My first encounter with options trading was a rollercoaster of emotions. I had heard stories of overnight fortunes and devastating losses, and I couldn’t resist the allure. Yet, as I delved deeper, I realized the importance of understanding options and their intricacies.

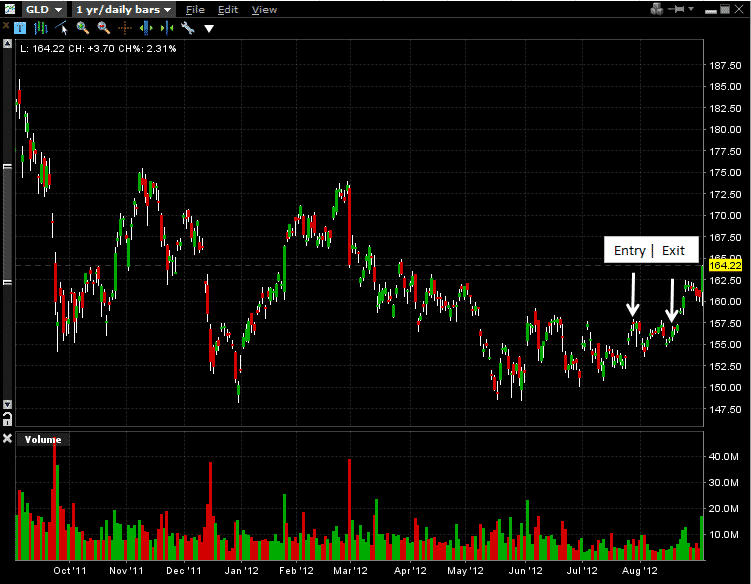

Image: rise2learn.com

Calendar options trading emerged as a fascinating strategy, offering a unique blend of risk and reward. By exploring the dynamics of time-bound options, I discovered the potential to optimize returns while managing volatility. Embark on this journey with me as we unravel the intricacies of calendar options trading.

Calendar Options Strategies: Navigating Time’s Delicate Dance

Unveiling Calendar Spreads

Calendar spreads, the cornerstone of calendar options trading, involve buying an option with a longer expiration date while simultaneously selling another option with a shorter expiration date, both bearing the same underlying asset and strike price. This strategy capitalizes on the differential time decay between the options.

The long-term option, with its extended lifespan, experiences a slower rate of time decay compared to its shorter-term counterpart. As the shorter-term option nears its expiration date, its value rapidly diminishes. This divergence creates an opportunity for profit, provided the underlying asset’s price remains relatively stable.

Calendar butterflies: Flitting Through Market Movements

Calendar butterflies introduce an additional layer of complexity. This strategy involves buying one option each at the extreme ends of the expiration spectrum, while selling two options with an intermediate expiration date. The profit potential arises from anticipating a range-bound market.

The long-term and short-term options serve as downside and upside hedges, respectively. The intermediate-term options, being more sensitive to time decay, generate the bulk of the profit if the underlying asset’s price stays within the defined range.

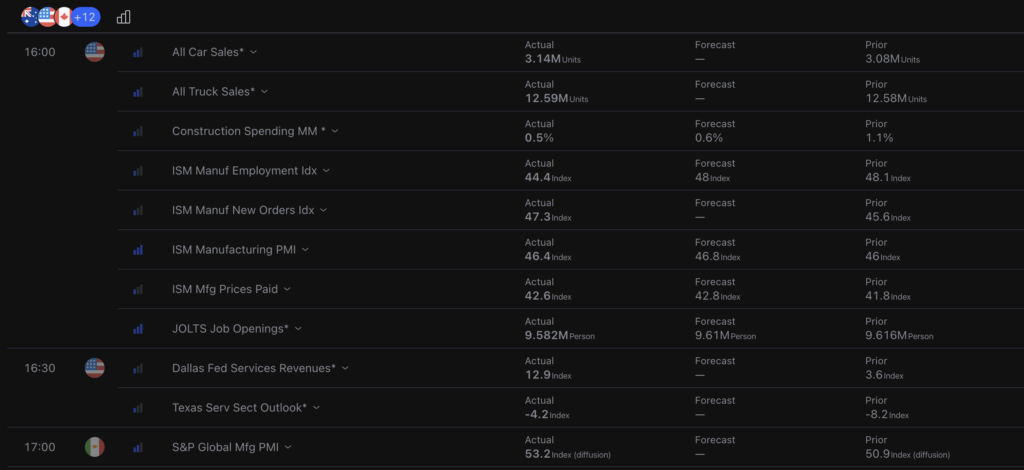

Image: optionstradingiq.com

Decoding Calendar Options Trading: Mastering the Strategies

Calendar options trading offers a nuanced approach to risk management and reward optimization. By grasping the concepts of time decay and the interplay between options with varying expiration dates, traders can capitalize on the ever-changing market landscape.

- Understand Time Decay: Time decay, the erosion of an option’s value as its expiration date nears, is a critical factor in calendar options trading. Analyze the rate of time decay for each option involved to maximize profitability.

- Choose the Right Strike Price: Selecting the appropriate strike price is crucial. The strike price should align with market expectations and provide sufficient room for the underlying asset’s price to move within the desired range.

- Monitoring Market Volatility: Calendar option strategies are sensitive to market volatility. Monitor volatility levels and adjust your trading plan accordingly. Higher volatility can accelerate time decay, potentially reducing your profit margins.

Expert Insights: Tips from the Trading Floor

Seasoned traders often share valuable insights that streamline the learning curve for aspiring options enthusiasts. Consider these expert tips to enhance your calendar options trading strategy:

- Start Small: Begin with modest trades to gain experience and refine your understanding. Gradually increase trade size as you become more comfortable with the strategies.

- Manage Risk: Risk management is paramount. Use stop-loss orders and position sizing strategies to mitigate potential losses. Diversify your portfolio across different underlying assets to reduce risk.

- Stay Informed: Stay abreast of market news and economic indicators that may influence the underlying asset’s price. Continuous learning and refinement are essential to long-term success.

FAQs: Demystifying Calendar Options Trading

FAQs: Demystifying Calendar Options Trading

Q: What is the primary advantage of calendar options trading?

A: Calendar options trading provides the potential for profit while managing risk by exploiting the differential time decay between options with varying expiration dates.

Q: What is an ideal market condition for calendar spreads?

A: Calendar spreads perform best in markets with relatively low volatility and a stable underlying asset price.

Q: What is the difference between a calendar spread and a calendar butterfly?

A: Calendar spreads involve buying and selling two options with different expiration dates while calendar butterflies include buying and selling options at three different expiration dates.

Q: How do I determine the profit potential of a calendar options trade?

A: Profit potential depends on factors such as time decay, underlying asset price movement, and the premium paid for each option.

Calendar Options Trading

Image: tradelocker.com

Conclusion: Embracing the Art of Calendar Options Trading

Calendar options trading offers a sophisticated and versatile approach to navigating financial markets. By understanding time decay, choosing the appropriate strike prices, and incorporating risk management strategies, traders can harness the power of time-bound options to enhance their trading outcomes.

As you delve deeper into calendar options trading, remember that knowledge is the key to unlocking its full potential. Embrace the excitement and challenges of this dynamic trading strategy, and let your understanding guide your journey towards financial success.

Are you ready to explore the world of calendar options trading? Engage with the comment section below and share your thoughts, questions, and experiences.