As an avid finance enthusiast, I’ve witnessed firsthand the allure and complexities of the financial markets. Two key components of this realm are stock trading and options trading, each carrying distinct characteristics and implications for investors.

Image: tradewithmarketmoves.com

Investing can be likened to navigating a labyrinth, and understanding the nuances of different investment options is paramount. In this comprehensive guide, I aim to demystify these two investment avenues, shedding light on their core differences and enabling informed decision-making.

Stock Trading: Ownership and Risk

Stock trading involves purchasing shares of publicly traded companies. By acquiring these shares, you become a partial owner of the underlying business. The value of your investment fluctuates in tandem with the company’s performance and market conditions.

Stock trading carries both potential upside and risk. Investors can reap substantial gains when company revenues surge and stock prices climb. However, market downturns can lead to significant losses, particularly if companies struggle or go under.

Options Trading: Contractual Derivatives

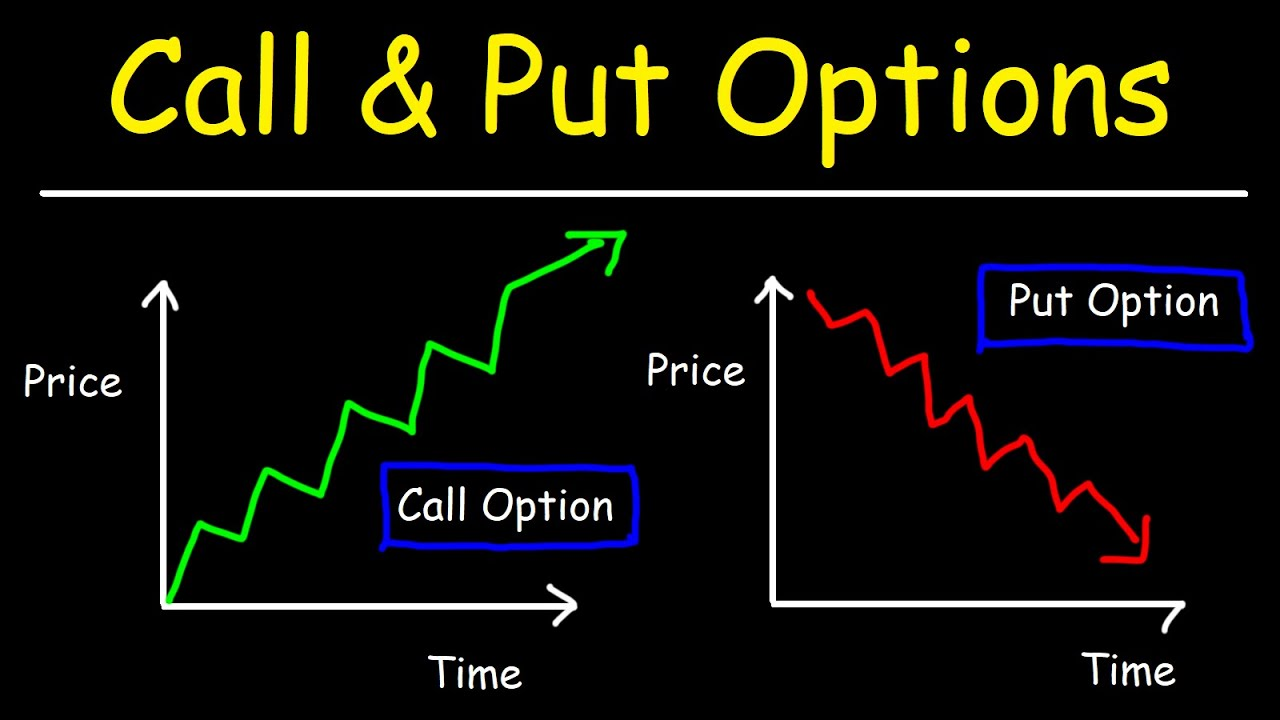

Options trading, on the other hand, operates differently from stock trading. Here, investors engage in contracts known as options, which grant them the right to buy or sell an underlying asset (usually a stock) at a predetermined price within a specific time frame.

Options trading offers more complexity and leverage compared to stock trading. Investors can employ various strategies, such as speculating on future price movements or hedging against losses. The potential for significant gains exists, but so does the risk of losing the premium paid for the options contract.

Understanding the Key Differences

Let’s delve deeper into the key differences between stock and options trading:

- Ownership: Stock ownership represents a direct stake in a company, while options merely convey a contractual right to buy or sell an underlying asset.

- Risk: Stock trading generally carries lower risk than options trading, as investors’ losses are limited to the amount invested in the stock. Options, however, expose investors to the potential loss of their entire premium.

- Leverage: Options offer leverage to investors, allowing them to control a larger number of stocks with a relatively small upfront investment.

- Flexibility: Options provide flexibility through various strategies and expiration dates. This allows investors to tailor their contracts to specific objectives.

- Time Sensitivity: Unlike stocks, options have a defined lifespan. Their value decays over time, adding another layer of complexity to options trading.

:max_bytes(150000):strip_icc()/StockOption_source-7a5ecb0c22a04d759e283596e7e64905.jpg)

Image: www.investopedia.com

Expert Tips for Investors

Navigating the financial markets requires a well-rounded approach. Here are some expert tips to enhance your understanding:

- Know Your Risk Tolerance: Assess your ability to endure potential losses before investing in any financial instrument.

- Understand the Underlying Asset: For both stock and options trading, it’s crucial to research the underlying asset or company.

- Practice with Simulations: Simulated trading environments can help investors test strategies and build confidence.

- Seek Professional Guidance: If needed, consult with a financial advisor for personalized guidance and tailored investment recommendations.

FAQs on Stock and Options Trading

- Q: Can I buy options on any stock?

A: Yes, most publicly traded stocks have corresponding options contracts available for purchase. - Q: What is the minimum investment for options trading?

A: The minimum investment for options trading varies depending on the contract’s specifications and the underlying asset. - Q: Is it possible to lose more than the premium paid for an option?

A: No, the maximum loss an investor can experience on an option is limited to the premium paid.

What Is The Difference Between Stock Trading And Options Trading

Image: investdetroit.vc

Conclusion

Stock trading and options trading present distinct investment opportunities, each with its own advantages and risks. Understanding the differences between these two avenues is essential for informed decision-making. By carefully considering your investment goals, risk tolerance, and time horizon, you can choose the approach that best aligns with your financial objectives.

Are you intrigued by the intricacies of stock and options trading? Delve deeper into the topic with further research and seek guidance from experienced professionals. The financial markets are a dynamic landscape, and ongoing learning is key to unlocking the opportunities they offer.