Investing in the stock market can be a lucrative endeavor but also a daunting task, especially for beginners. Two common ways to participate in the market are through trading shares and options. While both offer the potential for profit, they come with distinct characteristics and suitability factors. In this article, we will dive into the key differences between trading shares and options, helping you determine which option aligns best with your investment goals and risk appetite.

Image: ejizajif.web.fc2.com

Understanding the Basics: What Are Shares and Options?

At its core, a share represents a unit of ownership in a publicly traded company. When you purchase shares, you become a part-owner of the business and are entitled to a proportionate share of its profits (through dividends) and voting rights (at shareholder meetings). On the other hand, an option is a contract that grants you the right, but not the obligation, to buy or sell an underlying asset (typically a stock) at a predefined price on or before a specific date.

Trading Shares: The Path of Direct Ownership and Dividends

Trading shares offers the advantage of straightforward investment in underlying businesses. When you buy shares, you acquire a piece of that company’s future financial performance. If the company thrives, the value of your shares will likely rise, potentially generating capital gains and dividends. Dividends are regular payments made by companies to shareholders from their profits, providing a steady stream of passive income.

However, with shares, you also bear the full brunt of market fluctuations. If the company underperforms or the market tanks, the value of your shares may decline, leading to potential losses. Additionally, buying shares requires upfront capital investment, which can be a limiting factor for some investors.

Trading Options: The World of Rights and Leverage

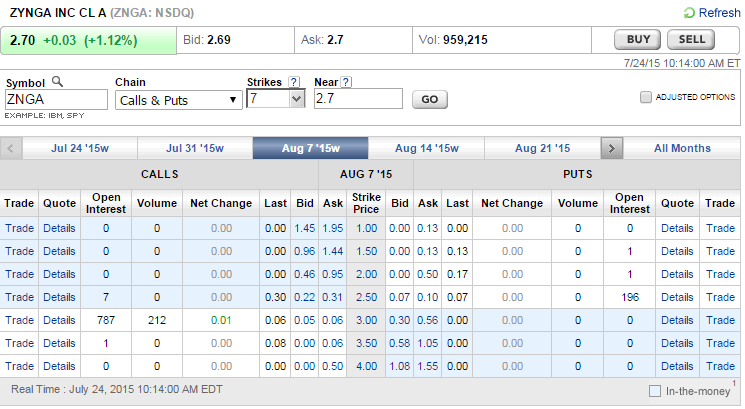

Options provide a more flexible and potentially leveraged approach to market participation. By purchasing an option, you are gaining the right to buy or sell an underlying asset at a specific price (the strike price) within a specific timeframe (the expiration date). Depending on your market outlook, you can choose to buy a call option (a right to buy) or a put option (a right to sell).

One of the key advantages of options trading is leverage. With a relatively small investment, you can control a significant amount of the underlying asset. This can amplify your gains if the market moves in your favor, but it can also lead to amplified losses if the market moves against you.

However, options trading also involves additional complexities and risks. The value of options can decay over time, especially as the expiration date approaches. Furthermore, options trading requires a higher level of market knowledge and risk tolerance compared to share trading.

Image: capitalflow.info

Which Option Is Right for You?

The choice between trading shares and options depends on your investment goals, risk profile, and time horizon. If you are looking for a relatively straightforward way to invest in companies and receive dividends, share trading may be your preferred option. However, if you seek potentially leveraged returns and are comfortable with higher risks, options trading might be a better fit.

For beginner investors, starting with shares may be a prudent approach, allowing them to gain experience and understanding of market dynamics before venturing into options trading. Seasoned investors, on the other hand, may use options to supplement their share-based investments and potentially enhance their returns.

Trading Shares Vs Options

In Conclusion

Trading shares vs. options offers contrasting opportunities and risks in the investing realm. By understanding the fundamentals of each approach, investors can make an informed decision that aligns with their financial objectives and tolerance for risk. Whether it’s the direct ownership of shares or the flexible leverage of options, choosing the right path can pave the way for successful market participation.

We encourage investors to delve further into the world of shares and options to refine their understanding and maximize their investment potential. Remember, the path to financial prosperity often lies in the intersection of knowledge, prudent decision-making, and a disciplined approach to investing.