Navigating the world of options trading can be a daunting task, especially when attempting to decipher technical indicators like the Moving Average Convergence Divergence (MACD). But fear not, intrepid traders, for this comprehensive guide will unravel the complexities of MACD options trading, empowering you with the knowledge to make informed decisions and potentially enhance your trading strategies.

Image: www.warsoption.com

Defining MACD and Its Significance

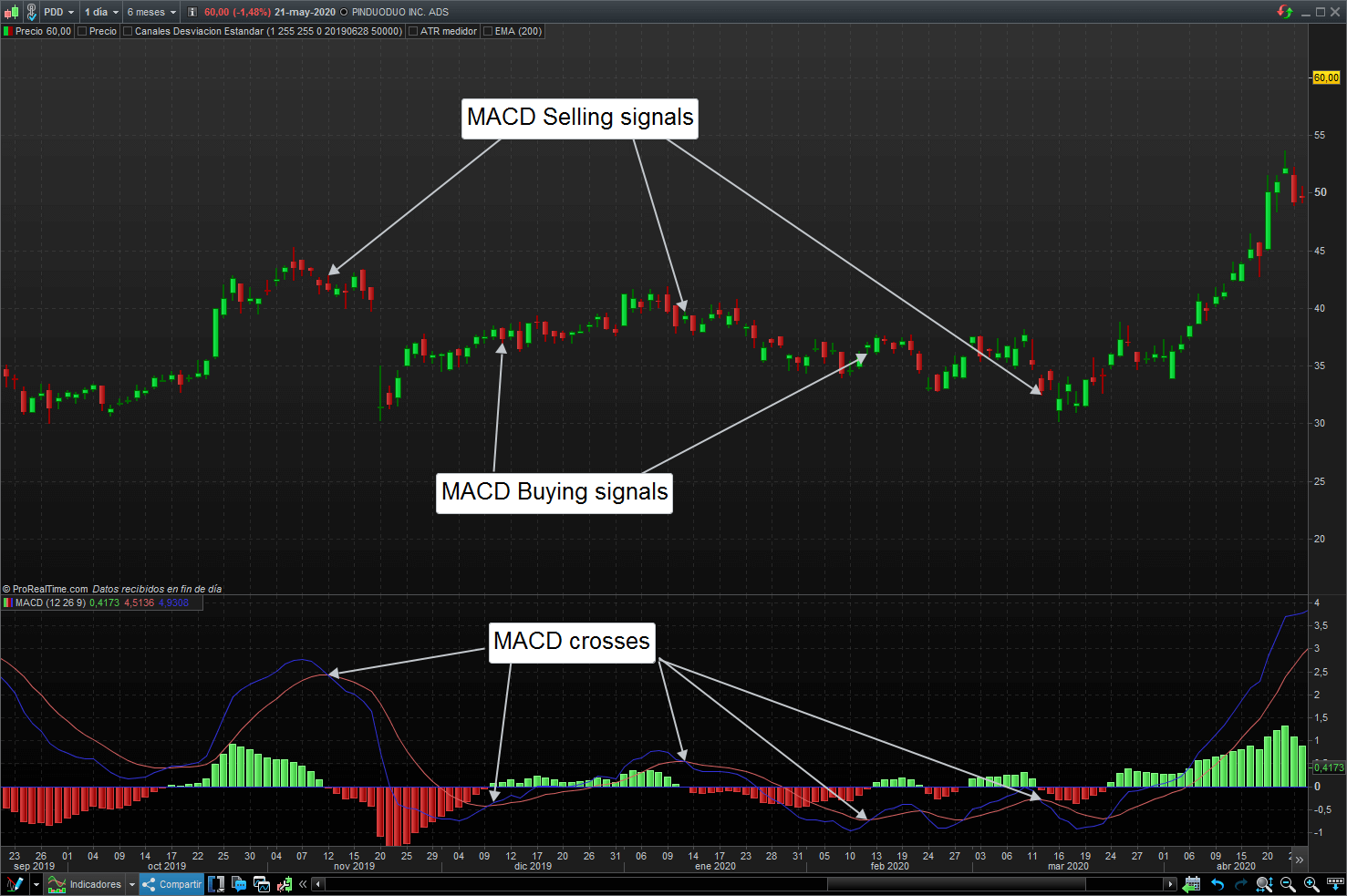

The MACD, conceived by Gerald Appel, is a versatile technical analysis tool employed by traders to identify trends and potential trading opportunities. It juxtaposes two exponential moving averages (EMAs), a 12-day EMA and a 26-day EMA, and plots their difference known as the MACD line. Additionally, a signal line, a 9-day EMA of the MACD line, is plotted to aid in discerning potential trend reversals. By analyzing the relationship between the MACD line and the signal line, traders can gain insights into the momentum and direction of the underlying asset’s price movements, empowering them to make more informed trading decisions.

Unveiling the MACD Histogram: A Visual Representation of Momentum

The MACD histogram provides a visual representation of the MACD line’s relationship with the signal line. The histogram is constructed by plotting the difference between the MACD line and the signal line, allowing traders to discern the strength of the momentum behind the underlying asset’s price movements. Positive values in the histogram indicate that the MACD line is above the signal line, suggesting bullish momentum, while negative values indicate bearish momentum. Divergences between the MACD histogram and the price action can often provide valuable trading signals, guiding traders towards potential opportunities.

Strategies for MACD Options Trading

MACD options trading involves utilizing the insights derived from the MACD indicator to identify potential trading opportunities. Traders can employ a range of strategies, tailored to their risk tolerance and trading style:

-

Crossover Strategy: This simple yet effective strategy revolves around identifying crossovers between the MACD line and the signal line. When the MACD line crosses above the signal line, it signals a potential buy opportunity, while a crossover below the signal line suggests a potential sell opportunity.

-

Divergence Strategy: The divergence strategy relies on identifying discrepancies between the MACD histogram and the underlying asset’s price action. When the MACD histogram exhibits bullish divergence (rising MACD line accompanied by falling prices), it can indicate a potential trend reversal, presenting a buy opportunity. Conversely, bearish divergence (falling MACD line accompanied by rising prices) can signal a potential sell opportunity.

-

Trend-Following Strategy: This strategy capitalizes on the momentum identified by the MACD indicator. Traders can enter long positions when the MACD line is above the signal line and trending higher, and short positions when the MACD line is below the signal line and trending lower.

Image: www.thatsucks.com

Macd Options Trading

Image: currency.com

Risk Management in MACD Options Trading

As with any trading strategy, risk management plays a crucial role in MACD options trading. Implementing appropriate risk-management techniques can help traders preserve their capital and navigate market volatility:

-

Position Sizing: Prudent position sizing dictates that traders allocate only a portion of their capital to each trade, avoiding excessive risk exposure. The risk tolerance of the trader and the volatility of the underlying asset should be carefully considered when determining position size.

-

Stop-Loss Orders: Stop-loss orders provide a means to limit potential losses by automatically exiting a position when a predetermined price is reached. Traders should place stop-loss orders at strategic levels to minimize losses in adverse market conditions.

-

Volatility Assessment: Prior to engaging in MACD options trading, traders should assess the volatility of the underlying asset. Elevated volatility can amplify potential profits but also magnifies risks, emphasizing the need for comprehensive risk management.