In the realm of financial markets, options trading stands as a powerful tool for investors seeking to navigate the volatilities of the market terrain. Options provide the flexibility to grasp opportunities or cushion against potential downturns, and at the heart of this intricate dance lies the equity line – a boundary that plays a pivotal role in shaping the odds of success. A deep understanding of the equity line empowers traders to maximize the potential of options trading while mitigating risks.

Image: otebagoqe.web.fc2.com

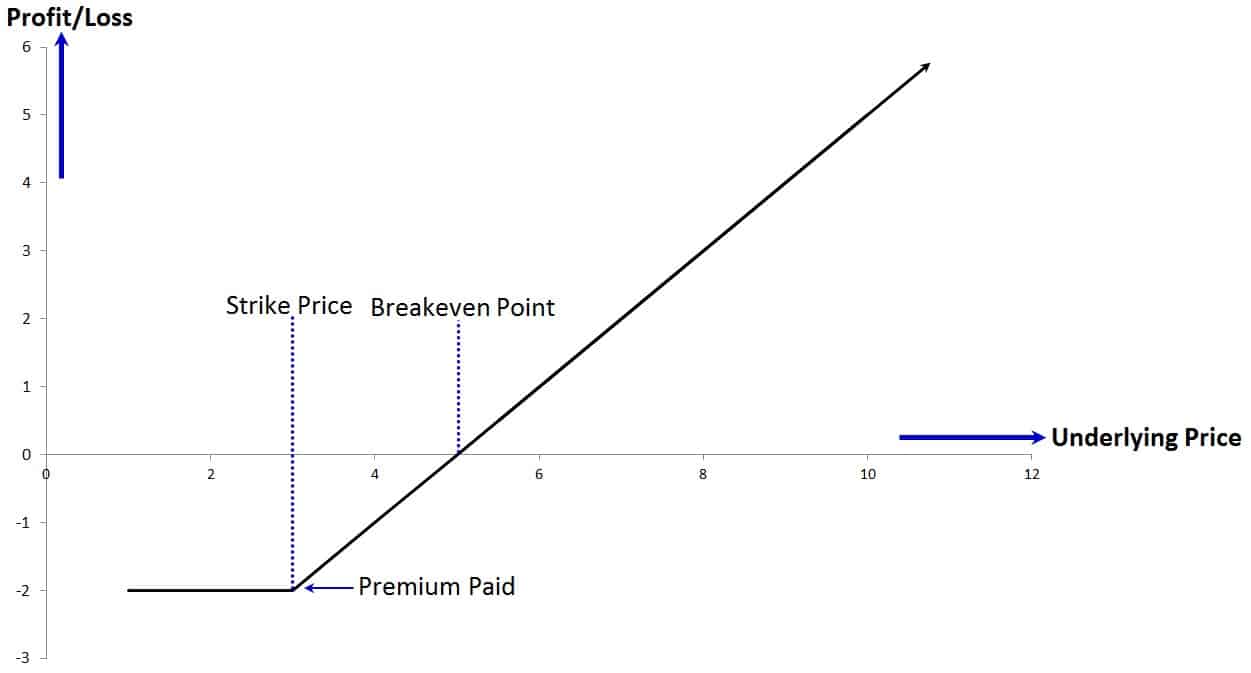

An equity line, in the context of options trading, refers to the theoretical value of the underlying asset at which the option becomes worthless. For a call option, the equity line is the current stock price plus the net premium paid for the option. Conversely, for a put option, it’s the current stock price minus the premium.

As the stock price fluctuates, the relationship between the stock price and the equity line determines the value of an option. If the stock price is above the equity line for a call option or below it for a put option, the option holds intrinsic value – the difference between the stock price and the equity line. However, when the stock price breaches the equity line, the option becomes worthless, as the intrinsic value dwindles to zero.

Traders use the equity line to assess the potential profitability of an options trade. By comparing the current stock price to the equity line at the expiration date, they can determine whether the option is likely to expire in-the-money, at-the-money, or out-of-the-money. The location of the equity line also helps traders gauge the risk and reward potential of the trade.

Furthermore, advanced options strategies like spreads and condors rely on the equity line to calculate maximum profit and loss scenarios. By leveraging multiple options with different strike prices and expiration dates, these strategies seek to capture the nuanced movements of the underlying asset. Understanding the equity line is crucial for accurately assessing the potential outcomes of such complex strategies.

To fully grasp the significance of the equity line, let’s delve into a practical example. Suppose you’re considering purchasing a call option with a strike price of $50, and the current stock price is $48. The net premium for the option is $2. In this case, the equity line for the call option is $50 + $2 = $52. If the stock price rises above $52 before the option’s expiration, the call option will have intrinsic value and can be sold for a profit. However, if the stock price remains below $52, the call option will expire worthless.

In conclusion, the equity line serves as an indispensable guidepost in the realm of options trading. By comprehending its relationship with the underlying asset’s price, traders can evaluate the potential profitability and risk associated with their trades. Whether navigating the intricacies of basic options strategies or venturing into the depths of complex spreads, a firm grasp of the equity line empowers traders to make informed decisions and maximize their chances of success in the ever-evolving financial markets.

Image: www.youtube.com

Understanding The Point Of Equity Line In Options Trading

Image: articles-junction.blogspot.com