Introduction: Dividends and Options

As an active options trader, I’ve witnessed firsthand the impact of ex-dividend dates on stock prices and options premiums. Understanding the mechanics and implications of this event is crucial for maximizing trading outcomes.

Image: optionstradingiq.com

Ex-dividend refers to the date when a company’s stock no longer trades with the entitlement to the recently declared dividend. This means that anyone buying the stock on or after the ex-date will not receive the upcoming dividend payment. The stock price typically adjusts downward by the amount of the dividend on the ex-date, as the value of the dividend is no longer reflected in the share price.

Implications for Options

Impact on Premiums

When a stock goes ex-dividend, the premiums of call options (right to buy) decrease, while put options (right to sell) increase. This is because the intrinsic value of a call option is reduced by the amount of the dividend, while the intrinsic value of a put option increases.

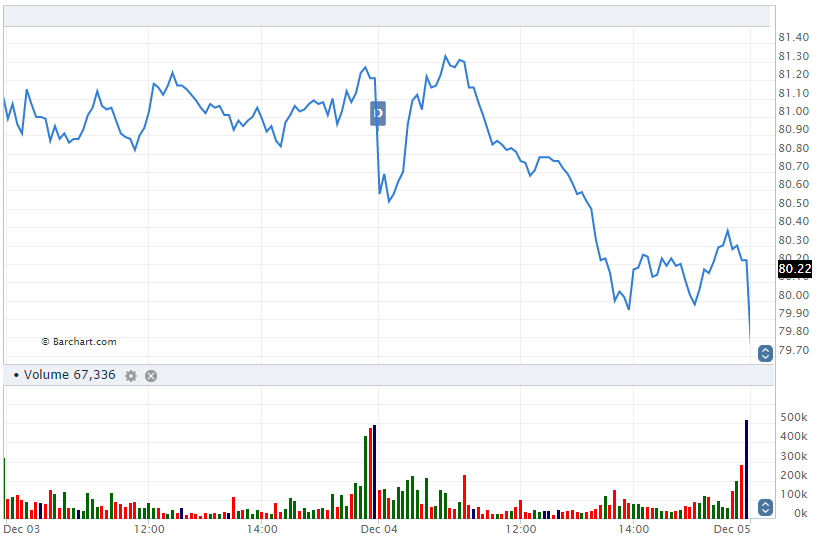

Short-Term Volatility

The ex-dividend date can introduce short-term volatility in option premiums. Some traders may look to capitalize on this volatility by buying or selling options around the ex-date, as the premiums typically fluctuate in the days leading up to and on the ex-date.

Image: shawnqbenedikta.pages.dev

Strategies for Traders

Adjust Trading Position

If you hold a call option that has gone ex-dividend, consider adjusting your position by reducing the number of contracts held or shifting to a lower strike price. Similarly, if you hold a put option, you may want to increase your position or move to a higher strike price.

Maximize Volatility

Some traders employ strategies that aim to leverage the increased volatility around the ex-date. This may involve buying or selling short-term options close to expiration, or using spreads to bet on the direction and magnitude of the price movement.

Latest Trends and Developments

Ex-dividend dates continue to be an important consideration in options trading, with recent trends and developments shaping its impact:

- Dividend Capture Strategies: Some investors use options strategies to capture dividends while maintaining a short position in the underlying stock.

- Ex-Dividend Day Liquidity: The liquidity of options can fluctuate around ex-dividend dates, impacting the ability of traders to enter or exit positions.

Tips and Expert Advice

Based on my experience and insights from experts:

- Monitor Stock Announcements: Stay informed about upcoming dividend declarations and ex-dividend dates.

- Understand Option Greeks: Knowing how Greeks like delta and theta affect option premiums is essential in evaluating ex-dividend impacts.

FAQ on Options Trading Ex-Dividend

Some common questions and answers related to options trading and ex-dividend dates:

- Q: What happens to my call option if my stock goes ex-dividend?

A: The premium will decrease by the amount of the dividend. - Q: Can I trade options on the ex-dividend date?

A: Yes, but it’s advisable to be aware of the potential volatility. - Q: Should I avoid trading options around ex-dividend dates?

A: Not necessarily, but it’s important to adjust your strategies and manage risks accordingly.

Options Trading Ex Dividend

Image: tuportavoz.com

Conclusion

Understanding options trading ex-dividend is essential for both experienced and novice traders. By staying informed, managing positions, and evaluating opportunities, you can navigate the complexities of ex-dividend dates and enhance your trading outcomes. Whether you’re a seasoned investor or just starting your journey, I hope this article has provided valuable insights into this important aspect of options trading.

Are you still interested in learning more about options trading and ex-dividend dates? Feel free to leave your questions or comments below!