Calendar Options Trading Strategies: Unlock the Power of Time to Enhance Your Portfolio

Image: binaryoptionsprofitcalculator.logdown.com

In the realm of options trading, time plays a pivotal role in shaping strategies and determining returns. Calendar options trading strategies leverage the time decay aspect of options to capitalize on price fluctuations and position themselves for potential windfalls. This article will delve into the intricacies of calendar options trading strategies, empowering you with the knowledge and insights to navigate the intricacies of this sophisticated trading approach.

Understanding Calendar Options Trading

Calendar options trading, also known as time spreads, involves simultaneously buying and selling options with different expiration dates on the same underlying asset. The primary aim is to profit from the time value decay of the short-term option while simultaneously capitalizing on potential price movements. In essence, this strategy pits the decay against the potential gains, often resulting in a net positive outcome.

Time decay, a fundamental concept in options trading, refers to the erosion of an option’s value over time. As the expiration date approaches, the value of an option gradually diminishes. This decay rate is influenced by factors such as time to expiration, volatility, and option type.

Types of Calendar Options Strategies

-

Bull Call Calendar Spread: This strategy involves buying a short-term call option and selling a corresponding long-term call option. It is designed to leverage an anticipated rise in the underlying asset’s price within a specific timeframe.

-

Bear Put Calendar Spread: This strategy employs a similar approach but with put options instead of call options. It benefits from an expected decline in the underlying asset’s price within a specific period.

-

Bull Put Calendar Spread: In this strategy, a short-term put option is sold, and a long-term put option is bought. This strategy anticipates that the underlying asset’s price will remain above a predetermined level within the given time frame.

Expert Insights and Practical Applications

According to renowned options strategist Oliver Kell, “Calendar options spreads are a powerful tool for managing volatility and capturing targeted returns. They allow traders to construct strategies that benefit from both short-term price movements and the decay of time value.”

Successful implementation of calendar options trading strategies requires:

-

Understanding the Underlying Asset: Conduct thorough research on the historical performance, volatility, and upcoming events related to the underlying asset.

-

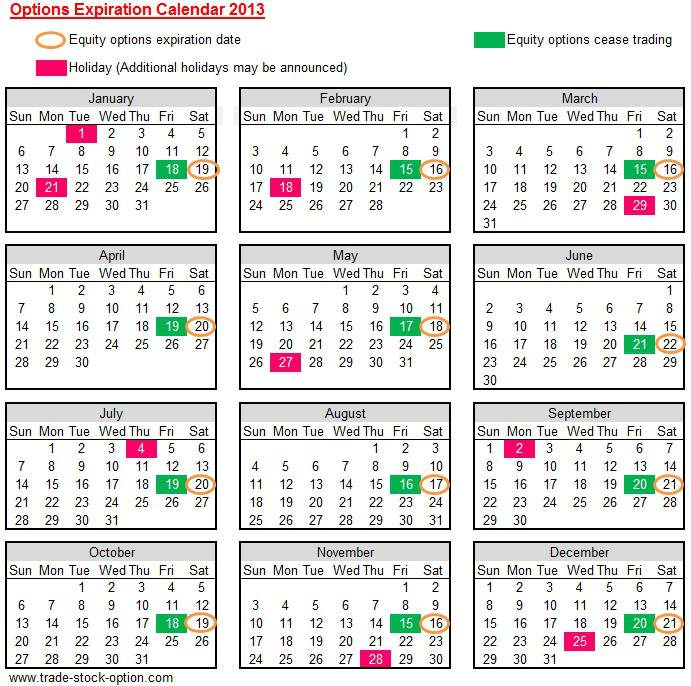

Selecting Appropriate Expiration Dates: Choose expiration dates that align with the anticipated price movements and the time frame for your investment.

-

Monitoring Market Conditions: Continuously observe market conditions, including volatility and price fluctuations, as they can impact the profitability of calendar options trading strategies.

-

Managing Risk: Implement proper risk management practices, including position sizing and stop-loss orders, to mitigate potential losses.

Conclusion

Calendar options trading strategies provide sophisticated investors with the opportunity to leverage time decay and potentially enhance portfolio returns. By understanding the concept, exploring different types of strategies, and implementing expert insights, you can unlock the power of time in your options trading journey. Remember to approach these strategies with a prudent and well-informed approach, as they involve inherent risks that should be carefully managed.

Image: www.myaalap.com

Calendar Options Trading Strategies

Image: www.pinterest.com