Option trading, often perceived as a complex and esoteric investment strategy, can be simplified into a series of accessible concepts that empower even novice traders to navigate the financial markets confidently. Options, financial instruments that grant the holder the right but not the obligation to buy or sell an underlying asset at a predetermined price and date, offer traders an array of strategies to suit their risk appetite and investment objectives. Understanding the basics of these strategies can unlock the potential for substantial returns while mitigating potential losses.

Image: www.cityindex.com

Understanding the Fundamentals: Call and Put Options

The first step in comprehending option trading strategies is grasping the fundamental types of options: call and put options. Call options confer upon the holder the right to buy an underlying asset at a specified price (known as the strike price) by a set date (the expiration date). Conversely, put options grant the holder the right to sell the underlying asset at the strike price by the expiration date.

Key Option Strategies: A Spectrum of Possibilities

The versatility of options allows for a wide range of trading strategies, each tailored to specific market conditions and risk tolerance. Some of the most commonly employed strategies include:

•Covered Call: A relatively conservative strategy where the trader simultaneously owns the underlying asset and sells a call option with a higher strike price than the asset’s current value. This strategy generates income from the premium received for selling the call option while limiting potential upside due to the obligation to sell the asset if the call option is exercised.

•Protective Put: This strategy is designed to hedge against potential losses by purchasing a put option with a strike price below the current value of the underlying asset. The premium paid for the put option provides downside protection, limiting potential losses in the event of a decline in the asset’s price.

•Bull Call Spread: A bullish strategy involving the simultaneous purchase of a lower-strike call option and sale of a higher-strike call option on the same underlying asset. This strategy benefits from a rise in the asset’s price while limiting the potential profit capped by the spread between the strike prices.

•Bear Put Spread: A bearish strategy that entails selling a lower-strike put option and buying a higher-strike put option on the same underlying asset. This strategy profits from a decline in the asset’s price, with the potential loss capped by the spread between the strike prices.

Advanced Option Strategies: Unveiling Complex Approaches

While the aforementioned strategies provide a solid foundation for understanding option trading, advanced strategies delve into more sophisticated and nuanced concepts. These strategies include:

•Iron Condor: A neutral strategy that combines a bull call spread with a bear put spread, aiming to profit from a relatively stable market environment with limited price movement.

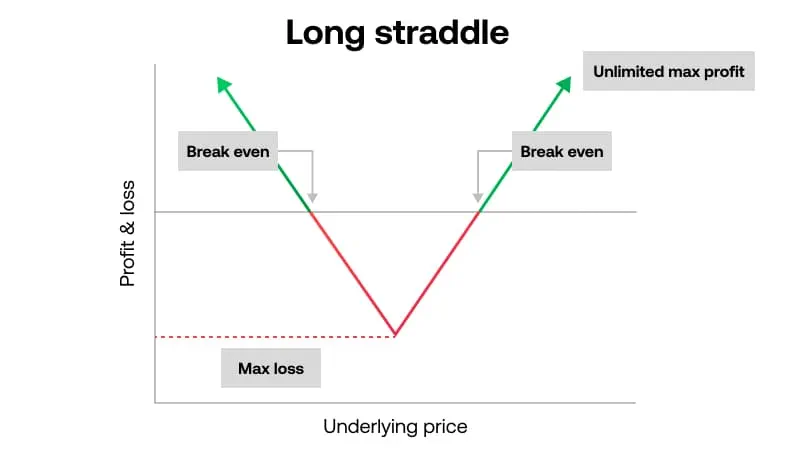

•Straddle: A neutral strategy involving the simultaneous purchase of both a call and put option on the same underlying asset with the same strike price and expiration date. This strategy benefits from significant price volatility, whether upward or downward.

•Strangle: Similar to a straddle, a strangle involves buying both a call and put option on the same underlying asset but with different strike prices. This strategy is suited for environments with moderate volatility expectations.

Image: buzzpublishing.net

Option Trading Strategies Simplified

Image: www.pinterest.com

Conclusion

Option trading strategies offer a spectrum of opportunities for investors seeking to enhance their financial outcomes through calculated risk-taking. By grasping the fundamental concepts of call and put options and familiarizing themselves with key and advanced strategies, traders can confidently navigate the dynamic financial landscape.