Image: www.pinterest.com

Introduction

In the realm of finance, options trading emerges as a compelling instrument that empowers investors to navigate the uncertainties of the market. From seasoned traders to aspiring entrepreneurs, understanding the intricacies of options can unlock a wealth of opportunities. This comprehensive guide will delves into the anatomy of options trading, unveiling its foundations, exploring real-world applications, and empowering you with expert insights.

Understanding the Basics: A Gateway to Options Trading

Options, in essence, are financial contracts that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. This flexibility allows traders to tailor their strategies to suit their risk appetite and investment goals.

Options are characterized by two key components: type and strike price. Call options empower holders to buy an underlying asset, while put options grant the right to sell. The strike price, on the other hand, represents the pre-agreed price at which the transaction can occur.

Mechanics of Options Trading: A Play on Time and Probability

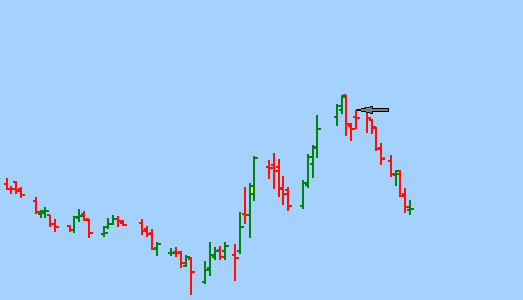

Options trading revolves around the interplay of time and probability. Traders purchase contracts with expiration dates ranging from a few days to several months. The value of an option decays as it approaches expiry, creating a sense of urgency.

The key to options trading lies in understanding the factors that influence its pricing. Volatility, the measure of an asset’s price fluctuation, plays a pivotal role. Higher volatility generally translates into elevated option premiums. Interest rates and time to expiration also exert significant impact on option pricing.

Exploring the Nuances of Call and Put Options

Call options offer a compelling avenue for investors anticipating price increases. By purchasing a call option, the holder secures the right to buy an underlying asset at a fixed price, regardless of its actual market value. This strategy is often employed in bullish markets or when investors believe an asset is undervalued.

Conversely, put options provide a hedge against potential price declines. With a put option, the holder retains the right to sell an underlying asset at a predetermined strike price, irrespective of its prevailing market value. This strategy is favored by investors seeking protection from downside risk or anticipating a market downturn.

Expert Insights: Navigating the Options Arena with Wisdom

Seasoned traders emphasize the importance of thorough research and understanding market dynamics. They advise traders to study historical trends, assess market sentiment, and monitor economic indicators before making investment decisions.

Furthermore, experts recommend adopting a measured approach to options trading. Managing risk is paramount, and it is prudent to allocate only a portion of your investment portfolio to options contracts.

Conclusion: Options Trading – A Powerful Tool for Adventure and Resilience

Options trading, while inherently complex, presents a multitude of opportunities for investors. By comprehending the fundamental concepts, leveraging expert insights, and implementing sound strategies, you can harness the power of options to enhance your financial acumen and navigate the ever-changing landscape of the market. Remember, like any financial instrument, options trading carries both risk and reward. Approach this arena with a blend of knowledge and prudence to unlock its full potential.

Image: www.asktraders.com

How The Option Market Work In Trading

Image: www.pinterest.ph