Introduction

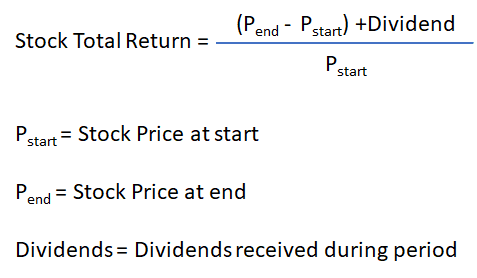

When a company declares a dividend, the stock price typically adjusts downward on the ex-dividend date, which is one business day before the record date. This adjustment reflects the fact that the dividend is paid to shareholders of record as of the record date, excluding those who purchase the stock on or after the ex-dividend date. Trading ex-dividend while holding options, however, presents unique considerations and potential implications for options traders. Understanding these factors is crucial for making informed decisions and mitigating risks in such situations.

Image: www.marketbeat.com

How Ex-Dividend Dates Affect Options Prices

The ex-dividend date affects option prices because the underlying stock price adjustment is reflected in the option’s intrinsic value. For call options, which grant the right to buy the underlying stock, the intrinsic value decreases by the amount of the dividend. Conversely, for put options, which grant the right to sell the underlying stock, the intrinsic value increases by the amount of the dividend.

Strategies for Trading Ex-Dividend When Holding Options

Options traders can employ several strategies to mitigate the impact of ex-dividend dates when holding options:

Roll the Options

One strategy is to roll the options to a later expiration date, allowing for additional time for the underlying stock to recover from the ex-dividend price adjustment. This can be especially beneficial if the trader expects a significant recovery in the stock price after the dividend payment.

Image: moneyinvestexpert.com

Sell Covered Calls

For call option holders, selling a covered call option can help reduce the impact of the ex-dividend adjustment. By selling a covered call, the trader creates an obligation to sell the underlying stock at a specified price. If the underlying stock price recovers after the dividend payment and exceeds the covered call strike price, the trader may capitalize on the additional gain while offsetting the loss in call option value due to the ex-dividend date.

Buy Protective Puts

For put option holders, buying a protective put option can provide a hedge against the ex-dividend adjustment. A protective put option gives the trader the right to sell the underlying stock at a specified price below the current market price. If the underlying stock price falls significantly after the dividend payment, the protective put option can help reduce the overall loss.

Exercise Early

In certain situations, especially if the dividend is large and the option is close to expiration, traders may consider exercising the option early before the ex-dividend date. This allows them to capture the value of the dividend while avoiding the potential loss of intrinsic value after the price adjustment.

Additional Considerations

When trading ex-dividend while holding options, it is essential to:

- Check option contracts carefully to understand the ex-dividend dates and potential impact on option prices.

- Consider the size of the dividend payment and its potential effect on the underlying stock price.

- Monitor market conditions and news closely, as external factors can influence the stock’s price movement after the dividend payment.

- Consult a financial advisor or broker for personalized advice based on individual circumstances and investment goals.

Trading Ex-Dividend When Holding Options

Image: www.marketbeat.com

Conclusion

Trading ex-dividend when holding options requires a thorough understanding of the potential implications and the judicious application of appropriate strategies. By considering the factors discussed in this guide, traders can navigate ex-dividend dates effectively, mitigate risks, and make informed decisions to optimize their options trading performance. Remember, it is essential to approach these strategies with a prudent mindset and consult with a qualified financial professional if needed.