In the ever-evolving financial landscape, option trading has emerged as a compelling tool for investors seeking to enhance returns and navigate market volatility. By understanding the nuances of option trading plays, investors can unlock the potential to maximize gains and mitigate risks in a compelling way. This comprehensive guide delves into the world of option trading plays, providing a clear and insightful blueprint for those seeking to master this financial art form.

Image: club.ino.com

Delving into the Fundamentals: What are Option Trading Plays?

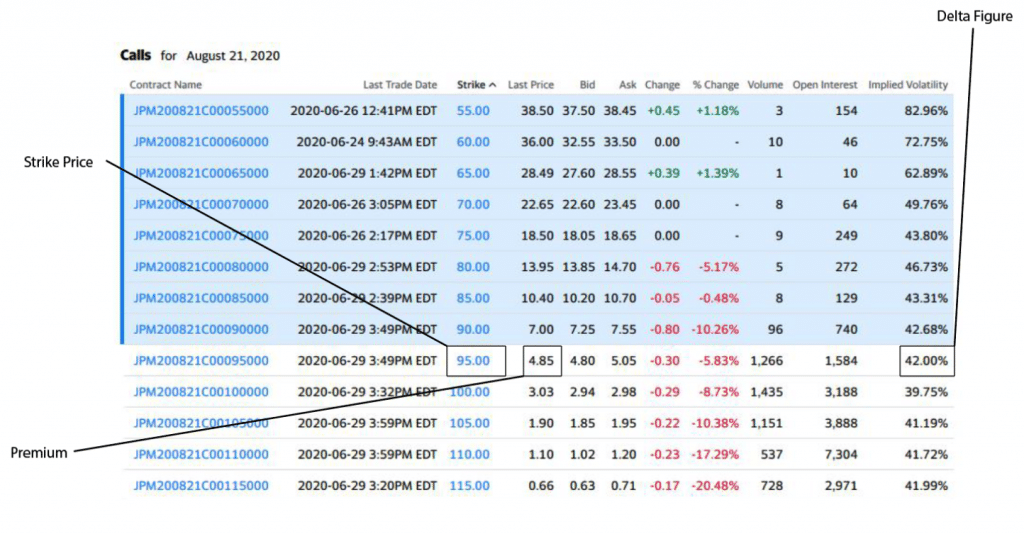

Option trading plays involve the strategic use of financial instruments known as options, which grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price. By leveraging these options, investors can speculate on the future direction of stock prices, hedge against potential losses, and generate income through premium collection. Understanding the basics of options trading, including various option types (call and put options), exercise prices, and expiration dates, forms the foundation for successful option trading plays.

Uncovering Popular Option Trading Plays: Strategies for Success

The realm of option trading plays encompasses a diverse range of strategies tailored to specific market conditions and investor objectives. Let’s explore some widely recognized and effective plays:

-

Bull Call: A bullish outlook on a stock’s price appreciation. This play involves purchasing a call option, granting the right to buy the underlying asset at a strike price above the current market price.

-

Bear Put: Anticipating a decline in a stock’s price. This play entails selling a put option, obligating the investor to sell the underlying asset at a strike price below the current market price.

-

Covered Call: A conservative strategy for generating income while maintaining exposure to stock ownership. This play involves selling a call option against a long position in the underlying stock.

-

Protective Put: Hedging against potential losses in a stock investment. This play involves purchasing a put option to establish a price floor below the current market price, limiting potential downside risk.

-

Straddle: A neutral strategy that profits from significant price fluctuations, regardless of direction. This play involves purchasing both a call and a put option with the same strike price and expiration date.

Navigating Complexities: Risk Management and Market Analysis

While option trading plays offer immense potential, it’s crucial to acknowledge the inherent risks involved. Effective risk management strategies are paramount to maximizing gains and mitigating potential losses. Techniques such as position sizing, stop-loss orders, and hedging strategies become essential tools in the trader’s arsenal.

Thorough market analysis forms the cornerstone of successful option trading plays. Keeping abreast of economic indicators, earnings reports, technical analysis, and geopolitical events provides invaluable insights into market trends and volatility. By leveraging a combination of fundamental and technical analysis, investors can make informed decisions and identify high-probability option trading opportunities.

Image: seekingalpha.com

Mastering the Market: Tips from Renowned Experts

Seeking guidance from experienced traders can significantly enhance one’s understanding of option trading plays and overall market knowledge. Here are some valuable insights from industry professionals:

-

“Incorporate risk management strategies into every trade, and never invest more than you’re willing to lose.” – Warren Buffett, renowned investor

-

“Technical analysis can provide valuable insights into price patterns, but it should complement fundamental analysis for a comprehensive understanding of market forces.” – Mark Douglas, trading psychologist

-

“Patience and discipline are crucial in option trading. Avoid emotional decision-making and stick to your predetermined trading plan.” – Nassim Taleb, author of “The Black Swan”

Option Trading Plays

Conclusion: Embracing Empowerment through Option Trading Plays

By mastering the art of option trading plays, investors gain a powerful tool to navigate market volatility and potentially enhance their financial returns. Understanding the different types of plays, implementing effective risk management strategies, and continually educating oneself from trusted sources are key to unlocking the full potential of option trading. Embrace the strategies outlined in this guide and embark on a journey towards financial empowerment and market success.