Introduction

Options trading, while lucrative, can be a complex and intimidating endeavor for newcomers. Navigating the intricacies of options requires a deep understanding of several key concepts, one of which is the Greeks. Understanding the Greeks is not merely important but essential for successful options trading. They provide invaluable insights into how various factors affect the value of an option, enabling traders to make informed decisions and minimize risk.

Image: www.forex.academy

This article delves into the depths of the Greeks: their meaning, significance, and practical applications. By mastering the concepts explained herein, traders can gain a competitive edge in the options market, unlocking the full potential of their trading strategies.

Understanding the Greeks

The Greeks are a set of seven metrics that measure the sensitivity of an option’s price to changes in underlying factors such as the stock price, volatility, time, and interest rates. Each Greek has a unique symbol and interpretation, providing traders with valuable information about the option’s behavior under different market conditions.

The seven Greeks are: Delta, Gamma, Theta, Vega, Rho, Kappa, and Lambda.

Practical Applications of the Greeks

The Greeks have numerous practical applications in options trading. Some of the most important include:

- Delta: Provides insights into the option’s sensitivity to changes in the underlying asset’s price.

- Gamma: Measures the rate of change of Delta and indicates how the option’s Delta will respond to changes in the underlying asset’s price.

- Theta: Represents the time decay of an option’s value, particularly important for short-term options.

- Vega: Indicates the option’s sensitivity to changes in implied volatility.

- Rho: Measures the option’s sensitivity to changes in interest rates.

- Kappa: Represents the sensitivity of the option’s price to changes in the risk-free rate.

- Lambda: Shows the option’s sensitivity to changes in dividend yield.

Traders can use the Greeks to construct sophisticated trading strategies, hedge their positions, and manage risk effectively.

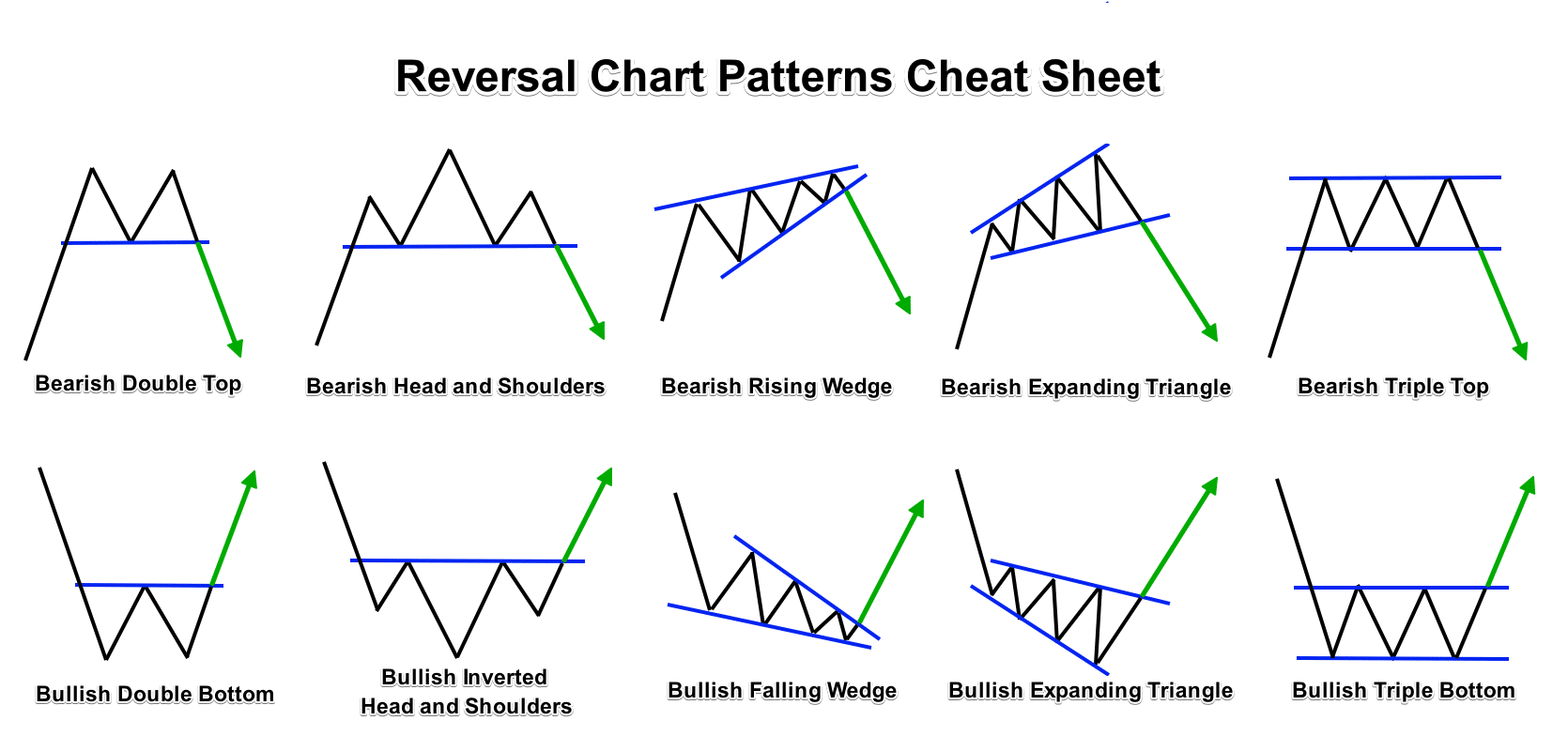

Image: www.tradethetechnicals.com

Most Important Topic In Trading Options

Image: alphabetastock.com

Conclusion

Understanding the Greeks is paramount to successful options trading. These metrics provide invaluable insights into the behavior of options in response to various market factors. By incorporating the Greeks into their trading strategies, traders can enhance their decision-making capabilities, minimize risk, and maximize profitability. Whether a seasoned veteran or a novice trader, a thorough comprehension of the Greeks is a fundamental building block for sustained success in the options market.