In the labyrinthine world of finance, option trading often emerges as a compelling strategy for savvy investors seeking to navigate market fluctuations. However, unraveling its income tax implications can be akin to deciphering an ancient enigma. This article aims to dispel the fog, providing a comprehensive guide to the tax rules governing option trading. By delving into each aspect and empowering you with actionable insights, we’ll untangle the intricate tapestry of option trading taxation.

Image: www.sharesexplained.com

Taxation Principles: Unveiling the Framework

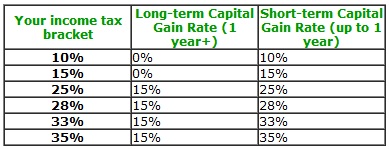

Income derived from option trading generally falls within the purview of short-term or long-term capital gains taxation. Short-term gains, realized from options held for less than a year, are taxed as ordinary income. Conversely, long-term gains, earned on options held for a year or more, enjoy favorable tax treatment at a lower rate. The distinction lies in the holding period, which plays a pivotal role in determining the applicable tax brackets.

Reporting Options Income: Clarifying the Process

Accurately reporting option trading activities is paramount. Form 1099-B, issued by the brokerage firm, serves as the primary mechanism for reporting option transactions. This document details the proceeds and cost basis of each trade, facilitating accurate tax calculations. Additionally, Schedule D, attached to Form 1040, provides a comprehensive platform for reporting gains and losses from option trading. Understanding these reporting requirements empowers investors to navigate the tax process seamlessly.

Unveiling the Nuances: Premium vs. Exercise

When an option is purchased or sold, a premium is exchanged. This premium represents the price paid to acquire the option contract. Upon exercise, the option holder acquires the underlying asset at a pre-determined price. Tax implications diverge based on whether the option is exercised or expires. Exercised options give rise to capital gains or losses, while expired options may result in ordinary losses but do not generate taxable gains. Comprehending these nuances ensures accurate tax calculations.

Image: www.daytrading.com

Navigating Complexities: Short Sales and Wash Sales

Option trading maneuvers often delve into sophisticated strategies like short sales and wash sales. Short sales involve selling borrowed shares with the anticipation of repurchasing them later at a lower price, profiting from the price differential. The tax treatment of short sales mirrors that of long sales, with gains or losses recognized upon closing the position. Wash sales, where a security is sold and repurchased within a short timeframe, generally result in disallowed losses but do not affect the taxability of gains. Understanding these complexities safeguards against potential tax pitfalls.

Expert Insights: Unlocking Tax Strategies

Seasoned tax professionals underscore the significance of meticulous record-keeping and timely tax planning. Maintaining a detailed log of option trading activities, including dates, prices, and premiums, provides a solid foundation for accurate tax preparation. Furthermore, consulting with a qualified tax advisor can illuminate optimal tax strategies tailored to individual circumstances, ensuring compliance and maximizing potential savings.

Income Tax Rules For Option Trading

Image: www.wallstreetprep.com

Conclusion: Demystifying Option Trading Taxation

Understanding the intricate web of income tax rules governing option trading empowers investors to navigate the financial markets with confidence. By embracing a comprehensive approach, meticulously tracking transactions, and seeking expert guidance when necessary, you can navigate the complexities of option taxation, maximize returns, and ensure compliance with tax regulations. The knowledge imparted within this article serves as a compass, guiding you through the ever-evolving landscape of option trading taxation.