Introduction

Image: ca.rbcwealthmanagement.com

The realm of investing offers a diverse landscape of opportunities, ranging from straightforward stock purchases to the intricacies of options trading. Understanding the fundamental distinctions between equity and options trading is crucial for investors seeking to navigate these markets effectively. This comprehensive article delves into the defining characteristics, advantages, and risks associated with both investment strategies, equipping you with the knowledge to make informed decisions.

Equity Trading: Ownership and Direct Exposure

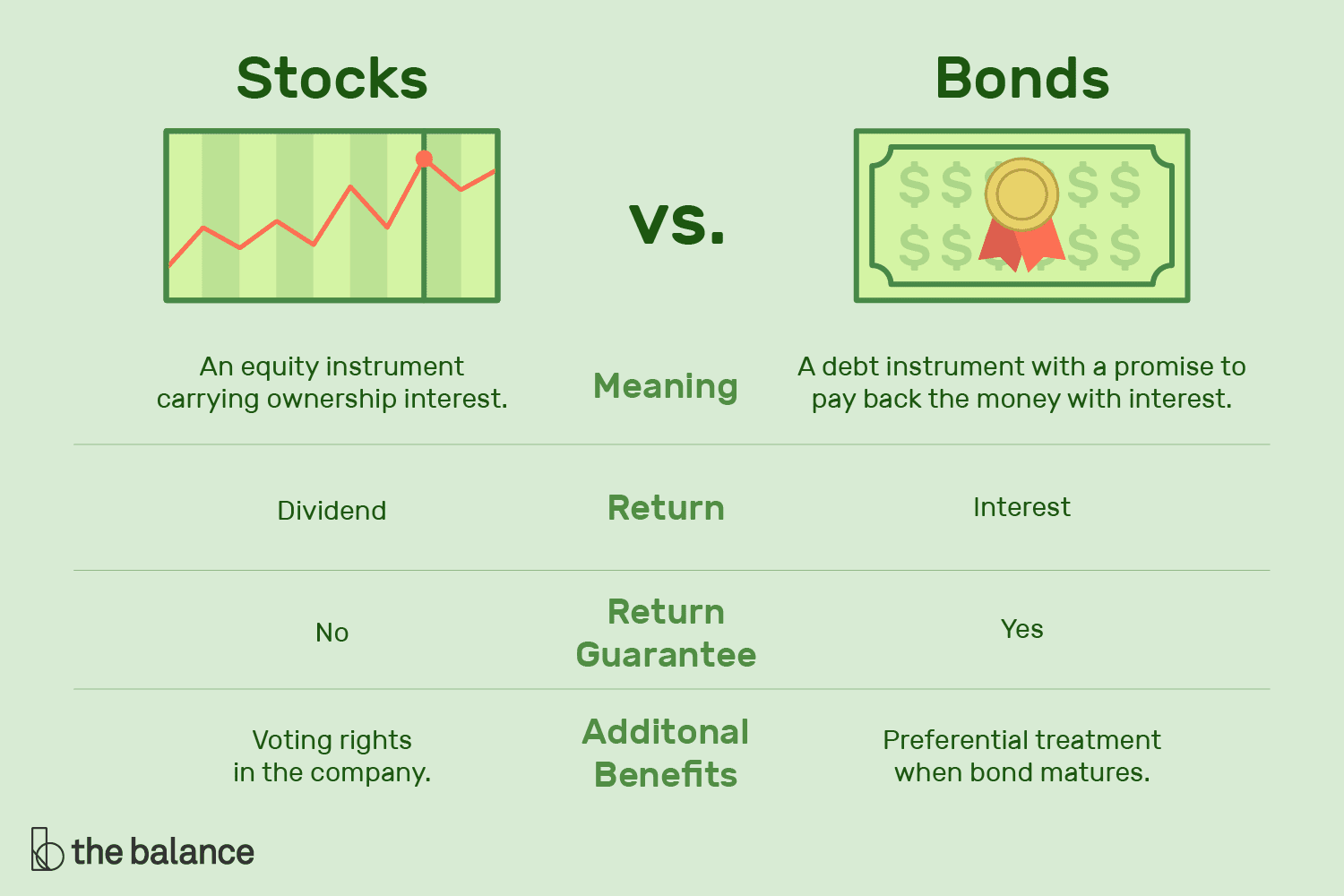

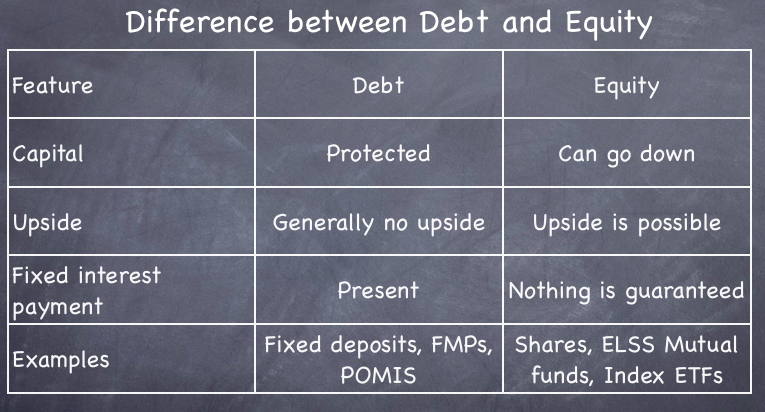

Equity trading involves buying and selling shares of ownership in publicly traded companies. When you acquire stocks, you become a shareholder, entitled to potential dividends and capital gains if the company’s value rises. Equity trading offers investors several benefits:

- Direct Ownership: Stocks represent a tangible stake in the company, providing a sense of direct ownership and a potential share in future profits.

- Historical Performance: Over long periods, equity markets have historically generated positive returns, making them a potentially lucrative investment.

- Dividend Income: Many companies pay dividends to shareholders, offering a passive income stream.

However, it is essential to note that equity trading also comes with inherent risks:

- Stock Price Volatility: Stock prices fluctuate based on market conditions and company performance, potentially leading to significant losses.

- Market Risk: Equity markets are subject to systemic risks, such as economic downturns or geopolitical events, which can impact stock values.

Options Trading: Speculating on Price Movements

Options trading provides investors with a different set of investment opportunities. Options are contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset, such as a stock or commodity, at a specified price. There are two main types of options:

- Calls: Options that give the holder the right to buy an asset at a certain price by a certain date.

- Puts: Options that give the holder the right to sell an asset at a certain price by a certain date.

The advantages of options trading include:

- Speculating on Price Movements: Options trading allows investors to bet on the future direction of an asset’s price without the need to purchase the underlying asset.

- Leverage: Options offer leverage, allowing investors to control a larger position with a smaller investment compared to equity trading.

- Hedging Strategies: Options can be used for hedging purposes, protecting portfolios against potential losses.

However, options trading also carries significant risks:

- Complexity: Options trading requires a sophisticated understanding of options contracts and market dynamics.

- Expiration and Time Decay: Options contracts have expiration dates, and their value decays over time, adding to the complexity and potential risk.

- Limited Profit Potential: Unlike equity trading, options have a defined profit potential, capped at the premium paid for purchasing the contract.

Choosing the Right Investment Strategy

The choice between equity and options trading depends on your individual risk tolerance, investment goals, and level of investment knowledge. Here’s a simplified summary:

- Equity Trading:

- Suitable for investors seeking long-term growth and dividend income.

- Requires a higher level of capital investment.

- Carries the risk of price fluctuations and market conditions.

- Options Trading:

- Tailored to experienced investors comfortable with complex strategies.

- Provides the ability to speculate on price movements with less capital outlay.

- Involves higher potential risks due to the intricate nature of options contracts and the ticking clock of expiration.

Conclusion

Equity and options trading represent distinct investment strategies with differing risk-reward profiles. Understanding their fundamental differences is crucial for informed decision-making. Consider your investment objectives, risk appetite, and level of expertise before venturing into either market. Equity trading offers direct ownership and potential for long-term appreciation, while options trading provides speculative opportunities with the potential for leverage and hedging. By carefully weighing these factors, you can choose the investment strategy that best aligns with your financial goals and risk tolerance.

Image: sagrta.blogspot.com

Difference Between Equity And Options Trading

Image: www.onemint.com