Option trading is a complex financial strategy that can yield great rewards but also carries significant risks. One such risk is mistiming dividend payments, which can result in substantial losses if not properly accounted for. This article delves into the intricacies of option trading, dividend timing, and the potential consequences of mistimed trades, equipping you with the knowledge to avoid this costly error.

Image: alphabetastock.com

Understanding Option Trading

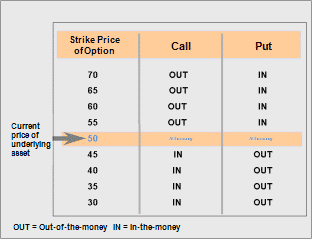

Options are financial contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset, such as a stock, at a predetermined price within a specified period. This flexibility makes options a versatile tool for various trading strategies, including hedging risk, speculating on price movements, and generating income.

The Impact of Dividends on Option Premiums

Dividends are payments made to shareholders by a company, typically representing a portion of its earnings. When a company declares a dividend, the stock’s price usually adjusts downward by the amount of the dividend. This is because the dividend is now being distributed to shareholders instead of being held by the company.

In the context of option trading, dividends can have a significant impact on the value of call options (the right to buy) and put options (the right to sell). Call options generally increase in value as the underlying stock price rises, while put options gain value when the stock price decreases. When a dividend is declared, the stock price typically falls, which can negatively affect the value of call options and benefit put options.

Mistiming Dividends: A Pitfall to Avoid

Mistiming dividends occurs when an option trader fails to adjust their trading strategy to account for an upcoming dividend payment. For example, if a trader holds a call option on a stock that is about to declare a dividend, the stock price may drop below the option’s strike price when the dividend is paid. This can significantly reduce the value of the option, resulting in a loss for the trader.

Similarly, if a trader holds a put option on a stock that is about to declare a dividend, the stock price may rise above the option’s strike price when the dividend is paid. This can also lead to a loss for the trader.

Image: optionstradingiq.com

Preventing Mistimed Trades

To avoid mistiming dividends, option traders should:

- Research dividend dates: Keep track of upcoming dividend declarations for the stocks underlying their options contracts.

- Adjust trading strategies: If a dividend is expected to significantly impact the stock price, adjust your trading strategy accordingly. Consider buying or selling options with different strike prices or expiration dates.

- Monitor price movements: Observe the stock price leading up to and following the dividend declaration to gauge its impact on option prices.

- Consider dividend adjustments: Some options exchanges offer dividend adjustments to offset the impact of dividend payments. Explore these options to minimize losses.

Seeking Expert Guidance

Navigating the complexities of dividend mistiming can be challenging. If you’re unsure about how dividends may affect your option trades, consult with a financial professional who specializes in options trading. They can provide tailored advice based on your investment goals and the specific options you’re trading.

Option Trading Mistiming Dividends

Image: www.848days.com

Conclusion

Option trading mistiming dividends is a significant risk that can result in substantial losses. By understanding the impact of dividends on option premiums, researching upcoming payments, and adjusting trading strategies accordingly, traders can minimize their exposure to this costly error. Remember, the key to successful option trading lies in careful planning, timely execution, and the ability to adapt to unforeseen market events, including dividend declarations. By following these best practices, you can mitigate risks and increase your chances of making profitable trades in the dynamic world of options trading.