Introduction

In the bustling financial world, traders seek to capitalize on market movements, often debating the most lucrative path: trading stocks or trading options. Understanding the nuances of each approach is crucial for investors looking to maximize their gains. This comprehensive guide will delve into the intricacies of both stock and options trading, unveiling their respective advantages, risks, and earning potential.

Image: www.pinterest.com

The Realm of Stock Trading

Stock trading involves the buying and selling of company shares representing ownership in that entity. When a company performs well, its stock value tends to rise, potentially generating profits for investors who bought at a lower price. Conversely, stock values can decline if the company’s performance falters, resulting in financial losses.

The primary advantage of stock trading lies in its simplicity and straightforwardness. It requires less specialized knowledge compared to options trading, making it accessible to a wider range of investors. Moreover, stocks offer dividend payments, which provide additional income for shareholders.

The Labyrinth of Options Trading

Options trading, on the other hand, involves contracts granting the buyer the right to buy or sell an underlying asset, typically a stock, at a specified price within a predetermined timeframe. Options provide a wider array of strategies for investors, allowing them to tailor their trades based on their risk tolerance and investment goals.

The allure of options trading resides in its potential for both hedging and speculating. Investors can use options to mitigate risk by protecting their positions in volatile markets. Additionally, options offer significant profit-generating opportunities, albeit with higher risks attached.

Comparative Analysis: Unveiling the Lucrative Frontier

Determining the more lucrative path between stock trading and options trading hinges on several factors, including:

1. Risk Tolerance: Options trading carries inherently higher risks than stock trading. Options contracts have time decay, meaning their value diminishes over time, potentially resulting in substantial losses.

2. Market Volatility: Options excel in volatile markets, where large price swings can amplify potential gains. Conversely, stocks tend to perform better in stable markets.

3. Investment Horizon: Stock trading is generally suitable for long-term investments, as it allows time for companies to grow and appreciate in value. Options trading, however, typically targets shorter-term profits.

4. Capital Requirements: Options trading often requires less capital compared to stock trading. Investors can control substantial assets with minimal upfront investment, amplifying both potential profits and risks.

Image: dailybayonet.com

Expert Insights and Actionable Tips

Seasoned traders and financial experts emphasize the following strategies for maximizing returns:

-

Diversification is key: Allocating investments across various stocks and options helps mitigate portfolio risk.

-

Market understanding: Stay abreast of market trends, company financials, and economic indicators to make informed trading decisions.

-

Discipline and Patience: Execute trades based on sound logic, avoiding impulsive decisions driven by emotion. Be patient and let investments ride out market fluctuations.

-

Continuous Learning: Keep up with evolving market dynamics, trading strategies, and risk management techniques.

Which Is More Lucrative Trading Stocks Or Trading Options

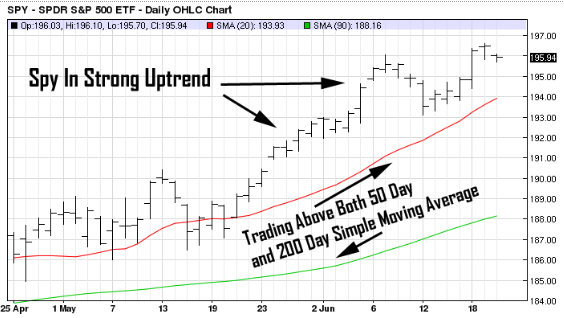

Image: www.investingshortcuts.com

Conclusion

The pursuit of financial success through trading can lead to both thrilling victories and humbling setbacks. Whether navigating the straightforward terrain of stock trading or exploring the complex labyrinth of options, the key to unlocking profitability lies in matching your risk tolerance, investment goals, and trading style to the appropriate approach. By embracing a disciplined and adaptable mindset, you can seize the lucrative opportunities that lie hidden within the financial markets.