Introduction: Unveiling the Potential of Options Trading

In the ever-evolving world of finance, options trading has emerged as a powerful tool for investors seeking to amplify their returns and enhance their risk management strategies. TD Ameritrade, a leading online broker, recognizes the significance of this lucrative market segment and offers a comprehensive platform to empower traders with the knowledge and resources they need to succeed.

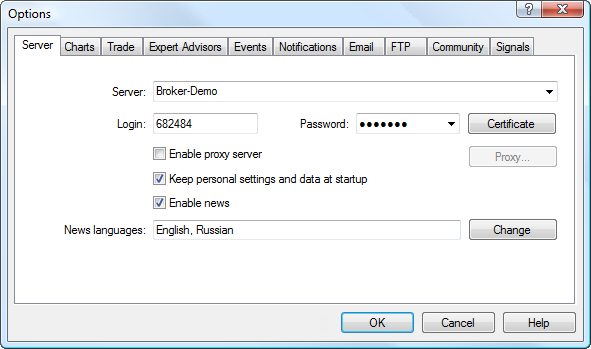

Image: www.metatrader5.com

Whether you’re a seasoned investor or new to the realm of options trading, understanding the fundamentals is crucial for making informed decisions and maximizing your potential. In this comprehensive guide, we’ll embark on a deep dive into the world of options trading with TD Ameritrade, providing you with the necessary insights to navigate this complex yet rewarding market.

TD Ameritrade: Your Gateway to Option Trading Mastery

TD Ameritrade has long been recognized as a pioneer in the online brokerage industry, providing investors with a robust platform that streamlines the complexities of options trading. Their platform offers an intuitive interface, advanced analytical tools, and a wealth of educational resources to accelerate your learning curve. Whether you’re seeking to enhance your income or hedge against potential downturns, TD Ameritrade empowers traders of all levels to harness the power of options.

Unlocking the Mechanics of Options Trading

Options trading, at its core, involves entering into contracts that provide the buyer with the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). These contracts offer investors the flexibility to navigate market fluctuations, potentially boosting returns and mitigating risks.

Demystifying Key Concepts: Calls and Puts

Call options grant the holder the right to purchase an underlying asset at a predetermined price, typically employed when bullish on the market’s direction. Conversely, put options allow the holder to sell an underlying asset at a predefined price, often utilized when anticipating a decline in the market’s value. Understanding the nuances of call and put options is fundamental to developing effective trading strategies.

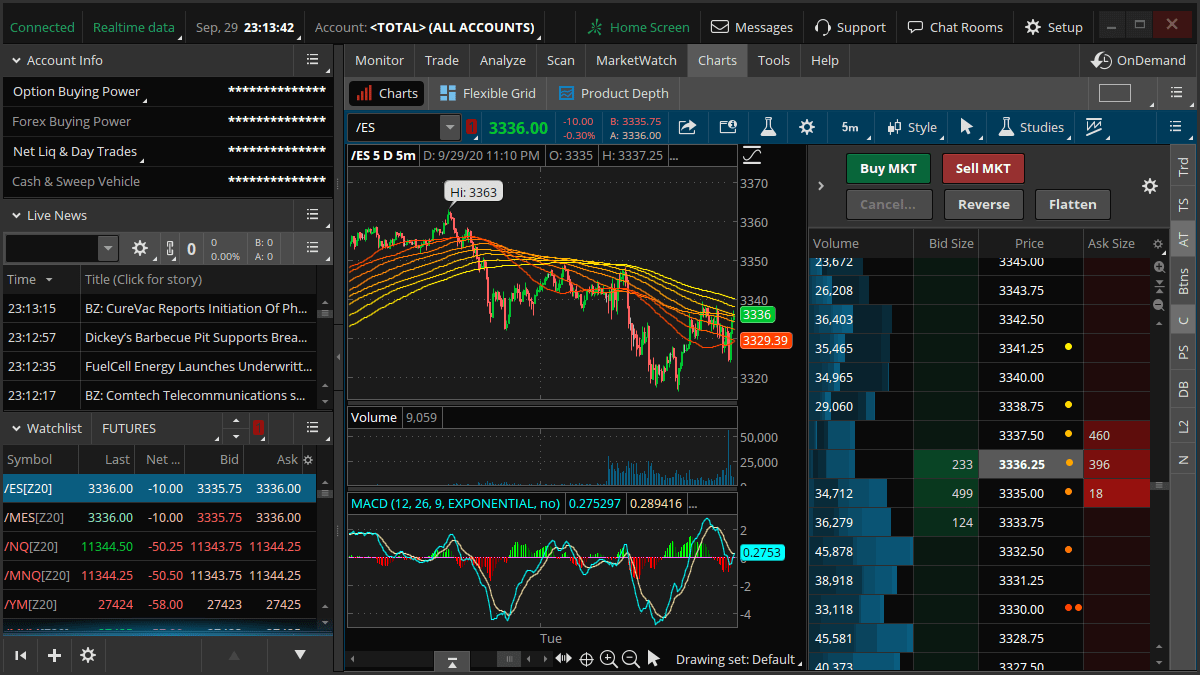

Image: www.wallstreetzen.com

Harnessing Volatility: A Key to Unlocking Option Trading Success

Volatility, or the measure of price fluctuations in an underlying asset, plays a significant role in option trading. High volatility increases the potential profitability, but amplifies risk, while low volatility generally implies a lower risk environment with more modest returns. Traders must carefully assess the volatility of an underlying asset and tailor their strategies accordingly to maximize their chances of success.

Options Strategies: Navigating the Trading Landscape

The realm of options trading offers a diverse array of strategies, each designed to suit specific investment goals and risk appetites. Covered calls involve selling call options against an underlying asset you own, generating income from the premium received while potentially limiting your upside. Conversely, naked calls involve selling a call option without owning the underlying asset, significantly increasing risk in pursuit of higher rewards.

Technical Analysis and the Art of Timing Options Trades

In the world of options trading, timing is everything. Technical analysis, the study of historical price movements, plays a crucial role in identifying optimal entry and exit points for options trades. Traders analyze chart patterns, moving averages, and other technical indicators to forecast future price movements and make informed trading decisions.

Managing Risk: The Heartbeat of Options Trading

Understanding and managing risk is paramount in the realm of options trading. Options contracts involve varying degrees of risk, ranging from low-risk covered calls to high-risk naked puts. Traders must carefully evaluate their risk tolerance and develop sound risk management strategies to safeguard their capital.

Tdameritrade Enable Options Trading

Image: github.com

Conclusion: Embark on Your Options Trading Journey with Confidence

Options trading presents a dynamic and potentially lucrative avenue for investors seeking to amplify their returns and enhance their risk management strategies. With TD Ameritrade as their trusted partner, traders can access a comprehensive platform, educational resources, and expert guidance to navigate this complex yet rewarding market. By understanding the fundamentals, embracing technical analysis, and implementing effective risk management strategies, you can harness the power of options trading to unlock your financial potential.