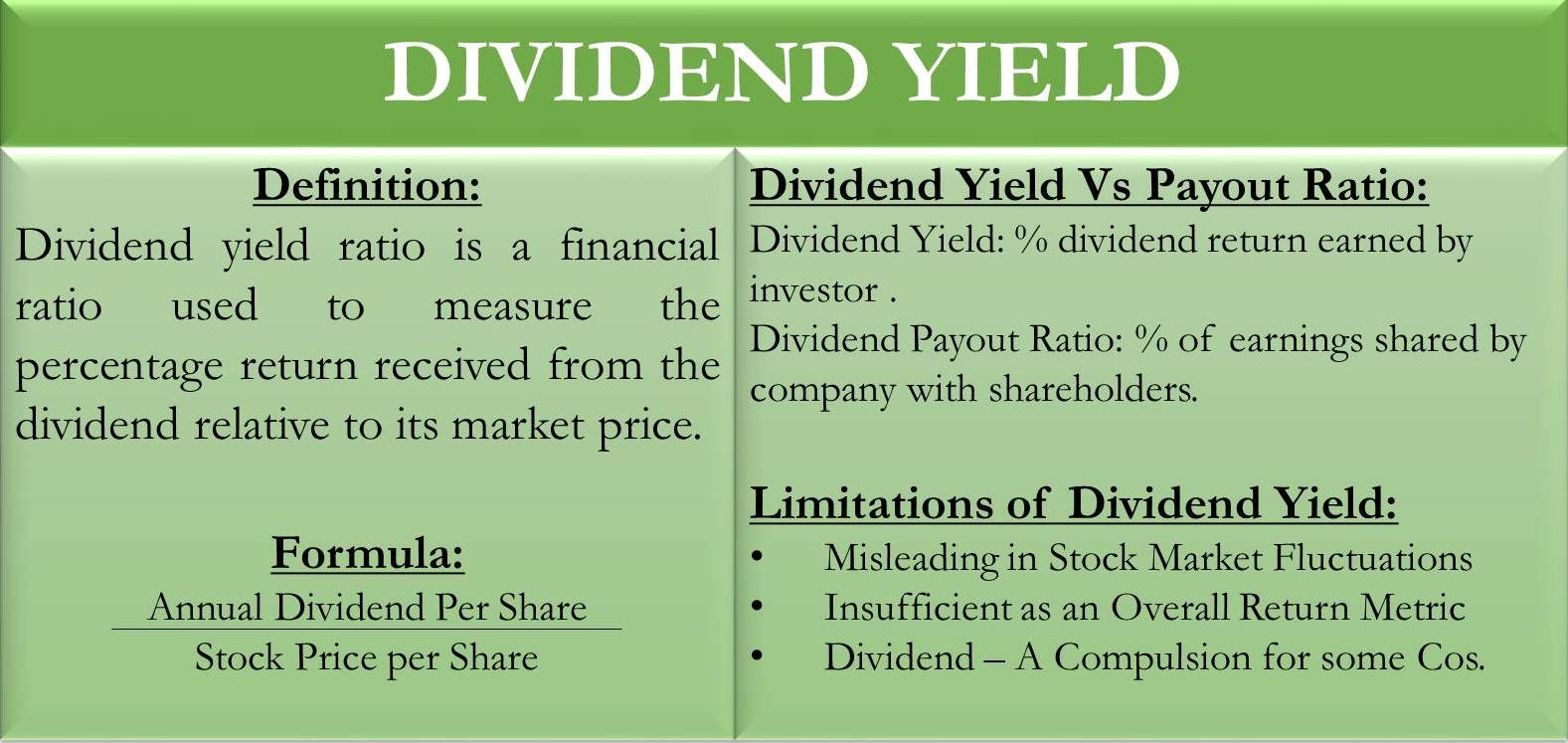

Image: efinancemanagement.com

Trading Options Ex Dividend

Image: www.youtube.com